Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI bill my clients for their quickbooks subscriptions that are purchased by me. How do I set up these transactions in quickbooks?

Two ways. When you enter a Bill from Intuit to be paid break it down by subscription and using billable expenses, record each monthly charge as billable to each client . Create client invoices and select the billable charges for each. In this process you can mark it up for whatever you want to charge, less than retail. You have to set up your expense as a two sided service item so that when you pay Intuit it is below thd line expense and when it is billed and paid by client it is above the line income.

Or you just record your expense to Intuit and separately bill clients for an income stream

Hi there, @AngelBK.

Thank you for raising your concern about QuickBooks subscription fees. I'm here to guide you on how to record these transactions in QuickBooks Online (QBO).

To get started, you can enter an expense transaction for the subscription payment. Then, make the amounts billable to your clients.

Here's how:

To bill your clients for their QuickBooks subscriptions, follow these steps:

For additional tips about recording billable expenses in QBO, you can open this article: Enter billable expenses.

I also recommend checking out these links to learn more about managing a wholesale billing plan:

If you have other questions, please feel free to click the Reply button and add a comment below. I'll be right here to provide additional assistance. Wishing you and your business all the best!

Yes, @AngelBK.

QuickBooks Online makes it easy to help you track how much you make and spend on each product or service. For a more detailed guide in adding services and products to your account, see our add product and service items page.

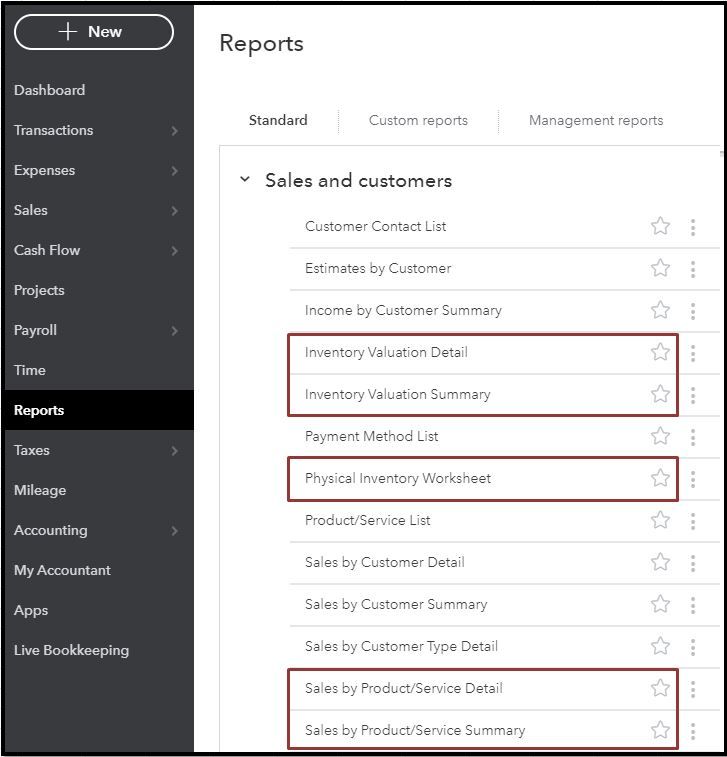

Then, QBO also has the reports you need to view your sales and inventory status. Let me guide you through the process.

Feel free to get back here if you have further concerns about setting up product and service items in QBO. I'll be around to help you in any way I can. Have a good one.

I wanted to find out if the attach file shows the correct format on how to enter in the products area the subscriptions that I bill my clients. I don't want to make any money with my subscriptions, it is a service that I provide for my clients. Please let me know if this is correct?

You’re on the right track, @AngelBK.

When you’re ready to invoice your clients, the service item you’ve created will be included in the list of the Product/Service column.

To learn more about adding service items in QuickBooks Online, check out this article for additional details: Add product and service items to QuickBooks Online.

In case you need to change your product and service items, you can refer to this article that can walk you through the process: Change product and service item types in QuickBooks Online.

If you have any further concerns with QBO, you can always tag me in your reply. It’s my pleasure to help you. Keep safe.

One other question I had was do I need to charge sales tax to my customer when I bill them for the subscription?

Glad to have you here, @shawnandcharlie.

Yes, you can charge sales tax to your customer when you bill them for the subscription. But it still depends if the client is subject to sales tax.

To verify, I suggest reaching out to your accountant for additional info regarding this matter. This is to ensure that you charge sales tax to the customer correctly and accordingly.

To set up your sales tax in QBO, here's what you need to do:

For further details, please check out this article: Set up your sales tax in QuickBooks Online. It also includes steps on how to edit and deactivate your sales tax rate and settings.

In addition to that, let me attach this link if you want to automatically do the sales tax calculations for you on your invoices and receipts for easy and accurate filings: Set up and use automated sales tax.

Don't hesitate to tag my name if you have other concerns with recording payments for your customer in QuickBooks. I'll be around to help. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here