Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowHas anyone received an EIDL loan advance? I'm wondering how I should account for it. According to the EIDL website, the loan advance does not need to be repaid, so I believe it's safe to assume that the full amount will be forgiven regardless of method of spending it (unlike the PPP loan). Should I record it as an Other Current Liability or some kind of asset? Not sure how to remove it from the books if I record it as a liability, especially as we start to spend the funds on biz expenses.

Solved! Go to Solution.

It would appear that the ACH deposit from the name of “SBAD TREAS 310” is your advance from the SBA. This advance does NOT have to be repaid. So most people are placing it under other miscellaneous income or doing a non-taxable income category. I've asked my CPA at large firms and they are confused too where to post it. I'd recommend where ever you post it to make sure it is clearly noted that it is the EIDL advance and not the actual loan since the actual loan needs to be paid back in 30 years which in that instance would be a long term liability loan.

from this page

https://disasterloan.sba.gov/ela/Information/EIDLLoans

The interest rate on EIDLs will not exceed 4 percent per year. The term of these loans will not exceed 30 years. The repayment term will be determined by your ability to repay the loan.

EIDL assistance is available only to small businesses when SBA determines they are unable to obtain credit elsewhere.

so deposit the funds and use a liability account as the source account for the deposit.

If you have some other site that says the EIDL is a grant please post that link.

Hi Rustler, the link attached by TLCLC is the same one I was looking at. So if that's the case, I should be accounting for it as a grant then? Do you know what exactly are all the implications I should take note of when setting it up as a grant?

Direct link:

I got some funds from the EIDL loan advance and I don't know how to account for them either.

It would appear that the ACH deposit from the name of “SBAD TREAS 310” is your advance from the SBA. This advance does NOT have to be repaid. So most people are placing it under other miscellaneous income or doing a non-taxable income category. I've asked my CPA at large firms and they are confused too where to post it. I'd recommend where ever you post it to make sure it is clearly noted that it is the EIDL advance and not the actual loan since the actual loan needs to be paid back in 30 years which in that instance would be a long term liability loan.

My Accountant told me that the best way to record the stimulus deposit would be to record the deposit, and the income account it should go to would be "Nontaxable income - 2020 Economic Stimulus" under Other Income.

I am struggling with this also. I understand the up to $10,000 amount is a grant and will not have to be repaid, and that the business may get an actual loan in 2 months down the road for $90,000 more as you mentioned that will need to be paid back. Do I record the $10,000 as non-taxable income and then the additional actual loan as Long Term Liability?

I am struggling further with the fact that they are saying that $10,000 grant reduces from the PPP Loan what can be forgiven. I read the business can refinance the PPP Loan to include the EIDL, but is that for the Loan portion or the grant? Anyone dealt with this or seen this? I obviously don't want the EIDL to reduce what can be forgiven on the PPP Loan when it is all being used properly.

Hello, @Chloe12.

I hope you're having a successful week so far. You can record your Paycheck Protection Program loan through QuickBooks and continue paying or re-hire your employees. The funds will allow you to continue to run payroll and pay your employees. You can also track the loan and what you spend it on by following these steps:

Now you'll be able to pay your employees and track your loan expenses. You can also run a Profit & Loss report to check how much your spending. I've included an article to help: Track how you use your PPP loan. As for all your other questions about loan forgiveness, I recommend getting in contact with your accountant. They'll be able to tell you what's best for your books and how to record the EIDL correctly.

I'm here to lend a helping hand should you have any other QuickBooks related questions. Enjoy the rest of your week!

Hi Anna - How do I record the ACH payment received from the SBA for the loan advance?

How do I record the initial deposit received from the SBA for the loan advance?

Hello, Jackie_Z

Let me see what I can do to help you record the initial deposit of your SBA loan. These steps will get you going in the right direction.

Start by crediting the loan as a liability and name it whatever you'd like to remember what it is. Set it up as a short-term liability if you know it'll be forgiven, as life of the loan is only 8 weeks. If you think for any reason it wont be forgiven, then you can set it up as long term liability, which has a 2 year repayment plan through 2020 and 2021.

Also, it is important to remember that you record it in the name of the bank you received it from because you're paying back or being forgiven by that bank, not the SBA.

Now that you're receiving the loan (or at least part of it) I suggest checking out the following article, it highlights the necessary steps that need to be taken for your loan to be forgiven.

If there's anything else I can help with, feel free to post down below.

Thank you and have a nice afternoon

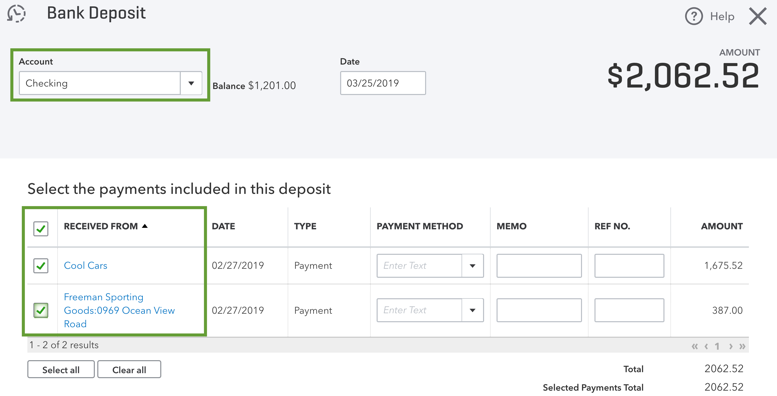

How do I enter the bank deposit? I need to record the deposit into the checking account so I can reconcile the bank statement. Step by step instructions please.

