Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowLet me share with you some information on why no income tax was withheld from your employee, @p62484c.

Federal and state income taxes are withheld per IRS Publication (Circular E), Employer Tax Guide. If a paycheck shows $ 0.00 or no withheld income tax, it could be due to any of the following reasons:

To fix this, review their gross pay and tax status. This is to verify that they meet the taxable wage base to have income tax withheld from their paycheck. For more information about the percentage method set by IRS, you can go to page 6 on this link: https://www.irs.gov/pub/irs-pdf/p15t.pdf.

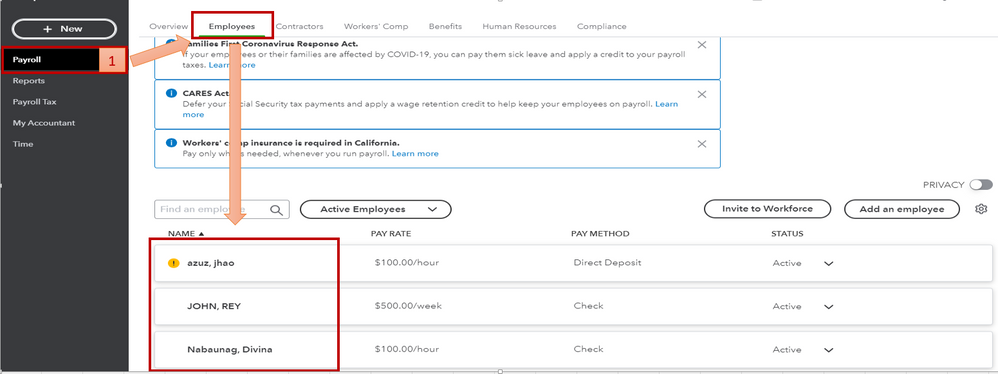

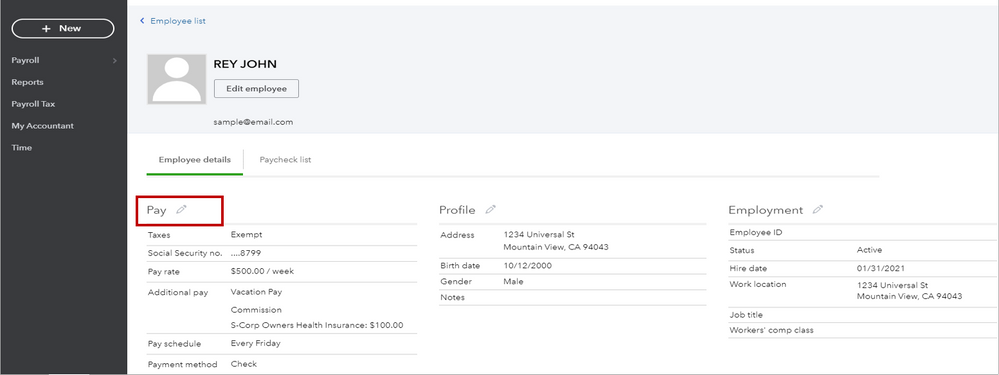

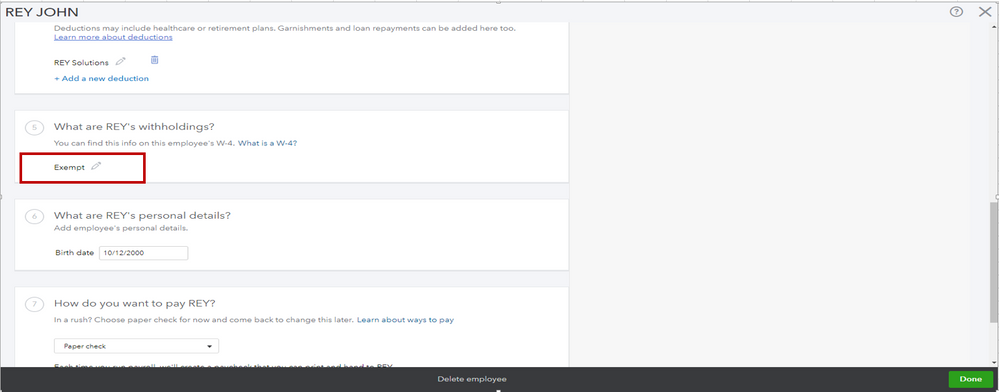

Next is to set an employee’s preference to Do Not Withhold if they explicitly claim exemption from withholding on their Federal Form W-4 or any state form. Here's how to check if an employee was set to Do Not Withhold:

You can change the employee's status to withhold taxes accordingly.

I'm also adding this article to learn about federal and state payroll wage bases and limits.

You can tag me if you have more questions about federal and state income tax. I'll help you in any way I can. Have a wonderful day.

Thanks so much for the response! Could this be due to the employees age? The employee is over 65 and I saw something about older workers not being charged Federal income tax until they meet a threshold?

Thanks!

Tim

Hi @p62484c,

I appreciate your prompt reply.

What you said is correct. An employee that's 65 years old, married, filing jointly, and make less than $27,000 combined can stop filing income taxes.

To remain compliant with payroll taxes, you can take a look at this article: Payroll Tax Compliance Links. Search for the correct state, and look over the Withholdings section for additional information.

Let me know in the comments below if you have other questions about payroll taxes in QuickBooks Online. I'll take care of them for you.

My employee has everything accurately on the w4 to be paying taxes, but they are not being pulled out. I dont know how to fix that.

Thanks for joining this payroll discussion, @bullardb.

I want to make sure you're able to pull out taxes for your employees. There are a couple things you need to look into if your employee's paycheck are not withholding taxes. See the following scenarios:

If that is not the case, given that their W-4 information is correct, I suggest contacting our payroll team. They can help check your account, and if possible, raise this case to our engineers for review.

To get a hold of a representative to check your account, follow these steps:

You can also chat with us online by clicking on this link: QuickBooks Online Payroll. To ensure we address your concern on time, check out our Payroll Support hours.

This thread will remain open for additional questions and updates. If you have any further questions about QuickBooks Payroll, please tag me anytime. I'm always right here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here