Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHow can I apply for a 94x online signature for electronic filing using QuickBooks Pro Plus 2024? I don’t have the same menu as QuickBooks Accountant.

In QuickBooks Pro Plus 2024, the option to apply for a 94x online signature for electronic filing is not available in the same way as in QuickBooks Accountant. The 94x e-filing feature is typically designed for QuickBooks Enhanced Payroll and QuickBooks Accountant versions, where you can apply for an e-file PIN directly through the software.

You can go to the IRS e-Services portal and apply for a PIN separately. Once you receive it, you’ll need to enter it manually when filing your 94x forms.

Thank you for reaching out, Ana. I have details that help you apply for the 94x online signature to utilize electronic filing in QuickBooks Desktop (QBDT).

Before anything else, know you'll need a payroll subscription to set up and apply for the 94X online signature for electronic filing. If you have a payroll subscription, these are the steps to set up:

Also, I recommend contacting the IRS so they can confirm your business details and the owner's information. Once done, you'll need to wait up to 45 days to receive your 10-digit E-file PIN. See this page for more details: Set up Federal e-file and e-pay in QuickBooks Desktop Payroll Enhanced.

On top of that, I got you this article to help monitor the status of your filings: Check the status of your payroll tax payments or filings sent through QuickBooks Payroll.

The Community space is open 24/7, and you can communicate with me in the comment section if you have other QuickBooks-related inquiries. I assure you that I'll be here to assist you all along the way and resolve your concerns. Keep safe.

Thank you very much. I tried to do it separately, but the IRS doesn’t offer that option. They state:

Steps to apply and use your PIN:

Complete the online signature PIN registration process, which is in your software package.

That’s why I was checking in my QuickBooks.

I followed your instructions, but I did not see the "payroll setup window and edit"

Applying for a 94X online signature for electronic filing has the same steps as applying for other federal forms, @Aloo.

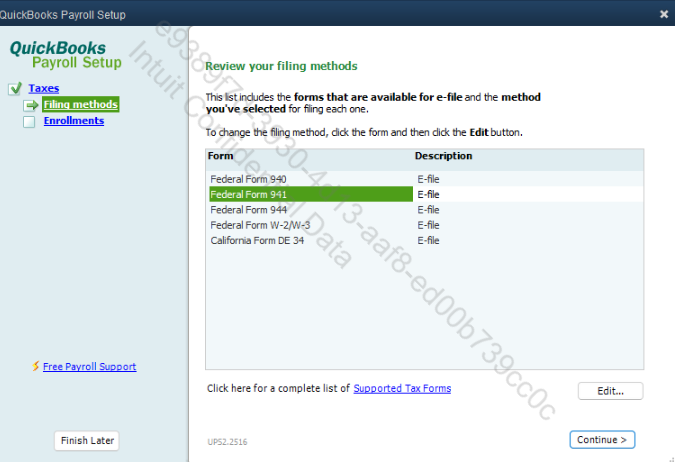

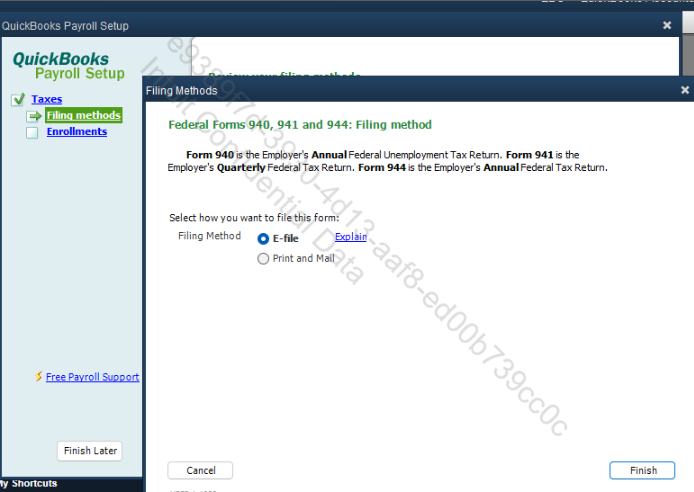

Follow the steps below to enroll:

