Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIt's great to see you posting today, ktorling!

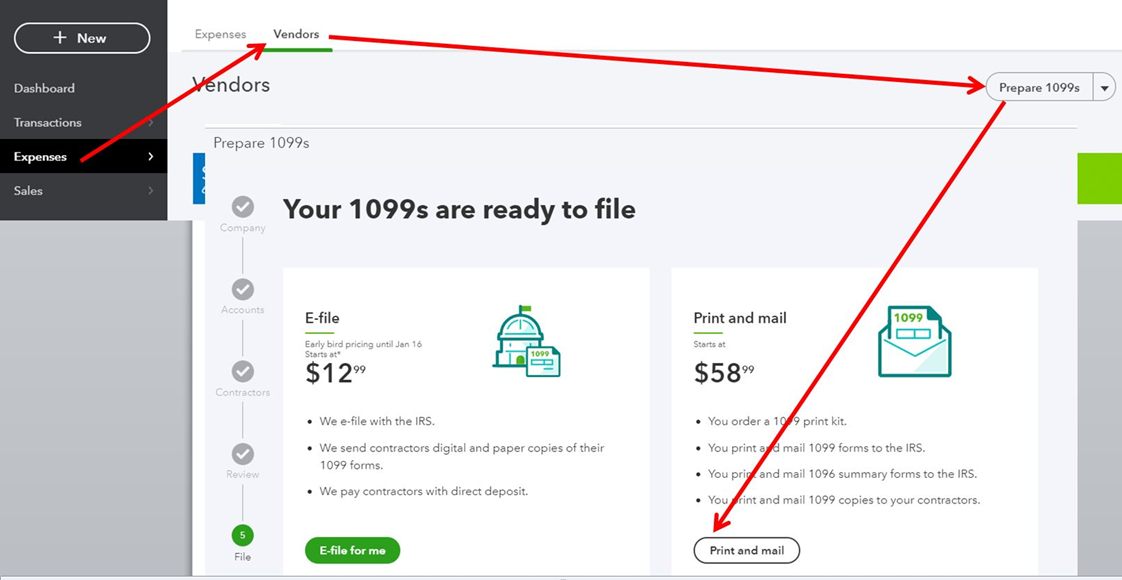

Yes, you can check your previously filed 1099 forms in QBO. Just follow these steps:

You can also log in to your 1099 E-file Service account and click Download and print copies for your records to print your filed 1099 forms.

On the other hand, if you need references for QBO, just go to the main support page and click More topics.

Let me know if you need more help. Take care and have a good one!

Following those steps, there is no option to view 1099 filings. The only option is to Prepare 1099s. I tried clicking that, and it gives me a message that is not yet time to prepare 1099s.

I am trying to retrieve copies from 2020. Can you please provide instructions to find these?

I got you covered, @ktorling-gmail-c.

You can get a copy of your previous year's 1099s if you've filed it through our 1099 E-file service, you can log in to your account and print a copy from there.

Follow the steps below:

If you print the 1099 totals under the Prepare 1099s screen, you can run 1099 Transaction Detail Report, 1099 Contactor Balance Details, or 1099 Contactor Balance Summary to see the 1099 totals, account, amounts, and other details. I'll show you how.

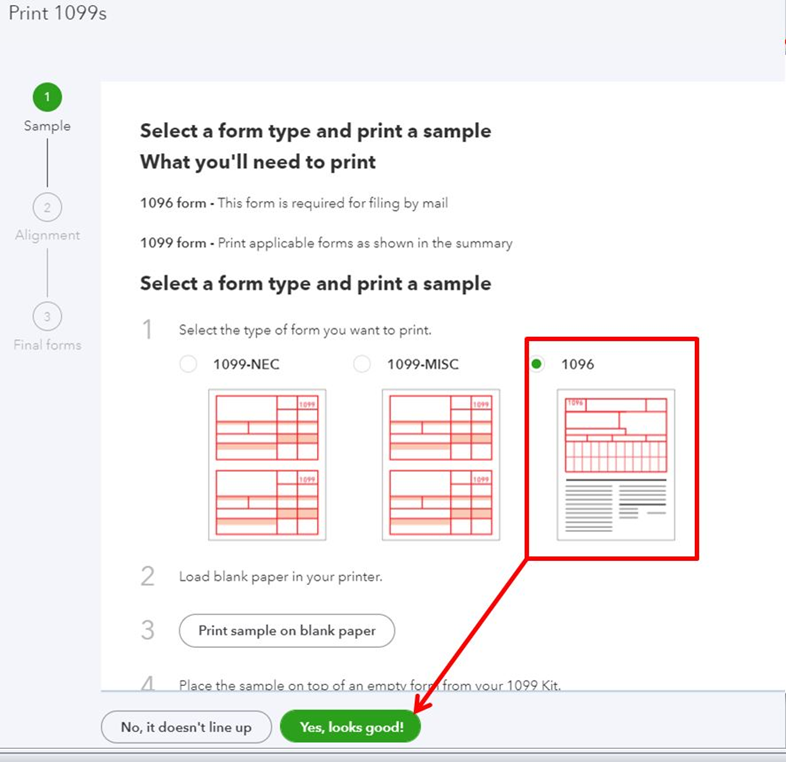

Furthermore, follow these steps get the 1096:

Please see this sample screenshot for a visual guide:

You can also read this article for reference: Print a 1096 form. To view other articles and guides, check out our general help topics page here.

Also, you'll want to know how to access and print your other tax forms to save a copy for future use.

You're always welcome to add any details if you have further questions about 1099 and 1096. We're always here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here