Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy accountant tells me I can't count an invoice for a sale until product has been delivered to client. Is this true?

I appreciate you sharing this in the Community forum, @t_al55. Let me provide insights on how invoices are recorded as sales in QuickBooks Desktop (QBDT).

Your accountant's guidance aligns with the revenue recognition principles of accounting, especially in the Cash accounting method. In this method, an invoice is recognized as a sale or an income when the product or service is delivered and payment has been received from your clients, mirroring the practices in QBDT.

In QBDT, upon creating and sending an invoice to your client, it's recorded as an Accounts Receivable on the Balance Sheet and as Income in the Accrual method of the Profit and Loss (P&L) report. Subsequently, when you receive and record the payment in the system, the invoice will now reflect in the Cash method of the P&L report.

Moreover, it's also worth knowing that you can customize your financial reports to cater to your specific business needs and provide valuable insights into how your business is performing.

Also, memorizing these reports can help you save the current customized settings, making it easier for you to access them in the future.

If you have any follow-up questions about managing your invoices and keeping track of your sales, please let me know by adding a comment below. I'm always here to help. Keep safe!

Thank you for getting back to me.

I understand, We have always used Quickbooks to create PO and Invoices as well as record payments and pay PO's but accounting was always done manually. I'm trying to use Quickbooks for everything now and I need to get Quickbooks to mirror the last manual entry. What do I need to do with the information already in QuickBooks so that I can pull a Balance Sheet Report, base on the Cash Accounting Method. So I can see if I can mirror my accountant year end numbers.

Thanks for reaching back, @t_al55.

I'm here to guide you on how to pull up a Balance Sheet report in a Cash accounting method so you can compare it with your accountant's year-end numbers.

