Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI need help with entering sales from square. I have the bank feeds enter deposits automatically. I need a journal entry to enter the square fees, discounts from sales, sales tax collected, tip income collected and gross sales. New to this and I dont want to enter incorrectly. Thank you

Solved! Go to Solution.

Hi, cvmom73.

Allow me to give more details about entering square fees and correcting past deposits in QuickBooks Online (QBO).

If you're using online banking when adding deposits, you can just undo the deposits from the In QuickBooks tab. Once done, these transactions will be transferred to the For Review tab.

Here's how:

Once you record all the transactions correctly, you can now start matching downloaded transactions. Refer to this article to learn more: Add and match downloaded banking transactions.

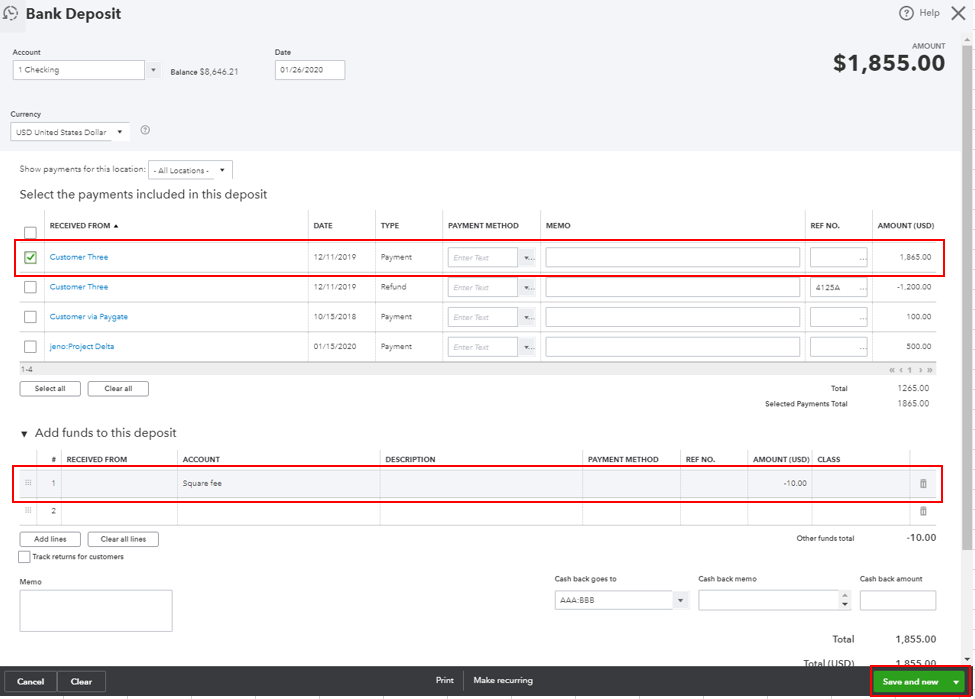

In addition, to lessen the total amount deposited, you can add a negative amount for square fee in the line item when entering bank deposit.

Let me show you how:

I'll be around here in the Community if you have more questions about correcting bank deposits. I'd be happy to help.

"I need a journal entry"

No, no, no you don't. You need daily sales receipts for items and taxes , etc and deduct the fees for net deposit either on the sales receipt or better in the actual deposit since you will be off if you just try to take the percent off of gross and forget the transaction fees.

If you are using the square program for restaurants (You I fixated tips) then if you sync it with QB rather than just the deposits in bank I g then the sales, taxes, tips, should all sync over to QB

And turn off the auto deposit recording. You need to review them before accepting, really

Thank you, I will do this moving forward. How do you suggest I correct the past deposits?

Hi, cvmom73.

Allow me to give more details about entering square fees and correcting past deposits in QuickBooks Online (QBO).

If you're using online banking when adding deposits, you can just undo the deposits from the In QuickBooks tab. Once done, these transactions will be transferred to the For Review tab.

Here's how:

Once you record all the transactions correctly, you can now start matching downloaded transactions. Refer to this article to learn more: Add and match downloaded banking transactions.

In addition, to lessen the total amount deposited, you can add a negative amount for square fee in the line item when entering bank deposit.

Let me show you how:

I'll be around here in the Community if you have more questions about correcting bank deposits. I'd be happy to help.

I would like to know this as well. My square show up as deposits and I have no idea what to do with them. Im new and my QB classes don’t start until April so I’m lost but don’t want to fall behind

Hello there, LisaLMT.

I appreciate you for joining this thread about your Square transactions. I'm here to lend a hand.

If you're using the Sync with Square app to import sales into QuickBooks Online, you can check the mapping of the downloaded transactions. You can go to the app's setting to review the setup and ensure the transactions will sync correctly.

Here's how:

In case you want to know more about the app, I'm adding the article I recommend on this: Sync with Square Hub.

Please keep me posted if you have any questions with QuickBooks. I'm here anytime to help.

SO far I have not done anything with the square. I have not downloaded the app to connect to QB because I was afraid of messing up my books. I wanted to research it first and QB is no help. I did switch to go payments and do just got my device. I hope it makes things easier for me. So far square just does auto deposit to my bank and it’s shows up but I don’t know where to outbid fees or record deposit amount. Any advise for me will be appreciated .

SO far I have not done anything with the square. I have not downloaded the app to connect to QB because I was afraid of messing up my books. I wanted to research it first and QB is no help. I did switch to go payments and do just got my device. I hope it makes things easier for me. So far square just does auto deposit to my bank and it’s shows up but I don’t know where to put fees or record deposit amount. Any advise for me will be appreciated . Is it better to use the app you suggested.

