Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI would like to know the proper way to enter business credit card payments in QB Premier Mfg Desktop 2019, please. If I use bill pay, the payment is removed from the G/L, applied to the invoice under vendor, but does not show up when I reconcile the credit card statement. If I write a check to pay the invoice, the money is removed from the G/L, but does not apply the payment to the invoice under the vendor. Which leaves me with an unbalanced statement or a way out of balance vendor account. What am I doing wrong? Help!!

Hello @CaryWW1025,

You can write a check and use your accounts payable account so you can close and pay the invoice. Let me show you how.

Once done, you can close out the invoice by following the steps below:

On top of that, I've also included this reference for a compilation of articles you can read while working with us: The different transactions you can use to track your purchases.

If there's anything else that I can help you with, please let me know in the comments below. I'll be here to lend a hand.

Good morning! I wrote the checks as directed. I went to pay bills and selected the credit card account. There is no credit linked from the checks I wrote. The checks do show in the vendors account and in the credit card reconcile page. But my vendor account has not applied those payments even though they are listed. What are my options now? Thank you so very much for your help!!

Thanks for keeping us updated, CaryWW1025.

Normally, the check will show up in the Credits section once you linked it to the accounts payable account. You'll want to make sure that you've selected the correct name of your vendor from the Pay to the order of drop-down menu. This way, you'll be able to properly the open bill. I'll guide you how:

Once done, follow the steps provided by my colleague, JonpriL in closing out your bill.

Additionally, here's an article that you can read to help you keep track of the credit card charges and payments: Set up, use, and pay credit card accounts.

If I can be of any additional assistance, please don't hesitate to insert a comment below. I'll always have your back.

Thank you for the response. I am using QB desktop, the instructions are basically the same. My checks were written as advised. They still were not in the credits or changing the account balance in the Vendor.

I went back and looked at previous payments, they were done under bill pay. I voided my checks and changed the payment using Bill Pay. Now my vendor balance is correct. Unfortunately the payments are showing up under the reconcile screen. Back to square one. I will be happy to include some screen shots if that would help. Thanks again!!

I think that @KlentB and @JonpriL might be misunderstanding your situation and what you are trying to do. I , myself, am not quite sure but here is the normal workflow with credit cards

If you use the card to buy something, you record credit card charges (Banking>Enter Credit Card Charges)

If you have a vendor bill in the system and wish to record payment with a credit card you Pay Bills and select the credit card as the payment source rather than default checking.

If you wish to record a check or ach payment TO the credit card company there are a couple of ways to get there. One, reconcile the cc account to the statement and you get a prompt to create a check. Two, simply Write Check from checking and detail is the cc account.

Review what you are doing with the above

My very frustrating problem is I cannot post a payment to my company credit card and have it link to the vendor's(AMEX) invoice like any other "pay bills" transaction.

I can "pay a bill" and the vendor's account balances. But the credit card reconciliation will not show the payment and I cannot balance to reconcile.

I can "write a check" and the payment will show when I reconcile the credit card account. But the vendor account balance won't be correct. The vendor account will show the check, it just won't take the amount off the total.

I have a credit card (AMEX) listed in my vendor's list. I have to pay the monthly invoice.

The credit card is also listed in the Chart of Accounts like the bank account I use to pay vendors. I have to reconcile from the monthly statement.

I enter my credit card charges from the monthly statement in the "Enter Credit Card Charges" window.

When I go to reconcile is the problem, either the AMEX account will not balance or the Vendor AMEX will not be correct. I am trying to get both balanced showing the payments I have made. Does this make my issue any clearer?

I don't want to give up just yet, @CaryWW1025.

Thanks for the additional details. Let me help you record your bill payments so you can reconcile your account seamlessly.

First, please ensure to select credit card as the payment method when paying your bills. This way, the said transaction will show up on the credit card register and balance the amount.

Here's how to do it:

If the same thing happens, you can run the Verify and Rebuild tool to determine and fix possible data issues.

When you're ready, you can now reconcile your account to keep your records correct.

Fee at ease to get back to me if you need more help with managing your bills in QuickBooks. I'll be here to help you anytime.

Good afternoon! I am so glad there are so many people wishing to help. I don't pay my credit card invoice with the same credit card I am trying to reconcile. I pay the credit card bill with the G/L account.

The issue is getting this payment to show up in the vendor credit card account and the credit card reconcile. As I stated before it will only show up in one, not both.

Thanks for getting back here and providing additional info on your concern, @CaryWW1025.