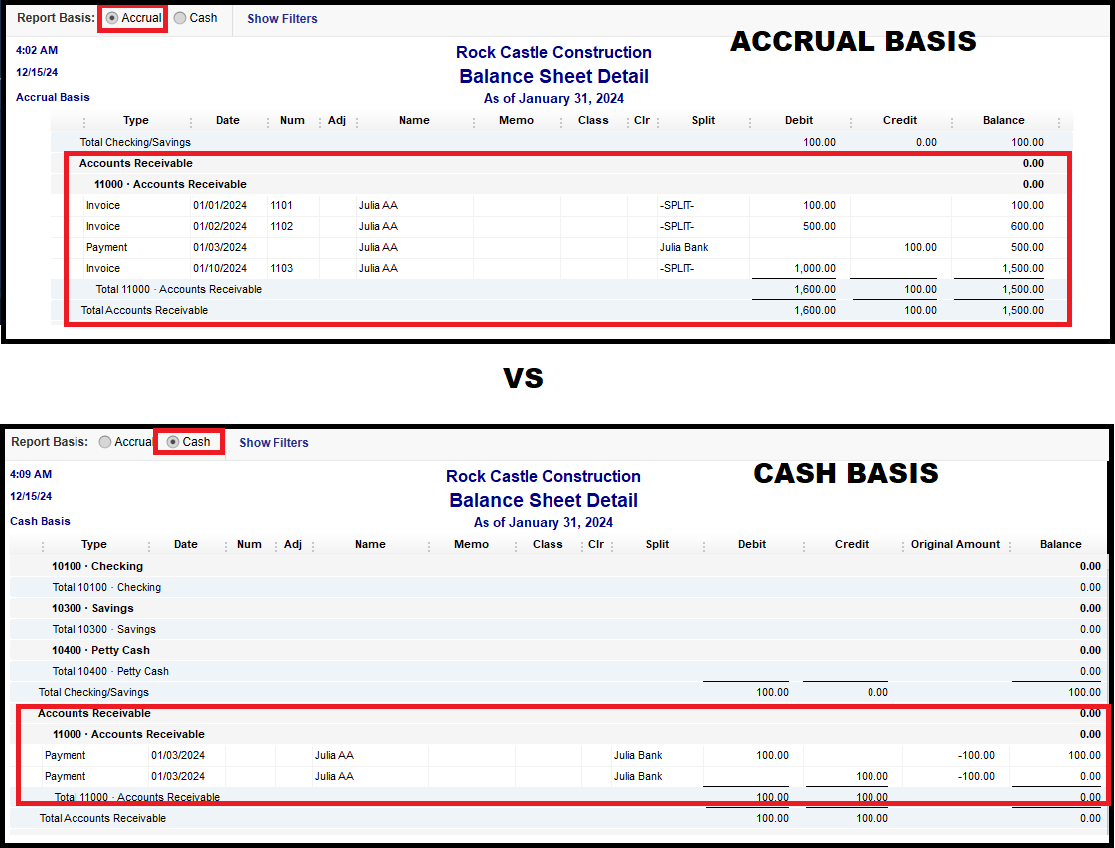

The invoices will be reflected on the Balance Sheet report on an accrual basis. Once the invoice is paid, it generates an income for your company. Since you want to generate a Balance sheet report, the invoices won't show on the cash accounting method. Instead, you can see the invoice payment from there. You may refer to the image below how the invoices and their payments will show on Accrual and Cash accounting methods on the Balance sheet reports:

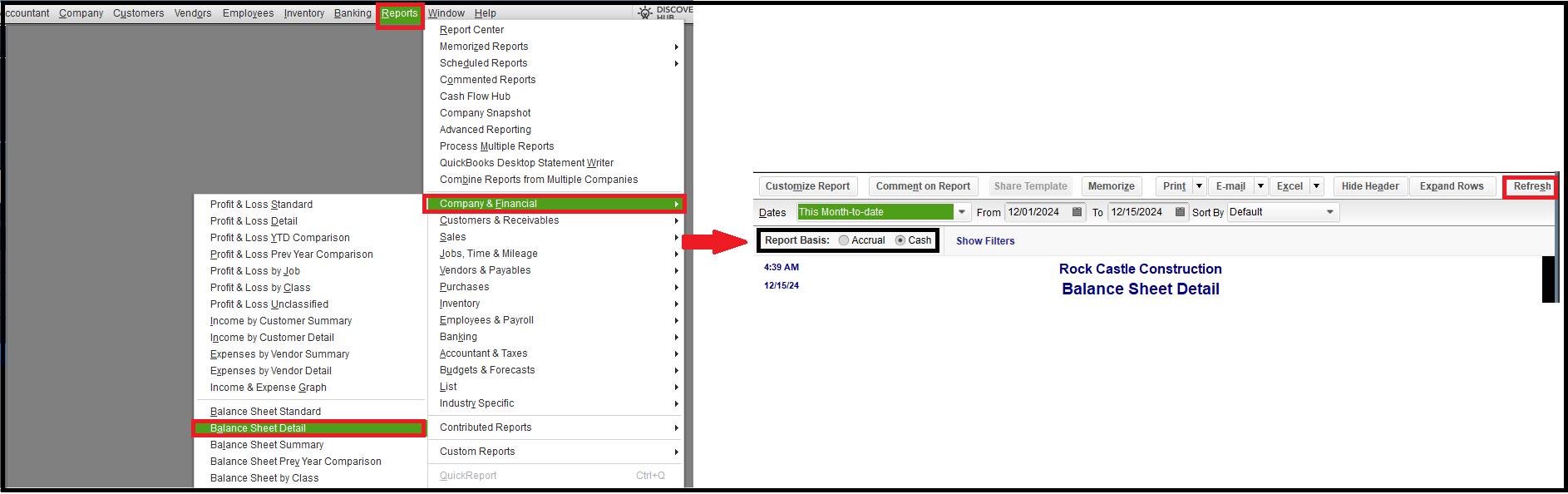

To generate the report and switch to a cash basis, you can follow the steps below:

