Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi QB Community,

We run a non-profit. Currently we have our P&L setup to show our Fundraising Income, and then each fundraiser we run as a sub account of "Fundraising Income". Then under Expenses, we have the same setup. "Fundraising Expenses" and each fundraiser /expense is a sub account of that.

We would like to set it up to show the net amount; and not make the board do the math themselves. Is this possible? If so, how do we set it up?

Hello there, JSTreasurer19.

I'd love to share insights about the P&L report set-up. The profit and loss (P&L) statement summarize the revenues, costs, and expenses incurred during a specified period.

Here's how to customize your P&L report:

1. Go to the Reports menu, then choose Profit and Loss from the Business overview section.

2.Click the Customize button, then update the Report period.

3.Select the Filter menu to expand the options, if you want to filter selected accounts mark the Distribution Account and select the preferred accounts from the drop-down.

4.If you're using the class tracking feature, click the Class check box then manually select the classes you want to view on the report from the drop-down.

5. Click Run Report.

See this reference on how to run a profit and loss comparison report.

Let me know how else I can help you with setting up your report. Have a nice day!

Hi. Thank you for the response; however this doesn't really answer my question. When we run the report it shows the income and expenses separately. The members of the board need to look at the fundraising income, and then subtract the expenses to get the amount. I was looking for a way to set up a contra account where it showed each category as income minus expenses already so the members of the board won't have to do the math.

Hello again, JSTreasurer19.

Thanks for getting back and providing additional information about your concern.

When running the Profit and Loss report, it's section is separated from Income and Expenses. To get the information you need, you can pull up a QuickReport for a specific income and expense account. Then, export the report to Excel. From there, merge the two data and get the net amount.

To export, here's how:

To learn more about managing reports in QBO, check out the below articles:

If there's anything else I can do for you, feel free to reach back out. I'm here to help. Have a great day.

This still doesn't answer the question. First of all, a non-profit does not have a P&L. We have a Statement of Activities.

We have ancillary product sales. I want to set up the cost of those sales as a contra-revenue account. I don't want an answer about how to pull a report. I want an answer about changing an expense account to a contra-revenue account.

Is that possible?

Good day, @southhigh. I can help you change your expense account to a contra-revenue account.

Yes, it's possible. You can edit an item and change the account from Expense to Contra-Revenue in your Chart of Accounts.

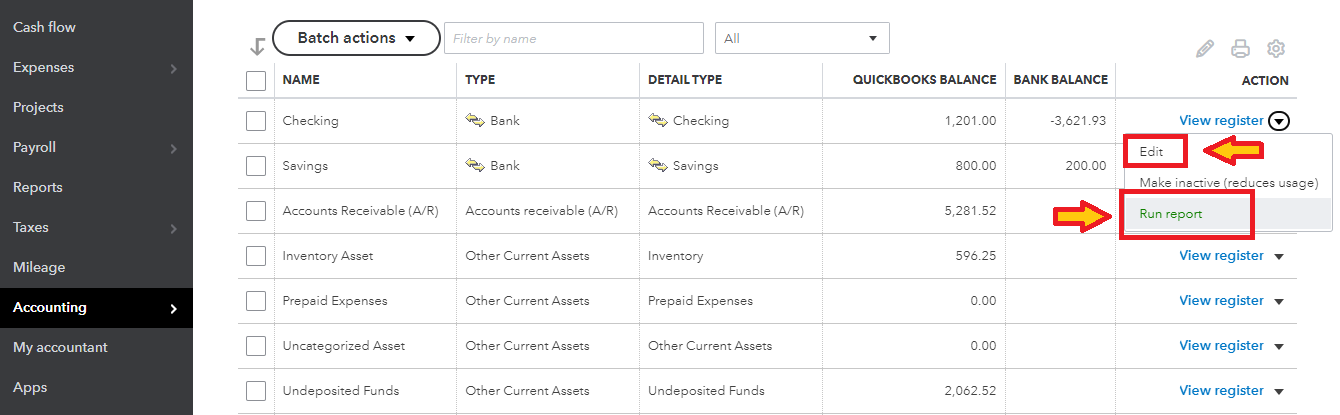

Here's how:

I'm also adding this article as your reference on how to add accounts to keep track of your transactions: Add an account to your chart of accounts in QuickBooks Online.

If you want to run a report from your accounts, you can do so by selecting Run report from the drop-down button in the Action column.

You can also memorize reports in QuickBooks Online.

Let me know if you need any further assistance in reconciling your bank or matching transactions. I'll get back to you as soon as possible. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here