Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a new payroll client who's prior accountant also used Intuit workforce. The employees are not seeing the W2's since my firm took over payroll. Is there something I need to do on my end so they don't just see prior accoutants payroll info?

Thanks for joining the Community, PFreijeTax.

To verify my understanding, does your client still have their previous accountant set up as an External Accountant user in their books? If so, they'll need to delete the user, then they can invite you as an External Accountant user.

In the event their prior accountant isn't set up as an active External Accountant user in their books, please follow up with me here.

I'll be looking forward to your reply. Have a great Friday!

Thank you so much for your response ZackE. So I hold the company file and started a new one when this client came on board on 1/1/24. It was quite a chore changing the payroll administrator over to my firm from the prior accountant. Because I hold the company file, I'm not sure how to answer your question. Also, to confirm, I am using QBD Pro.

Hi there, PFreijeTax. Allow me to share with you some information.

QuickBooks Workforce is a great way for your employees to access their pay stubs and W-2s at any time. Every time you run payroll, your employees will receive an email notifying them that their pay stubs are available to view and print. They can also view and print their own W-2s during tax time.

If you have new payroll, you can invite your employees to Workforce. They can use their existing Intuit accounts for this purpose.

To invite your existing employees, you need to add their email addresses to their profiles and set up the invites. Please follow these steps:

You also have the option to invite your new employees. Let your employees know that they'll have two QuickBooks Workforce accounts, likely with the same business name. One will have the past paychecks from your prior service, and one with the new paychecks and W-2s.

Once your employees receive the email with the invitation link, they can set up and use QuickBooks Workforce to view their pay stubs and W-2s. They will be prompted to create their own Intuit account, which will allow them to manage their user ID, personal settings, and security info.

For more information, please visit this article: Invite your employees to QuickBooks Workforce to see pay stubs and W-2s if you use QuickBooks Deskto...

Furthermore, you can check out this video to see the employee experience: How to set up and use QuickBooks Workforce to see pay stubs and W2s

Let me know if you have additional concerns about Workforce in QBDT, I'll be around to guide you. Stay safe!

Thank you kindly for your reply.

Re: "You also have the option to invite your new employees. Let your employees know that they'll have two QuickBooks Workforce accounts, likely with the same business name. One will have the past paychecks from your prior service, and one with the new paychecks and W-2s"

Invites have already been sent as I'm very familiar with that part. When you mention above that "they'll have two Workforce accounts", do you mean as in different username/passwords accounts or do they use one account and someone select within that account which company to look at? This is the part I'm having trouble with. The employee logs into the account they created from prior accountant but they do not see the current payroll info. Do I need to advise them to set up a new account?

Hello there, @PFreijeTax.

Let me share additional information about employee access in Workforce.

I understand you already invited your employees to Workforce. If your employee accepted the invitation using their existing account, they will only see one account and can only select one company to look at within that account. Otherwise, if they use a new intuit account, they will have a separate username and password for that company.

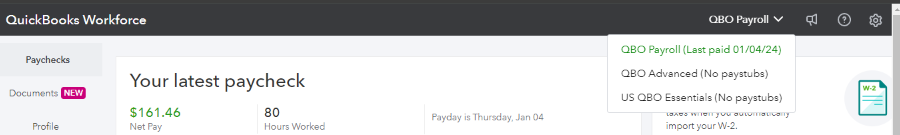

I would like to add that you need to invite them using your employee's existing account or the one they used when they register. Then, they can already toggle or choose different company by clicking the dropdown. See screenshot below for the sample.

If the issue persists, I recommend reaching Customer Care team.

Here’s how:

For future help, here are some articles to help you get ready during tax season:

Let me know if there's anything else I can do to help you with concerning payroll. I'm here to lend a hand. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here