Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Other questions

- :

- Multiple bank accounts

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Multiple bank accounts

We have three different bank accounts in QBO. I'm used to transferring funds between them. However, recently my ED opened a new bank account by writing a check from one of our existing accounts. I created the account in QBO, but now I need to know how to code the outgoing check - we use classes, so I don't want this to show up as a random expense. Would I use a Journal entry to show this transaction as a transfer so I don't have to class it as an expense? If so, how do I record the check number so that it doesn't screw up the reconciliation of the account it was written from?

As an example, check #4 for $500 was written from Bank A to Bank B.

Currently in Bank A's register, it is an Other Expense check written to Bank B

In Bank B's register, the line item is in Opening Bal Equity as a $500 deposit.

Is anyone familiar enough with non-profits who class out expenses to let me know if I need to adjust these entries?

Labels:

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Multiple bank accounts

I'm delighted to help you record the transaction accurately in QuickBooks Online (QBO), Sunshine. I appreciate the detailed information you laid in about your concern.

To clarify, we don't need to use the Journal entry for this situation. Instead, we should change the Category of the check transaction from Other expense to Bank B. This way, you can avoid having a random expense transaction in the system and categorize the data accordingly.

To proceed, kindly follow the steps below:

- Log in to your QBO account.

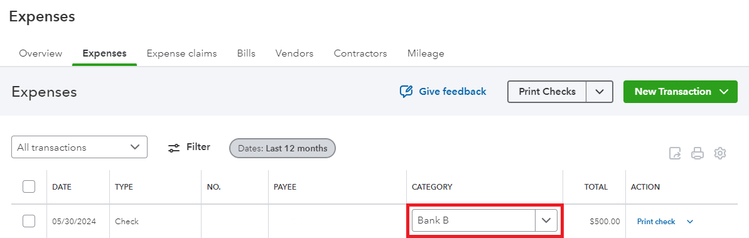

- Go to the Expenses menu and look for the check.

- From the Category column, choose Bank B.

- Once selected, the system will automatically save the change made.

For additional reference, you may review the Record a transfer by check part of this link: Transfer funds between accounts.

Finally, if you have more than one company file in QBO and need to transfer funds between those companies, you may check this article: Transfer funds between companies in QuickBooks Online. The article could help you achieve this task and use the feature seamlessly.

Let me know in the comment if you have follow-up questions regarding your check transactions in QBO. I'm one click away. Have a good one.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Ready to pay your team? Watch our Quickbooks 101 video below to get

started...

Join us fromMarch 17th-21st, to spring into action with Quickbooks this

sea...

QuickBooks Solopreneur was built with our brave, determined, and busy

self-...