Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

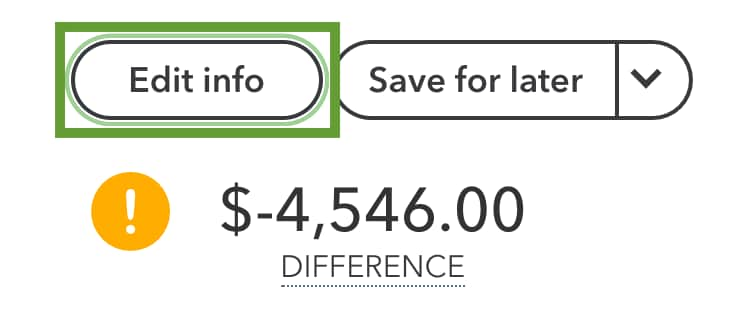

Hello, our home currency is USD. A vendor sent us two invoices in Euros. We paid them in Euros. We initiated one wire payment to pay the two Euro invoices (to reduce wire fees). In our bank feed, I applied that one payment to the two invoices. I am now in the process of reconciling my bank account but there is a discrepancy and its tied to the foreign transaction. How do I fix this? Thanks.

I can help you with fixing the reconciliation discrepancy that you're encountering with your account, @Sc0.

You can create a journal entry that can resolve the discrepancy that you have. Just make sure to consult with an accountant to help you choose the right accounts for your entry.

Here's how:

Refer to the following article for more information about adding journal entries: Create a journal entry in QuickBooks Online.

You can refer to the following article for more information about fixing errors you'll possibly encounter while reconciling your accounts: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

Once you're done, you can run a reconciliation report. That will summarize your beginning and ending balances as well as list which transactions were cleared and which were left uncleared when you reconciled. See this article on how to view and print it: How do I view, print, or export a reconciliation report?.

Let me know if you need further help in fixing the reconciliation discrepancy by leaving a reply below. Have a great rest of the day!

Can someone explain why there is a foreign exchange discrepancy for those 2 Euro invoices when I tried to reconcile it against by bank statement, but there was no discrepancy for another vendor of mine? This vendor also invoiced us in Euros and we paid in Euros. I find it hard to believe that the reason why there is no discrepancy is because the foreign exchange rate stayed the same.

Thanks for following up with the Community, Sc0.

When reconciling and comparting your transactions with the ones on your bank statements, you should see a $0.00 difference between the ending balance in your books and on the account's statement. If the ending balances don't match, you can find and fix issues to finish reconciling.

Here's a few things that can cause ending balance issues:

Here's how to find and fix reconciliation issues:

If there's still a difference after performing steps 1-6, you'll want to try entering transactions that aren't in your books.

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

I'll be here to help if there's any additional questions. Have an awesome day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here