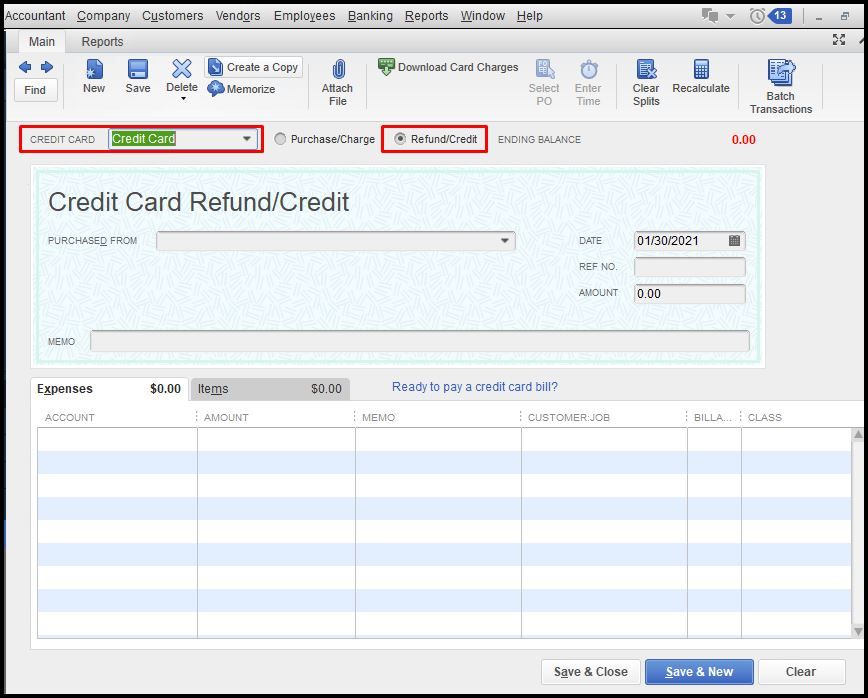

You'll need to create a Credit Card Credit to post the Credit Card payment in QuickBooks. To do so, please refer to the steps below:

To assist you further with the process, I suggest consulting your accountant to ensure your books are properly accounted for when recording this. If you don't have one, utilize our Find a Pro-Advisor tool to look for an accountant near your area.

Also, it's recommended to create a backup copy of your file before doing any changes. With this, we can make sure you have the original copy that you can restore anytime.

Once everything is ready, here's a detailed guide to reconciling your account: Reconcile an account in QuickBooks Desktop.

Feel free to get back here, if you have further questions in reconciling your credit card account in QuickBooks. I'm always here to help you. Have a good one.

I followed your procedure to pay the credit card bill, but I still do not see the payment in my credit card reconciliation.

Thank you for following the steps shared by my colleague, @Foamroof.

I've also replicated this in my QuickBooks example file, and payment is shown in my credit card reconciliation menu.

To isolate this problem, make sure that the transactions are linked to the right credit card account. In this way, it will be shown on the reconciliation page.

Once done, try to reconcile the credit card account again. Here's how:

I've added some screenshots for visual reference.

For detailed steps, please refer to this article: Reconcile an account in QuickBooks Desktop.

However, if the issue persists, let's resort the list so the transactions will back to the original order.

Here's an article about resorting list for more details: Re-sort Lists.

In case you need to find any problems when reconciling, you can refer to this article: Fix issues when you're reconciling in QuickBooks Desktop.

If you need additional help reconciling your accounts or any other question in QuickBooks, you can always tag me in your reply. I'll be here to help you. Keep safe and keep healthy.

Did you ever figure out how to fix this? I am having the exact same problem and need help. All charges are reconciled and in the vendor center the balance shows 0, but when I expand the grid to show the open balance all the individual credit card transactions still have a balance (bills and bill payments do not). Adding a screenshot for context. Any help is appreciated!

I'm here to share further details about your vendor and credit card transactions in QuickBooks Desktop (QBDT), @tenille10ille.

Based on your screenshot, I can tell that your bills are already paid, and the payments are appropriately applied. This is why the balance in the Vendor Center shows zero.

You may haven't linked your individual credit card transactions to the appropriate payments. That's why they still have a balance once you've expanded the grid. With this, you'll have to review the entries and make sure the payments and charges show up in your credit card register so you can reconcile as normal.

To learn more about using and paying credit card accounts to keep track of the charges and payments you made in QBDT, you can refer to this article: Set up, use, and pay credit card accounts.

Once you're done, match your existing expense entries to your bank feed transactions. This is to avoid duplicates and keep your account updated. Please see this article for the complete details: Categorize Bank Feed transactions in QuickBooks Desktop.

Also, I'd recommend reconciling your expense and credit card accounts every month. This will help you monitor your expenses and detect any possible errors accordingly. For the step-by-step guide, you can check out this article: Reconcile an account in QuickBooks Desktop.

Please don't hesitate to let me know in the comments if you have other concerns about managing vendor and credit card transactions in QBDT. I'll gladly help. Take care, and I wish you continued success, @tenille10ille.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here