Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have two credit card accounts, i would like to reconcile them as one because technically it's only on QBs that appears as if those are two different bank accounts but it's a single account. I wanted to reconcile those two accounts as one - is there a way to do this? See attached file - i would want to reconcile those two as one.

How can fix this?

Thanks for your help.

Meron G.

Thanks for reaching out to the Community, @Meron GG.

In QuickBooks, you can combine two accounts if these are just the same account. However, if both accounts have different credentials, then there's no way to merge it. You'll need to reconcile both accounts separately.

On the other hand, if you have a credit card with multiple subaccounts, then you can set it up by setting up the parent and subaccounts. To learn more about this process, you can check this article: About bank or credit card subaccount setup.

For more information about QuickBooks reconciliation workflow, please check this article: Reconcile Hub.

Add a comment below if you need assistance with anything else. I'm more than happy to help. Have a great day!

Thank you. But both accounts are the same account with the same credentials. The reason why the later is added because we were not able to download the transactions with the previous account.

Is there a way to combine them as we are referring to one single account.

Thanks

Thanks for getting back to us, @Meron GG.

Yes, you can merge both accounts with the same credentials. This way, you'll be able to reconcile those accounts as one. Let me guide you through the steps.

Before we start, please know that if those accounts have reconciliation reports, it'll be deleted from the account that has been merged. However, the status of the reconciliation (R) will remain on the merged transactions.

To merge two accounts, here's how:

Here's an article you can read for more details: How to merge accounts, customers, and vendors.

You might also want to check out this article to know more about the reconciliation workflow: Learn the reconcile workflow in QuickBooks.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a good one and be safe.

Thank you so much for helping me today.

I tried to do the way you walked me through - for the account that i want to keep i copied the information and account # and pasted it in the account that i want to eliminate and when i hit save it appears a message for a duplicate accounts and it doesn't give me the merging option. Maybe it's because both accounts are connected to the banking online? (See the screenshot attached).

Thank you

Hello there, @Meron GG.

You can follow the steps given by my colleague @Mark_R in merging your account. QuickBooks will display a message that says: "This name is already being used. Would you like to merge them?" please click Yes and your accounts will be merged.

Let me know if you need more help. Have a good one!

Thank you for helping me through out this messy process.

I tried to merge the two accounts but it keeps giving me the message in the attached file.

I want to reconcile the accounts but my balances are split up in the two credit card accounts.

Is there any other option to reconcile those two accounts?

Thank you again for taking your time in helping me.

Hi, @Meron GG.

Let me provide additional information about your concern in QuickBooks.

Currently, we're unable to merge the accounts, once it's connected to Online Banking or Web Connect. That's the reason why there's a pop message appearing on the screen.

Since both accounts are just the same credentials, we can make the other account inactive. This will hide the account from menus and your chart of accounts. Please follow the steps below:

Once done, you can now reconcile the other account. Just make sure to review your account in QuickBooks to make sure they match your real-life bank and credit card statements, here's how:

In case you encounter issues while reconciling an account, visit our Reconcile hub to help resolve the problem: Reconcile hub

We're always around if you need more assistance with your reconciliation concern. You can add more details by leaving a comment below. Stay safe.

Thanks a lot for helping me.

Before i deactivate one of the accounts i have one concern. The account that i am planning to deactivate is the one that i have been using until February 2020 which has been reconciled throughout last year and the beginning of this year. However the new account is created because the old account was unable to download online transactions for some reason. I have not reconciled March's credit card balance as i have two accounts linked to the same credit card online.

Now my question is - which account shall i deactivate? The old one (one that i have always used which has stopped downloading transaction but has some balances to consider but reconciled all the time until February 2020 ) or the new one (that is opened in March 2020 that has some downloaded transactions) ? Also note that both have some balances that i need to consider in order to reconcile successfully.

I am sorry for being a mess.

Thank you for helping me.

Meron G.

I’m here to clarify things out, @Meron GG.

We would need to combine these two credit card accounts. For us to do that, you can deactivate the old account to ensure that only one is connected to Online Banking. Then, edit the bank info to merge them by following the steps given by @Mark_R.

When deciding which account to merge, you would need to consider the reconciliation reports. Since this will be removed from the system while the reconciliation status (R) remains. I suggest you merge the new account with the old one. Also, performing the merging process is reversible. It is permanent and cannot be undone.

I've added this article that can guide you on how to reconcile an account in QuickBooks Online.

If you have further concerns, don't hesitate to click the Reply button. I'd be glad to assist you as soon as I can. Have a great day!

Is there a way to activate again the bank account that I deactivated? In order to merge the two accounts I first deactivated the new one ( where all my march's transactions were downloaded) - now after I deactivated this account I am not able to see March's transaction. Can I undo the deactivation?

