Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

How do I correct previous posted transactions in 2018 that were reimbursable expenses on a paid invoice that were posted to an income account only to a billable expense with both the income account and an corresponding expense account? My goal is to correct the billable expense accounting, so I have an accurate P&L statement.

Great question, Bergoman.

You'll need to manually edit per billable expense transactions for you to apply the correct posting accounts. For choosing on what type of expense/income account you'll need to use, it would be best to contact your accountant.

Here's how you can modify the expense transaction:

For more details about expenses, you can check out this article: How to enter, edit, or delete expenses.

You can also use the account history to show all the billable expenses linked to an income account. Then, you can manually edit the transaction in the register.

Just follow the steps in the Edit transactions section in this article: How to add or edit transactions in a register (or account history).

I found a helpful article for more details on how to find specific transactions in the register (or account history): How to find a transaction in the register (or account history).

Please leave a comment to this post if you need anything else. Thanks!

I only have the income side posted in all my transactions for 2018. I named it Reimbursable Expenses (income account) Keep in mind... I now have QBO Plus and I’m using the billable expense feature. So following your instructions, how do I identify the correct expense account (assuming QBO Plus created one) and link that correct expense account to my previous posted Reimbursable Expenses (income account) transactions? As mentioned, just want to have an accurate P&L for 2018.

Hello there, @Bergoman,

Thanks for the complete details.

We're unable to change the previous account since the expenses are already linked to your invoices.

You can either create a journal entry or change the income account assigned to the items. This way, your 2018 transactions are posted to the correct expense account.

I recommend consulting with your accountant for specific instructions on which account to credit and debit.

Here's how to change the income account assigned to the items:

Let me know if you have follow-up questions about the solution above. I'm always around whenever you need help.

The income account is correct. I do not want to change that for my items. I want to associate a correct expense account, so my P&L is accurate. On my previous transactions for 2018, my P&L only shows my income from Reimbursable items and no expense showing the canceling out.

Good day, Bergoman.

You'll have to open each expense transaction so you'll know the expense account.

I'll walk you through with filtering all expense transactions for last year. Here's how:

If you have more questions, don't hesitate to get back to this thread.

I’m trying to assign an expense account to my current items ( Products and Services) income account, so my P&L is accurate . I’m getting too many potential offers that are not addressing my problem. EXPENSE ACCOUNT alignment to my current already established income account for my items under products and services. Appreciate if someone can provide what I’m asking! Thanks in advance.

Hello, @Bergoman.

I'd be glad to join the thread and help you today so you'll be able to handle your transactions correctly.

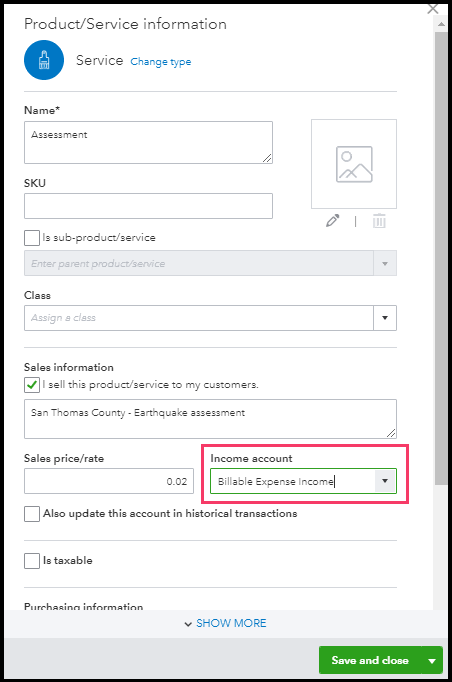

First, make sure to check your items. When setting up an item under the Products and Services, you have to select the correct income and expense account. If you're creating transactions using the item created, it will reflect to the accounts you've selected.

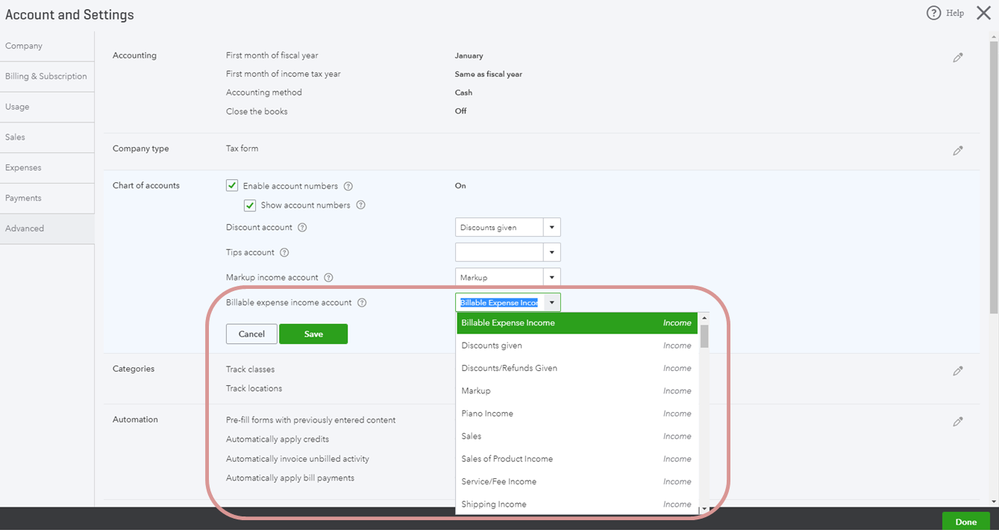

On the other hand, if you're creating billable transactions, you must ensure to check the settings and the account selected under Billable Expense Income.

Please know that the previous transactions created won't be affected prior to changing/modifying the items. If you want to reflect those transactions to the accounts you've selected, you need to delete and recreate them.

In addition, please ensure to customize your report so you'll be able to run the report correctly. To learn more about customizing reports in QBO, you may check this article: How to customize reports.

Please feel free to drop a comment below if you have any other questions about your transactions. I'd be always happy to help you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here