So is your way correct or the advice intuit quick book person give in the thread. I’m so confused with the fees that I can’t get one persons answer to match.

Hi LisaLMT,

You'll want to include the fees when you deposit the payment in QuickBooks, Then, match them with the downloaded transactions in the Banking section.

Here's how:

Once done, you can now match your deposit to the downloaded transactions.

You can check out this article for details: https://squareup.com/help/au/en/article/6081-intuit-quickbooks-sync-with-square-faq.

We're always here if you have any questions. Have a great day.

Hello,

I need some help with the Square integration with QB.

1) For each new Client/Projects, I use the Projects function in QB

2) I create an invoice that includes the processing fee amount

3) I process the invoice with Square Dashboard

4) I have the app for Square integration for QB installed

Here is where things are getting tricky

5) My square shows paid under the Sales/Invoice and my customer is Square Consumer. It just enters into my QB. I have no clue where it goes once the integration happens.

6) I including the processing fee on my client's invoices as they cover this expense

7) The deposit amount minus the processing fee shows up on Banking. Next, I receive payment and match it to the open invoice.

Not sure what is the correct next step here.

Hi there, PLP269.

Sales records in your Square account will be imported into QuickBooks Online as invoices. Bank deposit and transaction fees charged by Square are also automatically imported.

The imported transactions will also be posted under a default customer, named Square Customer. This is the reason why you can see that all invoices and processing fees are attached to that name.

Once imported, you just need to match the deposits and payments to the appropriate invoices. Let me share these articles on how to handle Square transactions in QBO for more details:

Visit us again in the Community if you have other questions.

Can you tell me which department of tech support I should connect with? I need to have someone do a screen share and go through all my books.

Hi again, PLP269.

Please follow these steps to reach out to our phone support:

The Community is always here if you have other questions.

@PLP269 wrote:

Hello,

I need some help with the Square integration with QB.

1) For each new Client/Projects, I use the Projects function in QB

2) I create an invoice that includes the processing fee amount

3) I process the invoice with Square Dashboard

4) I have the app for Square integration for QB installed

Here is where things are getting tricky

5) My square shows paid under the Sales/Invoice and my customer is Square Consumer. It just enters into my QB. I have no clue where it goes once the integration happens.

6) I including the processing fee on my client's invoices as they cover this expense

7) The deposit amount minus the processing fee shows up on Banking. Next, I receive payment and match it to the open invoice.

Not sure what is the correct next step here.

Delete step 4 above. Record received payment inside QB. Create deposit. Match to Square deposit into banking which you can plainly see in your Square login.

great!! it doesn't work on my qb online it is so frustrating.

Hey there, @expressconst.

Ideally, the steps provided by my colleagues should help track the Square processing fee. Since this isn’t the case, we’ll have to determine what’s causing the issue.

For the safety and security of your account, I suggest contacting our QBO Care Team. They can view your transactions in a secure environment and assist in recording and matching your Square transactions.

When contacting them, the transactions are now properly recorded in your account.

Stay in touch if you have any questions or concerns while working in QBO. Please know I’m just a comment away for help.

@expressconst wrote:

great!! it doesn't work on my qb online it is so frustrating.

What does not work and what version of QB are you using? You might want to start a new question with more detail.

These instructions seem pretty straightforward. However I went to "undo" my bank deposits and "match" them to my square invoice and it wont let me since the amounts are not exact matches. That is, the bank deposit is lower (due to Square Fee) than what is reflected in the Square invoice.

I also went into the Bank Deposit section to try and add a negative amount to what was reflected in my Square Invoices. There are no options to allow me to do that; no buttons to add additional lines.

I am completely stuck and need some help.

Thanks,

Hi, @dougj.

Allow me to provide additional clarification about matching downloaded transactions in Quickbooks Online (QBO).

To be able to match the transactions accordingly. First, you must create an expense account for the processing fee if you don't have set up one.

Once you have an expense account for the processing fee/s, you can now resolve the difference between the invoice and the payment when matching transactions from your bank feed.

Once completed, your transaction is now matched off against the invoice and the bank fees are accounted for.

For further details about matching and categorizing your downloaded transactions, you can check this article: Match and categorize your downloaded bank transactions.

You can also check our help articles in case you have any other QuickBooks concerns in the future: Help articles for QBO.

Let me know if you have any other questions about the steps provided above. I'm always here to help.

My QBO doesn't give me the option of your Step 4. I can go into bank deposit and enter an amount at the bottom where it says to add funds to this deposit. Should I go instead to the actual invoice and enter a negative amount for the Square fee? Any help appreciated.

Thanks!

Glad to have you in this thread, trinebean88fan.

You'll be able to see the Find match option once you click a transaction in the For Review section. You can take a look at the sample screenshot I've added below.

You can also make a bank deposit and enter a negative amount form there. Also, you'll want to check about downloading, matching,categorizing your bank transactions in QuickBooks.

The Community is always to help you out.

Sadly the replier didn't take int o account that a credit card charge is a credit but that it also comes with a debit of the credit card usage that business must track as it won't allow our sales to match up with our actual income and the credit card fees that are deducted from a business must be reported in our taxes.

cant add a negative amount. it does not allow me to

Hi there, @ago.

You'll want to make sure that the payment is selected in the Select the payments included in this deposit section so you can add the fee as a negative amount. Let me guide you through the steps.

Once done, it'll now decrease the total amount deposited.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here