Thank you!

I deactivated the account but now I cant see the downloaded transaction of March. I deactivated the new account because this account has only March's transaction downloaded. Now I would like to undo this deactivation because I lost all the march's transactions. Is it even possible to undo a deactivated account?

What other possible option do I have to retrieve back my march's transactions?

Thank you

Hello @Meron GG.

Let me guide you in reactivating your connected bank accounts. Once completed, you can merge the old account with the new one. This way, all the transactions will be recorded under one account.

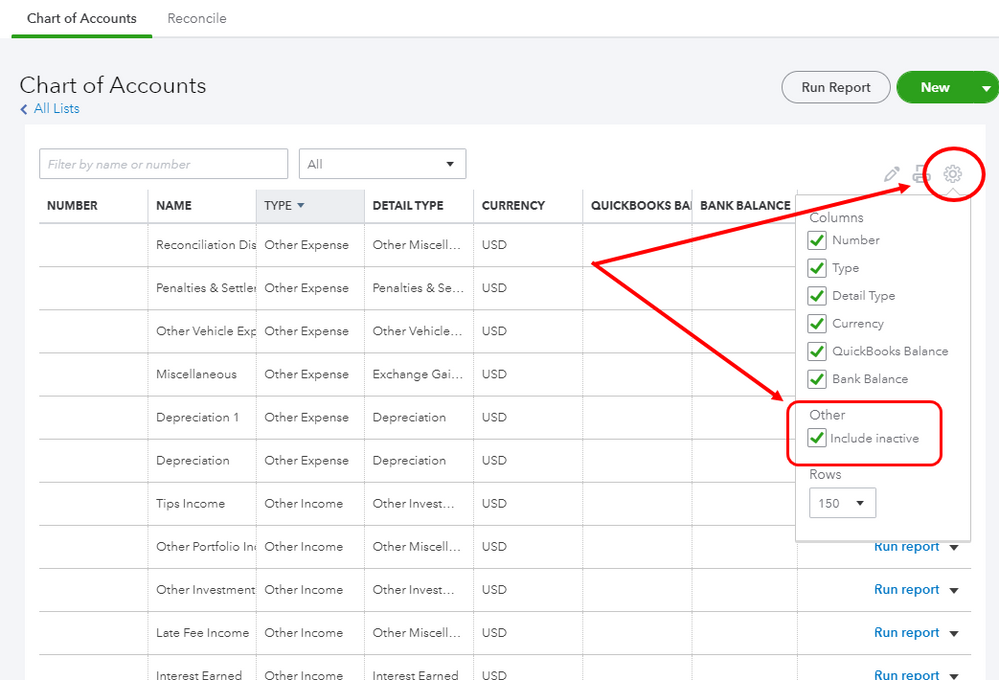

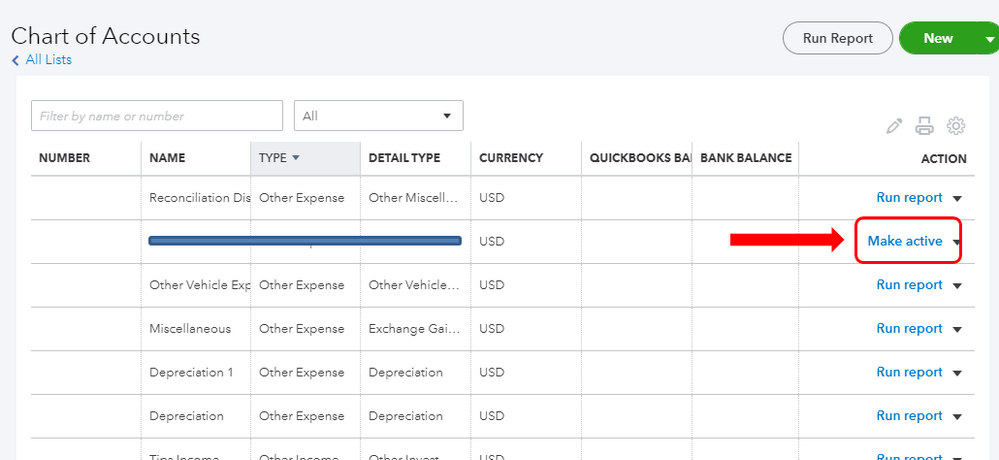

Here's how to reactivate your account:

Now, let's merge the two accounts.

Once completed, you can run an account quick report to see your list of transactions. Just click the down arrow beside View Register and choose Run report. To check more of the account limitations, you can view this article: How to merge accounts, customers, and vendors.

Keep me posted if you have other questions. The Community and I are always here to make sure everything is sorted out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here