Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

It is my understanding that Quickbooks Desktop allows you to record item receipt despite invoice not yet being received (DR Inventory / CR Item receipt liability account or goods received not invoiced), and then once you receive the invoice you create a bill therefore reclassify the accrual to AP (or at least that should be the entry flow).

We issue blanket POs, with various receipt dates. Invoiced received consist of shipments which may have occured over one or two months. Since inventory should be updated based on shipment date or receipt date (or at least in the correct month), how do I do this in Quickbooks online?

The vendor's invoice date, or when it is received, does not determine when to raise the transaction in your books. It's the receipt of the goods. So you would create a Bill transaction which increases inventory and liabilities (AP), dated when you receive the goods. The receipt date of the vendor's invoice is not an accounting event. For imports, the determining date is usually shipment from the foreign port

Hey there, @Anonymous.

Welcome to the Community space and thank you for the details you've added. I can help you enter goods received, but not yet invoiced, in QuickBooks Online.

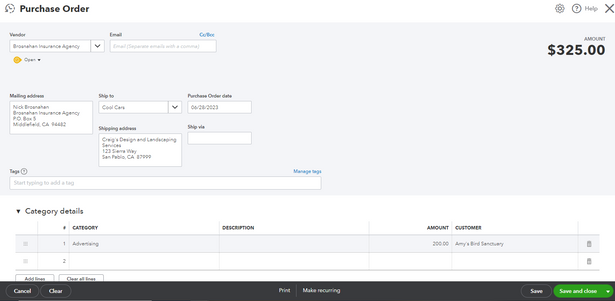

Creating an item receipt like in QuickBooks Desktop is not yet available in the QuickBooks Online version. However, you can create a Purchase Order and convert it to a Bill once you receive the items. Here are the steps to follow:

That should help you record your transactions in QuickBooks.

You can send your feedback to our product team so this may be considered in the future update. Please visit and post your idea in this link: https://feedback.qbo.intuit.com/forums/168199-quickbooks-online-feature-request.

You can add a comment below if you have other questions or concerns. I can provide further assistance. Have a blissful day!

The above solution doesn't work for me. Say my overseas supplier invoices goods to me on 1st January. I receive this invoice on 5th January by email. I receive real goods on 1 March . I have to pay in April. Now, when do I add his invoice and in what date? If I add invoice on 5th January, that means I add to my inventory, which is not correct and might mislead me since the inventory will be received later. If I add the invoice on 1st March in the date of 1st January, then my inventory in books changes for January which was again not the case. My real inventory in January was different.

Thanks for joining this thread, @APS4. Let me provide some insights about creating an invoice in QuickBooks Online.

If you plan to get paid in the future for products and services you sell, you can send your customers an invoice. When you decide to make an invoice, you can select any date you want.

To create one, here's how:

If you're using the new version of invoices, you may follow the steps in this article: Create and send invoices in QuickBooks Online. It also includes info to review open invoices and receive payments.

Additionally, let me share this link to help personalize and add specific info to your sales forms: Customize invoices, estimates, and sales receipts in QuickBooks Online.

As always, don't hesitate to leave a comment below if you have other questions about creating an invoice in QuickBooks. I'll be happy to help you. Keep safe and have a good day!

im trying to recieve items without them being added to payables. Often the vendor won't bill me for a week after receipt of the item. the way its working now is for all item receipts go straight to the payables and the clock starts. I'd like to be able to recieve the goods, then add the invoice from the vendor to payables when I receive it.

I'm trying to receive goods and not have them go straight to the payables. The way it's working now it as soon as I recieve anything from a vendor, the amount of the receipt goes to payables. Often the vendor won't bill me for a week or sometimes two and I don't want to start the clock on payables until the invoice arrives. Is this possible?

Hi there. The option to create a bill without affecting the Accounts Payable is unavailable in QuickBooks Online. Let me share further information and help you out on this.

It seems you're trying to create an Item Receipt currently available in QuickBooks Desktop only. Alternatively, you can create a Purchase Order and convert it to a Bill once you receive the items. I'll show you how:

Here's an extra module about handling bills to be paid later and bills to be paid immediately using bills, checks, or expenses: Learn the difference between bills, checks, and expenses in QuickBooks Online

Keep us updated by joining back to the thread. The Community is available 24/7 to assist. Stay safe always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here