Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy now

@kim38 wrote:so, what other accounting options is everybody finding, please.

It has been posted a couple times prior, by @Fiat Lux - ASIA that you can check out

2 apps to accept ACH payment for free?

https:// melio.grsm.io/quickbooks

https:// veem.grsm.io/veems

Personally, I wouldn't use anything related to QB, as they are they ones screwing over customers. But at least there are options.

thanks, that's accounting options for accepting ACH.

I'm asking about accounting options for Quickbooks online. i came from xero only because they discontinued their payroll services.

thanks

We don't want a fee and don't care if it takes a few days to post. Btw it used to be next day and free before.

I don't have anything to add except my "vote" to, "want an option to opt-out of the new 1% Quickbooks revenue tax.

THIS IS RIDICULOUS - REFUSE TO GIVE QUICKBOOKS 1% of MY REVENUE!!

HAVEN"T YOU MADE ENOUGH? WHY ARE YOU RIPPING OFF SMALL BUSINESSES?

I AM HAPPY TO WAIT 2-3 days. I have no bank charges for ach or paying by ach as I would never do business that way.

EVRYONE PLEASE JOIN IN PROTESTIG THIS

I too wish to opt out of faster payments. The cheep ACH fee was the main reason I signed up for QBO in the first place. Speed was never a concern.

The very moment I see that first $10 fee, I will be disabling Intuit's payment options for my customers on all Invoices. Not at all an empty threat, just simple math for me. All my ACH payments would get hit with that $10 fee. I'm not paying Intuit $120 a year for each client I have that pays monthly by check, when it use to only be $6 a year.

I ask you Intuit, would you keep a vendor that use to cost you $6,000,000 a year, you never had a problem with their timing in the past, now they tell you they will get it done even faster, but they're increasing their price to $120,000,000 a year? Oh' and you have plenty of other options still at that old rate, some less. Hmmmmm...

@Fiat Lux - ASIA after reviewing those options, they are solutions for business to business payments only and are not suitable for consumer to business payments.

What kind of business do you run?

@Fiat Lux - ASIA Home inspection business, payments we collect are from customers/clients, not other businesses.

QB--You will lose customers! I am a small business and can't afford the $10 per ACH fee I will now incur. I don't offer the option of credit cards because I DON'T WANT A FEE! You must offer an opt-out for those who are fine waiting 5 days for their money--which by the way is pretty ridiculous anyway. OFFER AN OPT-OUT!

I have yet to find a specific solution for this case. Some of our clients are using a field service app to integrate with QBO and accepting credit cards payment for up to a certain invoice amount. If the invoice is higher than that amount, they will ask the client to pay by ACH to their bank account to avoid any fee. They’re usually free, or cost a lower fee for the client. They typically take 2–3 working days to reach their bank account. They may provide the wire routing number if their clients specifically want to pay them with a wire. Wire transfers can cost their clients 20–30 USD, but will reach their account within 1 working day. If someone sends them the payment using a wire transfer, the banks will charge a 7.50 USD fee.

I have yet to find any accounting app accepting ACH payment for free any longer. I believe the company is confident to implement the new policy for this reason. You may explore 2 options as I mentioned earlier to accept ACH payments for free and integrate it with your QBO.

I will NOT RECOMMEND this service to anyone going forward!

This is a disgrace and a high tech white collar ripoff. Intuit did a similar thing with Turbotax Deluxe a few years ago (I guess ingrained GREED never dies) and had to retract because of customer outcry, so raise your voices! I am looking at alternatives, as this Intuit C-Level bonus will reduce my small profit by 10%.

Hey! I just got off the phone with an Intuit Rep who said Intuit is updating the software to offer back the FREE option for 3 to 5 days deposit, because there was a huge push back on Friday by customers. Let's see if they follow through; but it is a glimmer of hope, though no estimated date was available when we spoke!

I was just charged $10.56 on an ACH invoice deposit of $1056.00. Obviously there isn’t. $10 cap 😖

Thank you for letting us know about this, @lynn47.

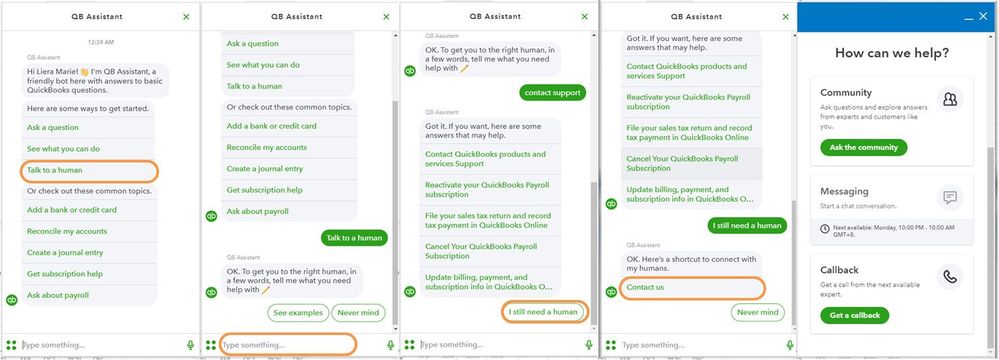

With ACH/bank transfer, the rate per transaction is 1% (Max $10). I'd suggest reaching out to our Payments support. They can review your account securely and check why you're charged for more than the $10 cap. You can contact them through your QuickBooks Online account.

