Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for posting in the Intuit Community, telkins,

Let me help share information about preparing and filing 1099.

In QuickBooks Online, we make 1099 easy whether you want to e-file or mail your forms yourself.

Upon setting up a vendor, let’s make sure that the Track payments for 1099s checkbox are selected. Moreover, in adding the payment, make sure that you date it for the right calendar year. You can check this article for more tips: Add or edit contractor payments for 1099s.

To prepare 1099 here’s what you’ll need to do:

I’m attaching some great resource that you can check on for guidance:

If you have further questions concerning 1099, please feel free to reach back out. I’d be happy to answer it for you. Have a great day!

I appreciate the response and your reply is spot on if the system is working properly. In fact, my case was added to an investigation because the reports are NOT pulling the correct information. For instance, certain vendors are NOT even showing up on the 1099 report because certain expense payments are NOT being pulled on the report but clearly you can see these payments within their vendor profile. In fact we (with the QBO help desk person), we tried to add a new expense account and re-assign these payments to the new expense account and these payments are still not appearing in the QBO report.

This is a major major problem. All the data is inputted correctly but QBO's 1099 reports are not pulling the data as it should which puts me in the very bad situation since my plan was to mail these out this week. Having twins next week so I don't have time or the luxury for QBO to sit on their hands and ignore this issue. This is a simple 1099 report ( worked perfectly well last year) that needs to work and I'm shocked that this is not getting rectified yesterday. Case # [removed] for your reference and hope someone can help get this rectified ASAP! Thanks for your reply!

Hi there, telkins.

Thank you for taking the initiative to call our phone support and providing details about your 1099 concern.

I've checked the open investigation and there are no updates as of right now. There isn't a current time frame for when this will be resolved. However, your case is added to the INV and as soon as we have an update, you will be notified via email.

I'll also get back to you personally once I get an update. Thank you for understanding.

I am having the exact same problem....what do I do?

Hi there, @fsachs.

I'm here to help you run 1099 reports for your vendors and vendor payments.

In QuickBooks Online (QBO), you're able to run reports that list your 1099 vendors, payments to vendors that need to go on 1099, and payments excluded from a vendor's 1099. I can guide you on how to open each.

To get started, here's how you can get the report that lists all of your 1099 vendors:

To create a report of all the payments you made this year to your 1099 vendors:

To see the payments excluded from a vendor's 1099, you can follow the same steps above (Step 4: Review - Check that the payments add up), then review the details under the Excluded column. The column displays the total of a vendor’s excluded payments for the year. Select the dollar amount in that column to open the report.

For more tips about running and customizing 1099 reports in QBO, I recommend opening these links:

Also, you may open these articles for additional resources when preparing your Federal 1099s:

Please let me know how else I can help you with your 1099 reports. I'm always here to help. Keep safe always!

Thank you. I already have all that. There is clearly a problem. For instance, I paid one contractor on 12/4, 12/15 and 12/31. I paid and recorded the payments all in the same manner. The 12/15 payment does not show up on the 1099 report. I even deleted and re-entered the payment and it still won't show up. It does show up in my P&L as a contractor expense.

Thanks for taking the time to inform us about what's happening with your 1099 processing, @fsachs,

Have you tried doing these steps in a private window. Unexpected issues this mostly are affected by the large data in the cache. This is because the data on a regular browser will overwrite itself and will remove history unless done manually.

While the incognito mode will not save any history, it is a great place to identify issues in the browser. Use these keyboard shortcuts to launch a new private window:

Clearing the cache can also help resolve browser issues in QBO.

If you already tried this, and still getting the same problem, I recommend getting in touch with our Support Team. They can help report this to our engineers who can help with program bugs and other technical concerns.

Also, regarding our support, we have made changes to our operation hours and our contact options. Our Live Help are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM til 3:00 PM on Saturdays.

