It's nice to see you here today, @mcculloughfinish.

You can bypass the SUI prompt by setting up the employee as exempt from SUI. Then, enter Applied For in the MN UI Employer Account Number box and 0.00% as its rate. This way, you can run an employee's paycheck. I'd first suggest consulting your state agency to confirm if your business doesn't require you to pay SUI taxes. Once verified, proceed with the steps below.

To set up an employee as exempt from SUI:

- Go to Workers from the left menu.

- Select Employees.

- Click the employee's name.

- Under Employee details, click the Edit (Pencil) icon beside Pay.

- Hit the Edit (Pencil) icon under the question What are [employee's name] withholdings?.

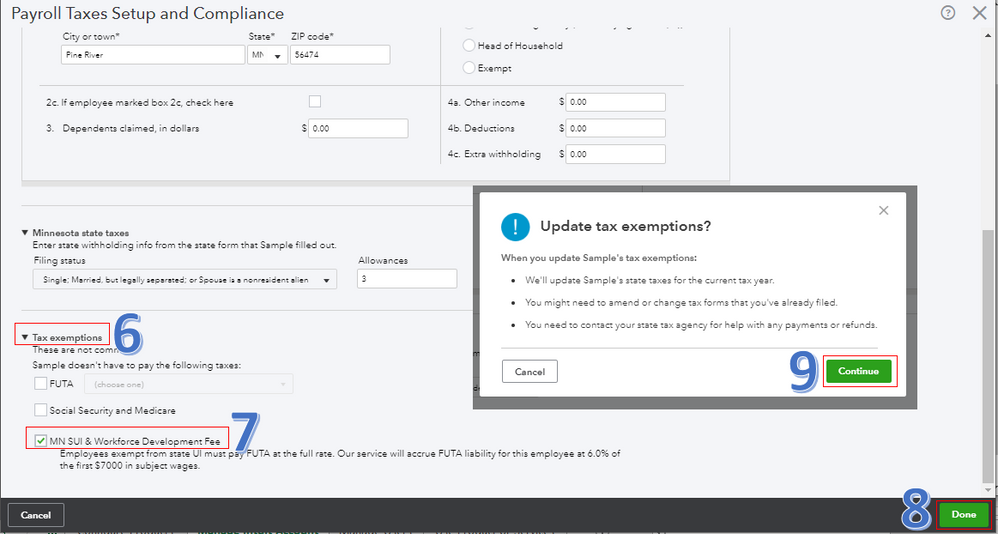

- Scroll down the page and choose Tax exemptions.

- Check the MN SUI & Workforce Development Fee box.

- Click Done.

- Choose Continue.

The screenshot below shows you the last four steps.

To enter the SUI number and rate from the payroll settings:

- Go to the Gear (Settings) icon at the upper right.

- Select Payroll Settings under Your Company.

- Select State Taxes - MN.

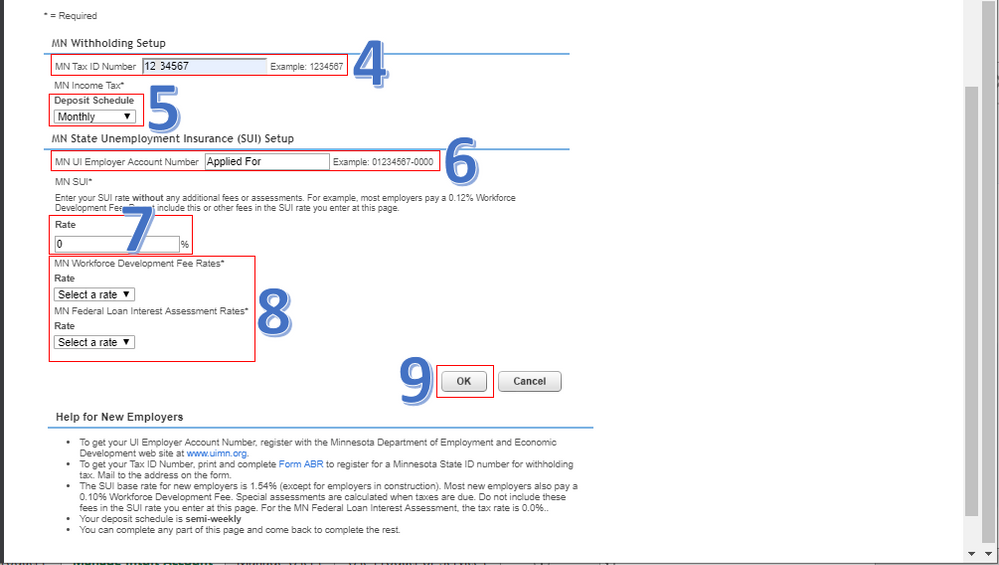

- Since you have a MN Tax ID, enter it in the MN Tax ID Number field.

- Choose the Deposit Schedule.

- In the MN State Unemployment Insurance (SUI) Setup section, enter Applied For in the MN UI Employer Account Number box.

- Select 0.00% as the rate.

- Choose the appropriate rates for the other MN taxes.

- Click OK.

See the screenshot below to show you the last six steps.

Once done, you'll be able to create a paycheck for your employee. Then, run payroll reports to make sure the payroll and tax details are accurate.

QuickBooks complies with the state agency's rules and regulations. Some states have reciprocity agreements. In your case, WI has no reciprocity agreements to MN. For more details, see the Multistate rules section through this article: About Multistate Employment Payroll Situations.

I'm just a post away if there's anything else you need. Have a good day, @mcculloughfinish.