Hey, Jackie_Z.

I'm happy to show you how to record the bank deposit. Follow along down below:

When these steps are completed you will be able to account for the deposit into your checking account.

I'm here if you need further assistance or have any other questions.

Thanks again for stopping by and have a nice evening.

Still looking for the correct way to enter a payment received by the SBA for the advance loan. Should it be entered using "Receive Payment" or "Bank Deposit", or maybe another way? I've seen this question "how to record a payment from the SBA" posted over and over and have not seen an answer to the first step in recording the payment.

If "Receive Payment", what steps need to be taken to record? It's not a customer paying me, so do I create the SBA as a customer?

If "Receive Payment", what steps need to be taken to record? Who do I list in the "received from" column, the "account" column?

Hey there, Jackie_Z.

Thank you for reaching out to the QuickBooks community. I found some helpful articles for recording that. I'll be including it below. If you have any other questions let me know. We're always here to help!

The first $10,000 is really a grant. I would make a short term liability account and record the deposit. Then I would make a journal entry to reduce the short term liability account and increase owner equity account. This was you have a historical trail of the funds.

When the true loan amount comes in,deposit into a long term liability account.

Why does it say the grant advance does not need to be repayed. If you are approved for the loan, the grant/advance is part of that loan and has to be repaid. It only does NOT have to be repayed if you don't got approved for a loan? I got two a deposits, the initial advance and the balance of the loan. Should I put it ALL under long term liabilities?

Good morning, @alabamarolltide.

Thanks for joining this thread. I'd be happy to provide information about the EIDL advance.

In QuickBooks Online, the advance through the EIDL program will be deducted from your forgivable amount on a Paycheck Protection Program (PPP) loan. Since this is being automatically deducted, you wouldn't need to pay it back.

For additional information about the EIDL advance and how it's being deducted, please refer to this helpful article: Paycheck Protection Program loan forgiveness.

Feel free to comment below if you have any more questions or concerns. Have a safe and productive rest of your day!

Hi,

Did you ever get a solid explanation on how to account for the EIDG?

I've checked threads and haven't found step by step directions anywhere.

Thanks in advance,

Tammy

OK the grant is not taxable and won't need to be paid back. Please correct me if I am wrong but I would think anything the grant is used for won't be deductible. I will be a watch out. The balance should be zero once the grant is used. Feedback?

I'm glad that you're joining this thread, gramirez_04.

What you've figured out is right that the EIDL loan advance/grant won't need to be paid back. Though, it is deducted from your eventual EIDL loan amount. On the other hand, if you never get an EIDL loan, your advance payment will be considered as a tax-free gift and may account for income but not taxable. With that, it does not need to be repaid.

In case you would like to know more about it, you can contact our specialist for further assistance. Use this link in time you need them: http://paycheckprotection.intuit.com/. To address your concern on time, you can reach out to them on their work schedule:

You can tap me on my shoulder anytime if there's anything you need. Stay safe and healthy!

Anne,

The OP is not asking about PPP. They are asking about the EIDL Grant. How does the EIDL grant get reported in QB? EIDL is completely different from PPP. Perhaps Intuit needs to do a bit more training on the Cares Act with their QB team.

@Nick_M wrote:Hello, Jackie_Z

Let me see what I can do to help you record the initial deposit of your SBA loan. These steps will get you going in the right direction.

Start by crediting the loan as a liability and name it whatever you'd like to remember what it is. Set it up as a short-term liability if you know it'll be forgiven, as life of the loan is only 8 weeks. If you think for any reason it wont be forgiven, then you can set it up as long term liability, which has a 2 year repayment plan through 2020 and 2021.

Also, it is important to remember that you record it in the name of the bank you received it from because you're paying back or being forgiven by that bank, not the SBA.

Now that you're receiving the loan (or at least part of it) I suggest checking out the following article, it highlights the necessary steps that need to be taken for your loan to be forgiven.

If there's anything else I can help with, feel free to post down below.

Thank you and have a nice afternoon

Nick, you are talking about the PPP.

The OP is not asking about PPP. They are asking about the EIDL Grant. How does the EIDL grant get reported in QB? EIDL is completely different from PPP. Perhaps Intuit needs to do a bit more training on the Cares Act with their QB team.

Hi, some of us are not taking the EIDL loan but we received the EIDL Advance which is a grant and doesn't have to be repaid. A previous poster mentioned that it's a non-taxable grant. The question remains then, for those of us only taking the grant how do we record this properly since it was auto deposited to our bank and what account does it fall under and how do we make sure it shows up clearly as the EIDL Advance Grant on the P&L so our accountant knows what to do with it at the end of the year?

Not sure if this is accurate but I saw this on another site:

The EIDL advance is technically a grant for small businesses of up to $10,000. Because it’s a grant, it’s not part of the loan that needs to be repaid. That means it’s going to be treated differently than a loan on your financial statements and your tax return at the end of the year.

Unlike the PPP loan forgiveness, this grant will probably need to be included in taxable income. This isn’t definitive because the IRS hasn’t specifically said that this advance should be included in taxable income, but previously they’ve been pretty clear that any forgiven SBA loan amounts need to be included in income. (https://bench.co/blog/tax-tips/2020-taxes-ppp-eidl-pua/)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here