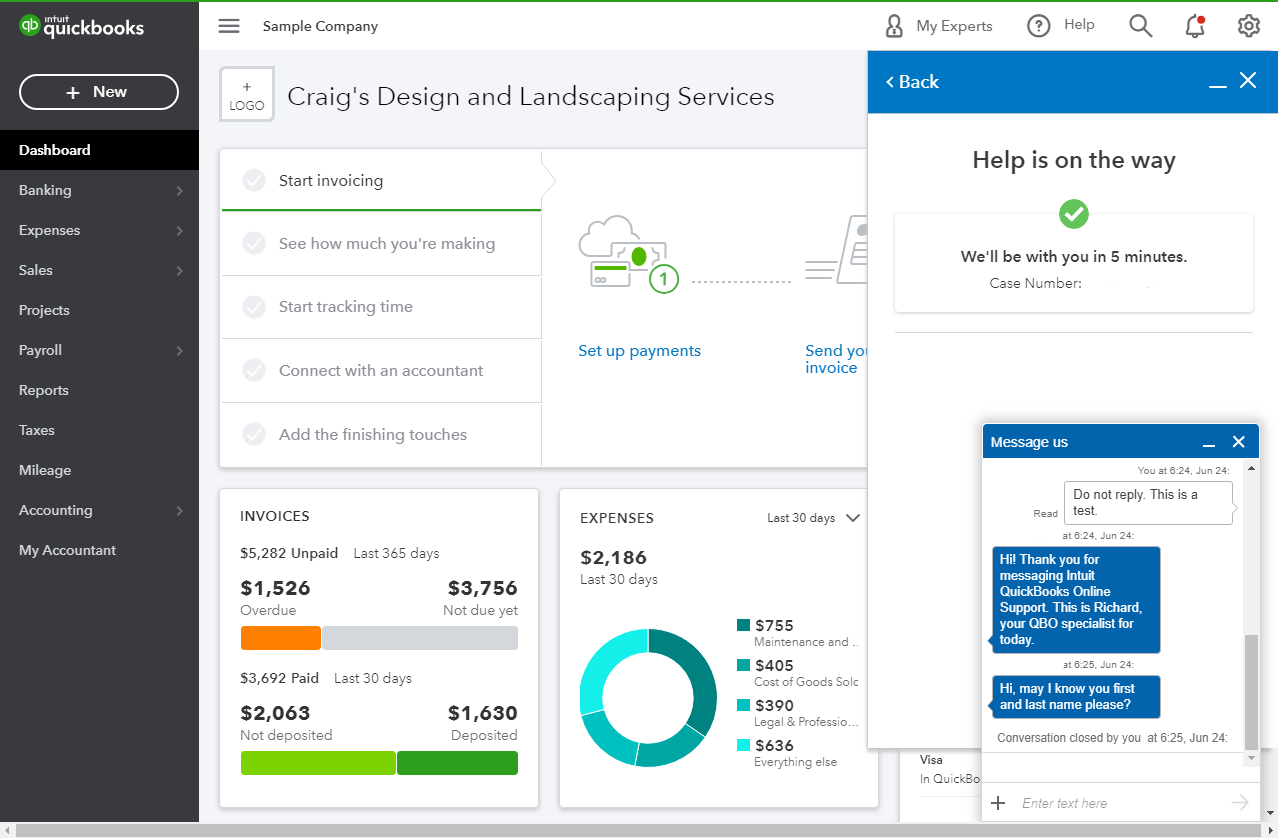

Follow these steps to reach out to a live agent:

When you're connected, provide all the information about your concern or request a viewing session with out representative.

If you opt to use the Start messaging option and gets an unresponsive behavior, try using a private browser using the steps above.

Keep me updated on how it goes by writing to us again. I want to make sure this 1099 concern is resolved and I'm here to provide further assistance. Have a good one!

Thank you. I did try it in incognito mode, and I was surprised to be able to see one of the two I couldn't see. but then I ran the report again and I could no longer see it. I will contact support tomorrow. By the way, I did try and contact support yesterday at 1 pm ET and got a message that support was closed.

This is all beyond frustrating. I saw the same issue arise with someone on these boards last year. Clearly there is an issue with the 1099's and I cannot fathom how you don't have it fixed yet. This is beyond stressful and time consuming.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here