Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have just bought QB desktop 2023 for my business. I need to create an invoice for a customer that shows current rent due, plus a past due balance that is not already in my newly set up QB

Thank you for purchasing QuickBooks Desktop for your business, PebbleCreek1!

Have you entered the new invoices already? I recommend entering the old and new invoices so you can easily keep track of them. However, you can just enter the total of the old invoices as a lump sum. I'll show you how.

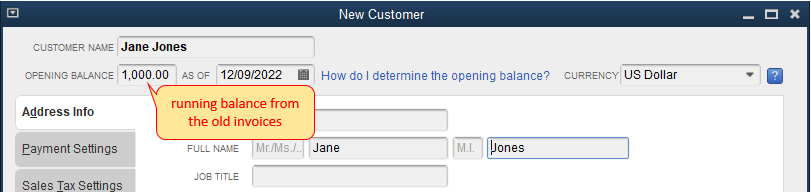

For the old invoices, you also have the option to enter their total amount as an Opening Balance on the customer's profile as you create it. This will turn into a lump sum invoice. However, you'll not see this option if you've already created the profile, but you can create a lump sum invoice instead.

Step 1: Create the customer's profile.

Enter the opening balance as you create the profile:

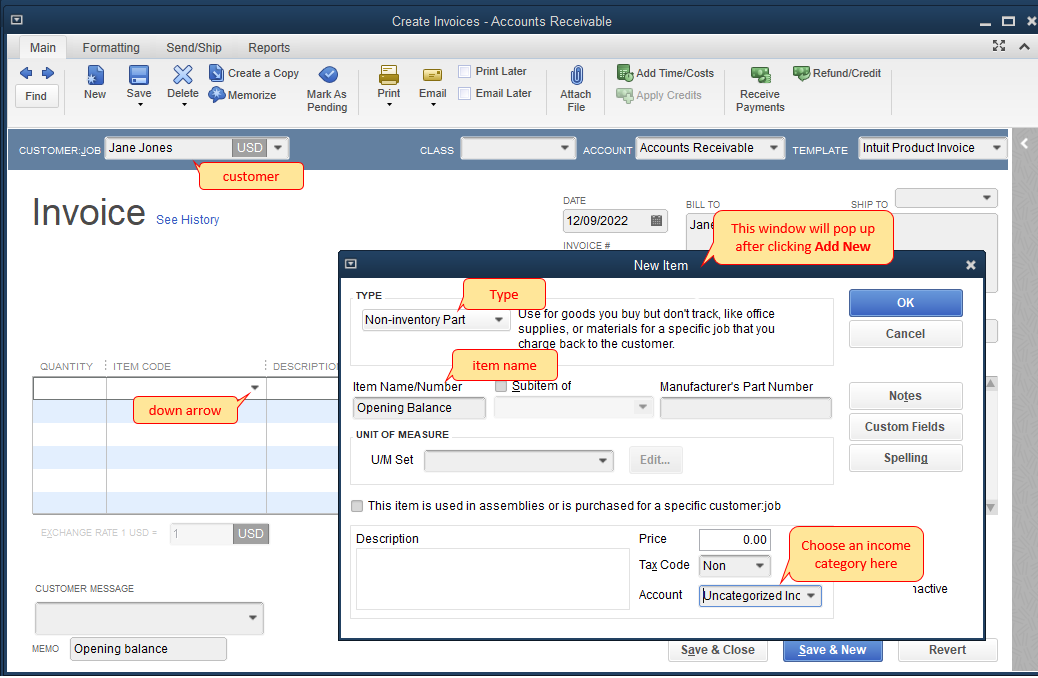

Create a lump sum invoice if the profile was already created without entering an opening balance:

I recommend creating the customer profiles and the items you sell first, so you only need to select them when you record more invoices.

Let me know if you need more help with your records. Take care and have a good one!

Hi JessT, yes, I really need to create invoices today, but can I create an invoice today and backdate the invoice to make it reflect months past? For example, can I create a January 1, 2022, Feb, Mar, etc, invoice for a tenant? And then show that the invoice was paid on Jan 29, Feb 29, etc, for those months?

Along those lines, can I backdate payments to an already created invoice from months ago? For example, if I created an invoice back in May and the tenant's payment was made in May after the invoice, can I go in today and input that payment and show the date it was paid in May?

I've kept paper records since Jan 2022, but set up QB Desktop 2023 just recently. I now need to get all of these records/transactions to reflect in QB, so I can produce a monthly, yearly report for our records, accountant, etc.

Hi there, @PebbleCreek1!

Yes, you can create back-dated invoices and payments as long the date in every transaction is a match. Say you create the invoice dated January of 2022, the invoice date must be 01/01/2022, and enter the payment with 01/29/2022 as the payment date.

Now that you'll have to enter each invoice along with the payment from the oldest to the earliest date on your records to get the accuracy of your report. Kindly read and use this article to learn more about the invoices and payments entry in QuickBooks:

Let us know in the comments below if you have any other QuickBooks concerns. Wishing you continued success!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here