Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhy is QB Payroll showing as payee instead of CA EDD on QBO bank register? This has never happened before. Our QBO bank register is not linked to our bank account.

Thanks for reaching out regarding the issue you've encountered with your bank register, Geri. It appears that the transactions were recorded with a different vendor other than CA EDD. Let me guide you in changing the payee.

We can verify the transaction and change the payee in your bank register.

Here's how:

You may also check the Vendors section to see if there's a profile named QB Payroll. If there is, you can make the status inactive and create a new profile for CA EDD.

Also, regardless of whether your QBO bank register is connected to your actual bank, all accounts in your Chart of Accounts will appear in the bank register. This is because the bank register reflects all transactions recorded within QuickBooks.

Additionally, refer to this article about editing your transactions in your account register in QBO.

Furthermore, to ensure your transactions and bank accounts are balanced, you can reconcile them for accuracy. Refer to this article for detailed steps.

If you're referring to something else, I recommend clicking the Reply button below so we can respond and show you how to resolve your QuickBooks-related concerns. I'll be around to assist you with the transactions in your bank register. Stay safe always.

QuickBooks Payroll was not in our chart of accounts. I went to Vendors, changed the name from QuickBooks Payroll to CA EDD and made QB Payroll inactive. How do I now enter a memo? When I check Edit, it takes me to the original entry made by QB, but there is no memo or description line.

The QuickBooks Payroll setup as a vendor will not appear as an account in the Chart of Accounts (COA) because it is not included in the list that QuickBooks uses to track your financial data, usergeri. To enter a memo on the transaction, follow these steps:

For more information on modifying transactions in the account register, check out this article: Find, review, and edit transactions in account registers in QuickBooks Online.

For future reference, you can consult this article on best practices for reconciling your account: Reconcile an account in QuickBooks Online. This article also provides guidance on addressing challenges during the reconciliation process.

Did you know you can get tailored guidance to keep your financial records organized and reduce stress at tax time? Our QuickBooks Live Expert Assisted service offers various help, such as properly categorizing transactions and resolving issues like mismatched balance statements.

If you would like to run reports for a quick overview of your business performance, just let us know. We're here to help!

Would appreciate it if QBO did not arbitrarily enter a vender in the payee section and just use CA EDD for payroll tax payments, like QBO has done for the last five years!

Secondly, trying to enter data in the memo field by going to the memo field on the register does not work. I get the message that I "cannot edit...from here. In some cases, you can edit by clicking the edit button." When I do that, there isn't a space on QBO-generated withdrawal details to enter a memo.

Hi there, @usergeri. When you record a tax payment in QuickBooks Online (QBO), the system will automatically generate a vendor-specific to that state. I'll provide more details below and point you in the right direction to help correct this as soon as possible.

Before anything else, please know that CA EDD is vendor-generated when paying tax payments associated with that specific state. Thus, the system automatically generates vendors depending on the tax payment recorded in the account.

Since yours doesn't reflect the appropriate vendor for that transaction, I recommend contacting our Live Support. This way, they can check on your account and share alternative ways to handle this situation to correct the details. These are the steps:

Feel free to visit this page for more details: Get help with QuickBooks products and services.

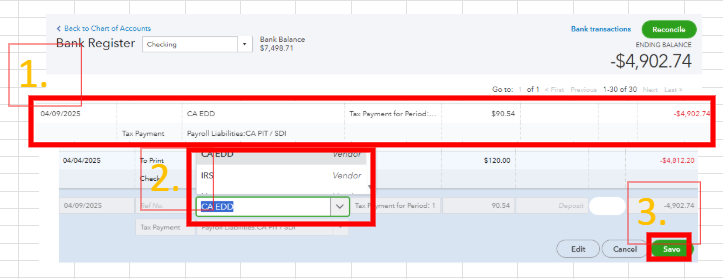

In the meantime, you can manually select CA EDD as the payee for that tax payment. This way, you can correct the details of that specific transaction in your bank register. These are the steps:

For visual reference, see the image below.

Moreover, here's an article to help you review payments you've made to taxes you have in QuickBooks: View your previously filed tax forms and payments.

I can also assist you in organizing tax payment transactions or addressing other inquiries related to the program. Please let me know in the comment section so I can respond promptly. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here