Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI ran my first payroll today and the L&I tax was calculated based on all hours. We had employees with sick, vacation and holiday pay (yes our holiday pay is it's own code). I need to know how to get this tax to only calculate on hours worked please.

Yes, that's the way QuickBooks does it. It's always been this way, and I guess it's hard to fix as they've never gotten to it.

Hmm, well that is unacceptable to me so I will have to manually adjust if this is truly the case.

If you figured out how to manually adjust it, can you please share?!

You should be able to unselect the sick, vacation and holiday in the L&I setup so it's not including those hours in the calculations. You may need to override the hours on the paycheck if multiple workers comp codes are used though.

Any chance you have a go around like this for QB Online payroll? There are very limited options in the set up process.

Hello, @MollySkinner.

Can you tell me more about the process that you're referring to? That will surely help us provide an accurate solution to the concern that you're having.

You can click the Reply button below to add more details.

I'm looking forward to hearing from you soon! Take care and have a wonderful day!

So, when I enter payroll in QB Online Payroll, I am entering the hours worked for each employee (we are mostly teachers), and then I am entering holiday pay hours and then sick/vacation hours. Our employees are on an annual contracted salary, so their monthly amount stays the same and isn't dependent on the hours. Nevertheless, the hours for the three categories above (worked, holiday, and sick/vacation) are put in.

BUT, Washington Worker's Comp (L & I) should only be applied to the worked hours. I wish Quickbooks could apply the L & I withholding to each employees pay based on the "hours worked" box that I am already filling out.

I will give an example. Let's say we have a teacher who is a .75 FTE employee, and he makes $3,000 per month. In January, there were 19 work days and 3 holiday pay days. I would multiple 19 days by 8 hours per day by .75 to reflect that teacher's actual worked hours. In this case, they worked 114 hours in January. The holiday hours are calculated the same: 3 x 8 x .75 to come out to 18 hours. For WA State L and I, this employee only should have 114 hours of withholdings (at a rate of .1223 per hour). If I use the 160 assumed, then the employee has too much withheld.

Since I am entering that 114 hours in the box already under "hours worked," I wish Quickbooks could just use THAT amount to calculate the L and I. However, it doesn't seem to be possible through the payroll settings to do this, so I suppose I will have to track it for each employee separately and enter each as a withholding manually for every pay check.

Hi Molly,

In Washington, for salaried employees reporting hours for L&I is generally based on a static number of hours unless there is support for all employees actual hours worked. Assuming not all hours are tracked specifically, you would need to report 480 hours for a full time salaried individual, regardless of actual hours worked. If you are tracking hours for ALL employees, then of course there may be different reporting. I'm guessing the issue you are encountering for hours is related to how QuickBooks is tracking based on salary and I'm not sure there is much flexibility currently.

If you are reporting outside of QuickBooks you have the flexibility to report differently, then would need QB to adjust the liability to accurately reflect the liability.

Hope this helps.

Katryna

Welcome back to the Community, @MollySkinner. Thanks for providing the complete details of your concern.

Let's send feedback or product recommendations to help improve the features and your experience using QuickBooks Online Payroll (QBOP).

For the time being, Washington (WA) L & I tax is calculated based on employee's all or total hours. After setting up workers’ compensation classes and rates to calculate the premiums on your employees’ paychecks, you can use our WA Workers’ Comp Worksheet or a payroll report as a guide to help you pay your premium and file Form WA F212-055-000 quarterly with the state.

I can see how the benefit of being able to apply the Washington L & I withholding to each employee's pay based on the hours worked would aid you in managing your payroll transactions and taxes with QBOP. With this, I would encourage you to send suggestions or product recommendations. We'll take them as opportunities to improve the various features of our products.

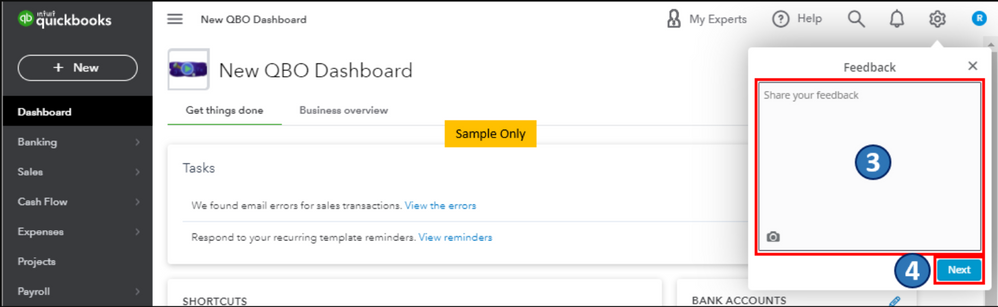

Your valuable feedback will be forwarded and reviewed by our Product Development team and will help improve your experience while using the program. Here's how:

On top of that, I'd also recommend visiting this page to keep you updated with the latest software improvements and enhancements with QBOP: QuickBooks Online new features and improvements .

Please feel free to leave a comment below if you have other feature concerns or questions about managing transactions in QBO. I'm always ready to help. Take care, @MollySkinner.

I have followed the instructions to set up the WA L&I deduction. Which is by setting up the deduction with tax tracking as "none" and then proceeding from there. The issue I am having is the amount the employees have had deducted is reducing their wages in box 1 of their W2. Why would this be? I cannot find anything that states this should reduce the wages. Following the instructions puts this deduction immediately under gross wages and adjusts the gross wages in the payroll summary.

Am I the only one to wonder about this?

Hello there, Nickel.

Let me share how Washington (WA) affects W-2 in QuickBooks Online (QBO).

When an employee's wages are subject to a deduction, such as the Washington L&I deduction, it can affect the amount reported in box 1 of their W-2 form. Box 1 includes wages, tips, and other compensation for federal income tax purposes.

Additionally, setting up the deduction with tax tracking as "none" means it's not subject to federal income tax. However, it still reduces the total value of wages subject to federal income tax, hence the reduction in box 1 of the W-2 form.

For more information, visit this link: Understanding W-2 box amount differences.

Additionally, I've added this article that can help you file the forms: File your W-2 and W-3 forms.

Let me know if you need more help working with W-2 in QuickBooks. I'm always here to help. Take care.

To not include Sick & Vacation Hours for L&I, edit the payroll item for L&I. In the window for "Calculate based on quantity," "Calculate this item based on hours," should be checked, and underneath ensure to uncheck the line that says, "Include Sick and Vacation hours." If it is already checked or if you have the same problem after unchecking "Include Sick and Vacation hours," check to make sure your payroll items for sick and vacation time are set up as type (Sick/Vacation).

I just switched to QBO as well and discovered this short coming in QBO as well. WA State L&I and its method of calculation has been around decades. Why QBO doesn't support it is an egregious oversite. Maybe it has been addressed and buried in it's obfuscated interface. If that's the case please point me to it.

QuickBooks calculates WA workers' compensation based on the employee's pay type, pjvet.

In QuickBooks Online, only one class and rate can be assigned per employee. For those with multiple classifications, workers' compensation must be calculated manually.

For salary employees, QuickBooks complies with WA L&I regulations by calculating workers' compensation at 160 hours per month, which appears on the first paycheck.

In contrast, you'll need to input hours worked when processing paychecks to ensure accurate workers' compensation calculations for commission employees.

For more information, check out this article: Set up and manage Washington (WA) workers' compensation.

If you want to run payroll reports to view information about your business and employees, feel free to scan this material: Run payroll reports.

Come back to this post if you have additional questions or clarifications about managing payroll in the program. We're always here to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here