Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWithholding amount is 0.00 for State and Federal for current payroll. This has calculated correctly the entire year (and past 10 years). The employee (one employee) is setup correctly (just verified) for withholding. The QB payroll message is: "You may notice that the federal and/or state withholding amount on this paycheck is 0.00. Federal and state withholding amounts are calculated by annualizing the wages on a paycheck (i.e. multiplying wages times pay periods in the year). When the resulting annualized income is small, the withholding amount can correctly be 0.00, even when the employee usually has taxes withhold.

Intuit "help" suggests that payroll not setup to deduct taxes, confirmed payroll properly setup for 10 years. What to do? I need to issue payroll with deductions taken for federal and state. Appreciate any insight as to why this never happened the past 9 years in QB payroll at this point in the year. Thank you.

Hi there, @Nancy02.

The possible reason why the Withholding amount is 0.00 is that your employees are exempted from Tax Withholding. And I'd like to share a few information about this and help you from there.

Just to clarify, have you made any changes to your employees' details, like their marital status and withholding allowances? If so, that's the possible reason why the withholding amount is 0.00.

Withholding will base on the employees' W-4 form if they're claiming exemption from it. Thus, your employee is married claiming three withholding allowances.

For more information about withholding, you can read the Publication 15 "Employer's Tax Guide" from IRS for more details. Here's the link: https://www.irs.gov/pub/irs-pdf/p15.pdf.

Also, if you want to issue payroll with withholding deductions, I recommend seeking help with your Tax Preparer or Accountant. This way, they can offer you some advice about this matter.

In case you need tips and related articles in the future, feel free to visit our QuickBooks Community help website for reference: QBDT Payroll Self-help.

If you have any other concerns, feel free to leave a comment below. I'll right here to help.

Thanks for quick reply. That is not the problem - as noted in my post, the employee record is correct. It is about QB. After substantively spending the day on this yesterday and doing google searches, I found a solution that worked, by reversing the payroll, (then I rebooted) and started the payroll again - all the tax deductions appeared properly. Thank you again for your response.

I appreciate you taking the time to reach us back, Nancy02.

I'm glad to hear that you've found a solution to your concern about the zero amount withholding. Thanks for keeping us updated and for sharing the steps you've taken to resolve this. I believe this will help other users who are experiencing the same issue.

To be more familiar with QuickBooks Desktop Payroll features, here's an article that you can refer to: QuickBooks Payroll Services and Features for QuickBooks Desktop.

You can always visit us again if you have other questions. I'd be more than happy to help. Wishing you continued success!

We occasionally run into this problem where NONE of the taxes calculate. We get out of QuickBooks, shut down the program completely, then reopen and log back in and everything works.

We've also see issues where at the beginning of the year (but not the first paycheck-- more like the 3rd or 4th) the program will deduct Medicare, then add a second line-item for Medicare and deduct it again. The employee set-up is correct (you can't add or subtract that tax anyway), and it won't do it on all employees, and it only happens the once. It's odd. It's not bad enough that we need to call or anything, just annoying that we can't trust the program at all.

Welcome to the Community, KTFPC.

There are four factors we need to consider to ensure the program calculates the correct withholding. These are the following:

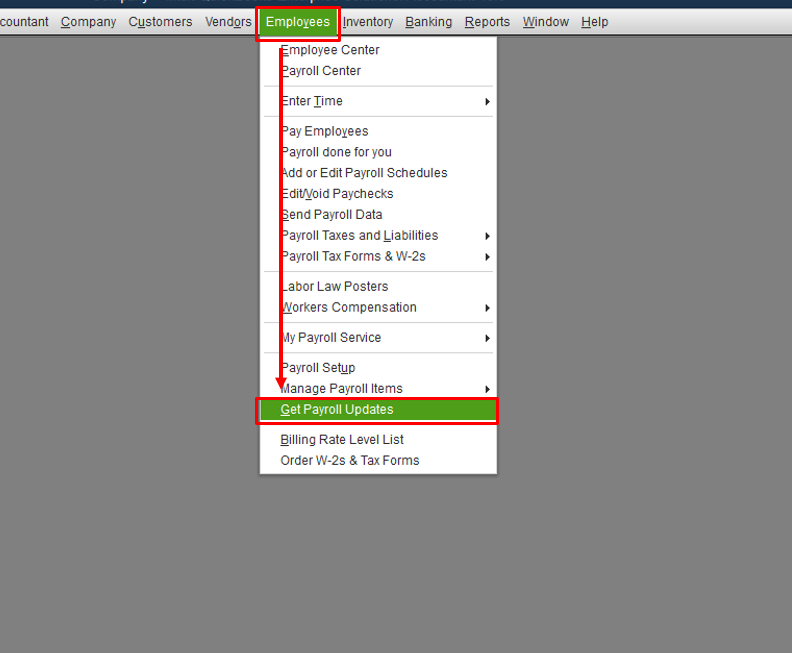

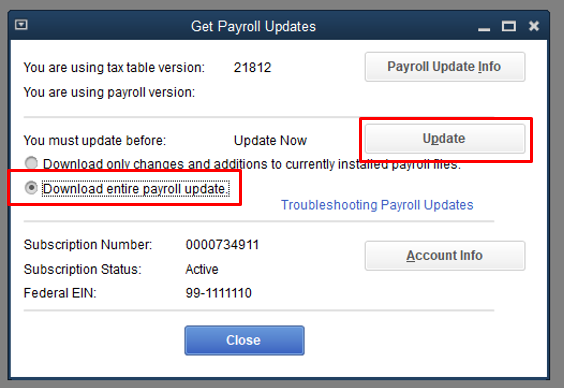

I'd suggest updating the payroll tax table as well before running the payroll. Let me show you how:

To know more about QuickBooks payroll, here are some articles for future use:

Don't hesitate to drop me a reply below if you need further assistance. Have a nice day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here