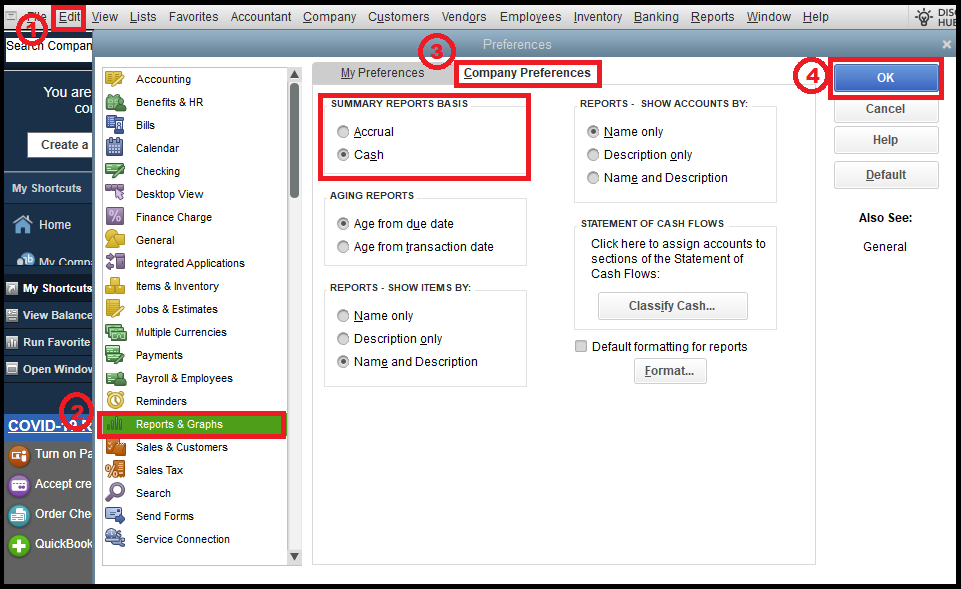

Also, if you want to utilize this accounting method as a default for all your reports in the future, you can set this up in your company preferences. Here's how:

Furthermore, you can run and use QuickZoom Reports to bring up more detail about that number or item and open one of the listed transactions in its original form.

You can also set up and modify Scheduled reports to send reports on a regular and recurring scheduled time.

Rest assured I've got you covered if you have any other questions about managing reports in QuickBooks Desktop. Wishing you a fantastic day ahead!

Thank you.

One more question, the following is how we use QB. Please let me know how this would effect the Balance Sheet.

1. We Create PO

2. We create estimates for Client

3. Estimate is approved and turned in Invoice ( Client pays in 90 days)

4. WE pay 50% to Vendor for PO ( we are invoiced full amount Vendor only require the 50% to ship full order)

5. Get payment from client

6. Pay remaining balance to vendor ( Last 50%)

How does this process effect the Balance Sheet, also by chance is there a way for you to show me each as it appears in QB using Cash Basis.

Thank you once again for your time and help.

Thank you for responding to the thread, @t_al55. Let me go ahead and provide you with some information about your balance sheet.

The transactions that will affect your balance sheet are posting transactions like invoices and paying bills. The invoice will impact your accounts receivable, and the payment will impact your accounts payable.

Creating your purchase order and estimates will not impact your balance sheet.

I'm sharing these articles that can help you with your reports:

We'll be here if you still have questions about your balance sheet report. Have a lovely day and take care!

Once again thank you for your help. I have a much better understanding of things.

I have one last question,

If at the end of the 2023 I had 10 Open invoices and my accountant only used one of these invoices to create my year end balance sheet, because that invoices product would be delivered by the end of the year of 2023, and all other invoices would not be completed until 2024. Whether I use the Accrual Method or Cash there is no way for me to get QB to match their year end Balance sheet.

I appreciate your continued engagement, t_al55.

I'm glad to hear you have a better understanding of the processes. Let me share some details about the invoices shown in the report.

In QuickBooks Desktop (QBDT), the invoices displayed in reports depend on your accounting basis. With the Accrual basis, both paid and unpaid invoices appear in the report. However, with the Cash basis, only paid invoices are shown.

Additionally, the most common reasons for the Balance Sheet and Profit and Loss discrepancy are the following:

For more details, check this link: Fix a Balance Sheet that's out of balance.

Furthermore, I suggest seeking guidance from your accountant to discuss your financial situation in detail. They can guide you in addressing discrepancies and ensuring accuracy in your year-end balance sheet.

Moreover, you can visit this page to learn how to set up and send progress invoices, helping you split an estimate into multiple invoices as required.

Let me know if you have other questions about the balance sheet discrepancy. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here