Here's how:

To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. For more information, check out our support hours and types.

To know more about the different QuickBooks Payments fees, you can open these links:

Visit us again should you have other questions or concerns about the processing fees. We're always here to answer them for you.

Please share when you find a good alternative to Quickbooks. I've been using it for 30 years ... .and would LOVE to stop giving them my money.

Contact us in private to purchase a 3rd party conversion service.

This is a terrible decision to force your customers to pay your 1% fee. In case you didn't realize we are still in a global pandemic that has really hurt small businesses. Every dollar matters to keep our businesses going. WE DID NOT ASK FOR NEXT DAY DEPOSIT! You are just a greedy company and considering I already pay a high monthly fee for your services I will now be changing my accounting to another company. I have also been disappointed with your customer service every time I have tried to reach out for some help. Quickbooks is just the worst and I will go back to free accounting system since I will have the same abilities and not have to pay the monthly subscription fee and having my hard earned money basically stolen!

@Amy1119 wrote:I will go back to free accounting system since I will have the same abilities and not have to pay the monthly subscription fee and having my hard earned money basically stolen!

You may switch to a free accounting app but still you have to pay something to accept payment. We found the following notes on their website

We also allow businesses to accept payments online so you can get invoices paid faster; we charge a competitive 2.9% + 30¢ fee to process most credit cards (with 3.4% + 30¢ fee for American Express), and 1% for bank payments (where available).

Consider 2 options to accept ACH payments for free and integrate it with your QBO as I mentioned in the earlier post.

Just a little update (and maybe some encouragement) for those who may be continuing to deal with this payments situation. It's one thing to be frustrated about it ... it's another to use it as an opportunity to make things better for your business:

Since March when this change was forced on us, we've been able to move about 50% of our payments out of Quickbooks and to more reasonably priced alternatives:

1. ACH automated collections from clients are being handled through Chase Bank's ACH service. Fees are approximately $0.50/transaction. This is a good option for any recurring subscription-like payments.

2. Monthly payments from tenants are being handled through Rentler. Fees are $0/transaction. This is a good option for rent/lease situations. Rentler allows for consumer-entered

3. Payments received from business clients are being handled through Melio. Fees are $0/transaction. This is a really good option for payments coming from other businesses as it's already nicely integrated with QBO and essentially works the same way.

Our business if fairly complicated for its size and has different business lines, which is why we have multiple payment solutions. Our customers are generally now happier with these purpose-built solutions compared to our previous QBO Invoice process - you may see similar benefits as you move away from QBO Payments.

My take away from this experience is that I was thinking about QBO in the wrong way. I was thinking of it as a sort of operating system for our business, with accounting at the center:

I now realize that's now how it needs to be done. Instead, we need to think of QBO as an accounting tool, not the center of our business. As such, we are also dropping QB Time and QB Payroll. Once those are gone, we also don't need QBO Advanced. We've made good progress towards this:

The key thing is to think of QBO just an accounting tool that has to integrate with other stuff ... instead of the center that other things need to integrate into. Mainly, I'm just sad that it has to be this way. I love the product, but the reality is we just can't base our business on a product that pulls this sort of pricing shenanigans. Not a trustworthy partner that we feel we can grow together with, although it's better to correct now than later. In the process, we're finding practical benefits we didn't have before, in addition to financial savings as well, of course.

This may not be what's best for others, but just wanted to share in case others are wondering how they could approach these pricing problems.

Peace!!

I'm a QB Desktop user pretty pissed at the ACH rate going from $1 to $3, much less 10% for QB Online. I did the math -- if you have customers regularly paying you $4,500 or more, QB maxing out at $10 is ok for you. But anyone with less than that paid normally, you could probably use a merchant service like paysimple (.65 cents plus 0.2% fee of total payment). I don't care about paysimple nor have i signed up but it's very tempting to move away business from Quickbooks. I will keep looking. Companies like quickbooks count on us being invested in their ecosystem and then pull this crap on you knowing a lot of your complaining will amount to nothing. Some of your business banking might have treasury mgmt services - it might not have fancy invoicing but worth a look.

The tone-deaf, Quickbooks Team replies about your incredibly shameful timing on imposing this 1%/$10.00 ACH

fee is spectacular to watch unfold. Perfect timing to hurt folks the most, coming out of COVID and at tax time.

No question all of us are going to have to explore other ACH venues to prevent Intuit from confiscating thousand of our hard earned, and much needed dollars each year.

If you all are smart, in my opinion,you would roll this back to the previous model, like UPS, etc, in which you have no extra fee for 3-5 day ACH payments, and the 1%/$10.00 fee for folks who need their funds the next day,.

They are just the last one to follow the market. I noticed no accounting app offers ACH payment for free any longer. If you are running a B2C operation, you should explore what your bank can offer. Wise offers ACH payment for free (2-3 days) and wire payment for $7,5 per transaction (< 12 hours).

https:// wise.prf.hn/l/64dl92k

Otherwise, consider a payment processor to integrate with your QBO. One app offers $0.65 + 0.2% to integrate with your QBO invoice.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here