Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I have QB Desktop Pro 2020.

I have an employee that has used (already paid) 6 hours more vacation time than the maximum allowed. Now his vacation amount accrued shows -6. This was not intended and now I need to fix the issue.

Question # 1: Is it possible to fix this after he has been paid?

Question # 2: I thought QB has a warning or notification so this does not happen unintentionally?

Any help for a resolution on this would be greatly appreciated.

Thank you!

Thanks for bringing this with us, @Hunters16.

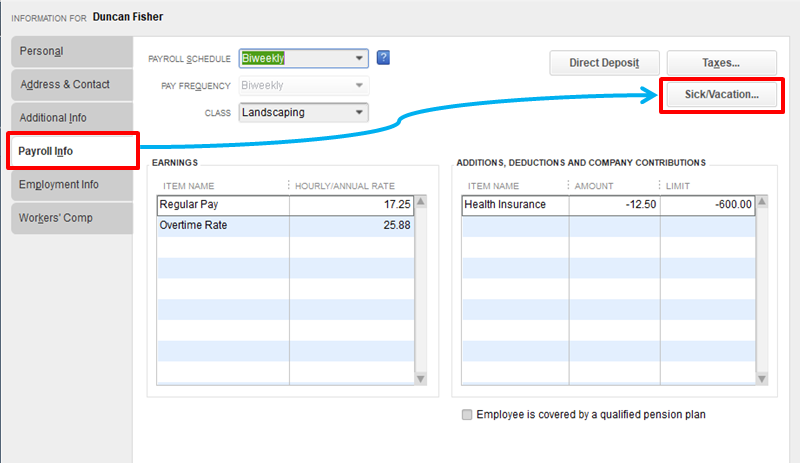

We can manually edit the employees' Sick/Vacation setup or check the Do not Accrue sick/vac box in QuickBooks Desktop (QBDT). Doing so can stop QuickBooks from accruing vacation time.

Here's how:

You may also follow the steps below on how to check the Do not accrue sick/vac box.

I've added some articles here about adding the appropriate accruals to your payroll system and updates for sick and vacation pay:

Let us know if you have any questions about payroll. We're always here to help.

Hello,

Thank you for the reply to my question.

However, I am not able to zero out the vacation hours. The employee has 80 hours of vacation allowed per year, he has already taken and been paid for the 80 hours, in addition to this, in error he was paid an additional 6 hours of vacation. My question is why did QB allow this to happen, I thought a warning should have come up and stated the employee had used all his vacation for the year and no more was available?

My other question is how can I take back the 6 hours of vacation pay that he was overpaid?

Thank you,

Louise

Let's perform some steps so you can correct the employee overpayment, @Hunters16.

You can track their available time off or vacation in payroll from time to time to ensure you’ll always be updated.

There’s a way to set the benefit not to accrue on your employee's paycheck, so the program will stop. You can mark the "Do not accrue sick/vacation pay" box if they already consumed it.

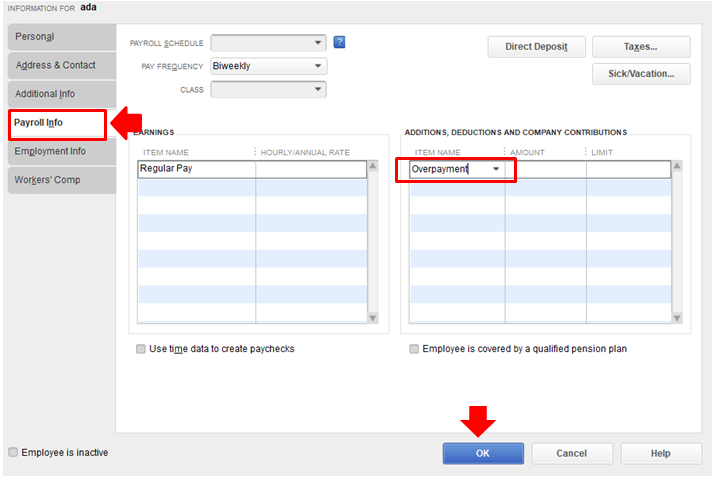

Regarding the 6 hours that were overpaid, you'll want to create a deduction payroll item. This way, you can add it to their paycheck to reduce employee's wages for the overpayment and correct year-to-date (YTD) taxes. Let me guide you how:

Once this matter is settled, you can make the payroll item inactive. Just go to the Lists menu, then Payroll item List.

You can also run payroll reports, such as Payroll Summary. This helps review your employee’s wages, taxes, adjustments and contributions to ensure all of them are appropriately recorded.

Let me know if you have other payroll concerns. We’re always here ready to help. Keep safe.

Hello,

Thanks again for the reply.

I am not able to mark the"do not accrue sick/vacation pay box, as I still need to continue accruing sick pay for this employee.

Regarding the fix for the overpaid 6 hours, will this process remove the -6 in the employee vacation available box?

Also, I am a little confused about adding the deduction to the employee payroll, I am not sure which liability account to select. It seems to me I would need to add multiple liability accounts to correct all the effected accounts? Am I wrong on this?

Thanks again for the help.

Louise

Thank you for getting back to us here on the Community page, @Hunters16.

The deduction item will only subtract the overpaid amount of your employee's vacation time. At this time, you can manually track the accrual, then adjust it once your employee generates 6 hours.

Here's how you can manually adjust the employee's available hours.

On the other hand, you can select payroll liability when creating the deduction item, or consult with your account for further assistance.

In case you need additional guides while working with payroll, feel free to read the details from this link.

I'll be right here to continue helping if you have any other questions. Just add a comment below. Have a great day!

How do I stop vacation and personal time from accruing, I keep getting messages people have hit the max amount? We don't use Quickbooks to track our vacation and personal time.

Stopping your employees' vacation and personal time from accruing in QuickBooks Desktop (QBDT) is my priority, @WheelCollision. Let me guide you on how.

When you don't use QBDT to track your employee's sick and vacation details, you'll have to set the Sick and Vacation hours to zero in the Sick and Vacation Defaults window. This way, QuickBooks will stop vacation and personal time from accruing. Here's how:

Once you're done, you may set up manual payroll in QBDT. This will let you do your payroll manually and track taxes and file your forms yourself. To know more about this, I'd recommend checking out this article: Set up manual payroll without a subscription in QuickBooks Desktop.

Also, I'm adding this article to further guide you in managing your business's growth using QBDT: QuickBooks Help Articles. It includes topics about account management, banking, and expenses, to name a few. You can click the + More topics button to view other selections.

Let me know if you have other concerns about managing employee records (vacation and personal time) in QBDT. You can drop your comments below, and I'll gladly help. Take care, and I wish you continued success, @WheelCollision.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here