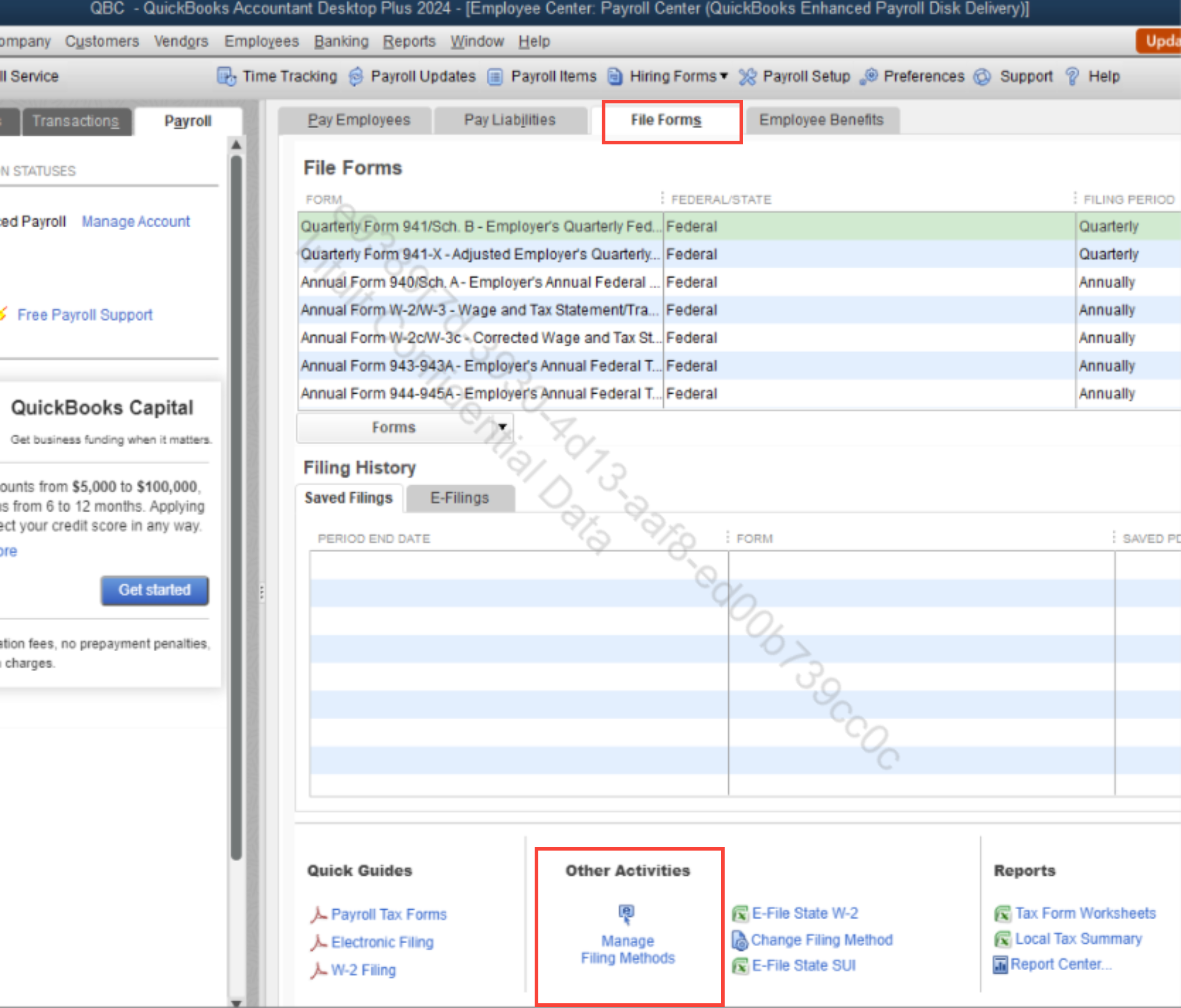

First, you need to set up your federal filing method.

Then, wait up to 45 days to get your 10-digit E-file PIN.

Leave a comment below if you need further assistance to enroll for e-filing in QuickBooks Desktop.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here