Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIs there a way to set up a test company so that I can train others prior to going live? I was told by someone a while back that QB won't allow that because you have to set up using Tax ID # and it will show it already exists. We use QBD Enterprise.

Thanks for your interest with this feature in QuickBooks, @NNeese,

If you already purchased a QuickBooks Enterprise license and installed it on your computer, you have the option to use a test file. All live versions of the program is equipped with sample files so our customers can run tests without penetrating the actual account.

You can access the test account on the QuickBooks startup page when you launch the program. See this illustration:

If you're currently working on the actual company, you can switch to the sample file by clicking the File menu and selecting Close Company/Logoff.

Adding your business information is optional for test accounts. Access the company file anytime just like how you normally open the actual company.

You may also visit this link to learn more about opening a practice file: How to Create a Practice or Testing File in QuickBooks?

Doesn't have a license with us yet? Don't worry, you can still avail to our 30-day QuickBooks Desktop trials. The following article has a list of programs that you can install and use for training purposes: Download a trial of QuickBooks Desktop

Feel free to connect with me again if you have any questions. I'm just a click away for additional concerns or help. Have a lovely day!

You can do what is mentioned above. However, you can also just copy your existing company over to a "TRAINING TEST COMPANY" so it has all your real info in it. Then just open your new file using the QB file dialog.

We do this all the time for training and it works well. Since it has our company info already in it, it provides better training.

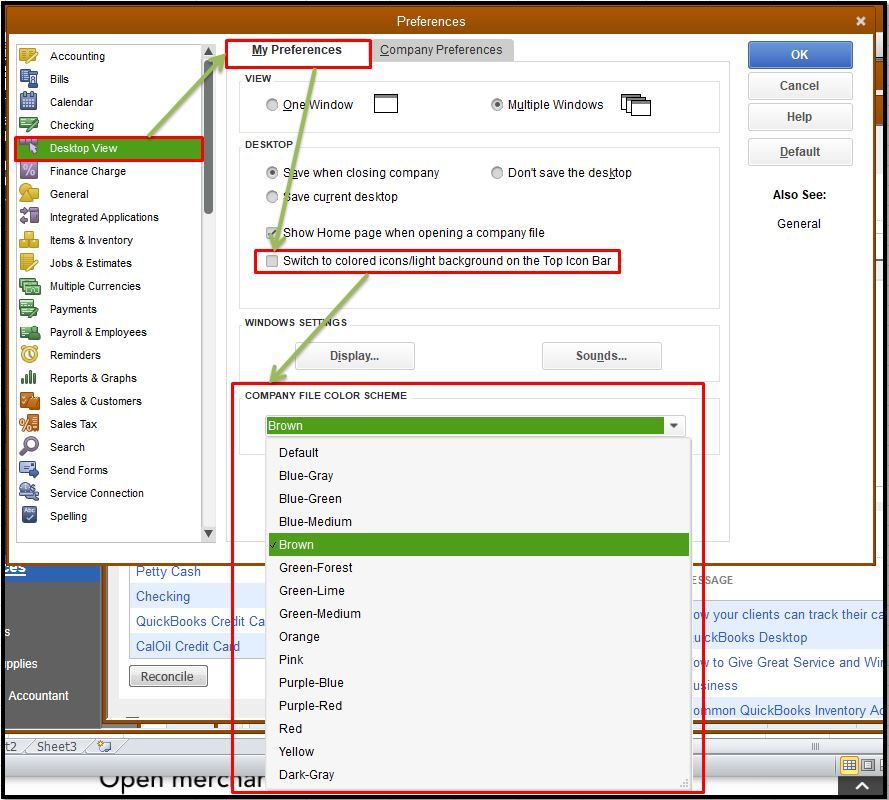

One word of caution - make sure your employees are working in the real company when necessary and training only during training - we changed the colors of the test company so that they are very different than real company so it's obvious.

What if you opened a test company file to install hardware such as printers and then uploaded your company file to the test company and saved it as the working company file? We don’t use a test company but wanted to “test” the hardware connectivity before installing our working file. The file doesn’t show it’s a “test” or “sample”file.

Hey there, budgeco.

Thanks for dropping by the Community I'm more than happy to assist you today. My recommendation to you would be to create a backup of your working company file, and then test out your hardware. Creating the backup will allow you to revert to it, if you accidentally do anything you didn't want too. For the steps on how to create a backup, follow this in-depth article listed here. Also, as previously mentioned, it's a good idea to change the colors of of your test and company files so you know exactly which one you're working with. Here's how:

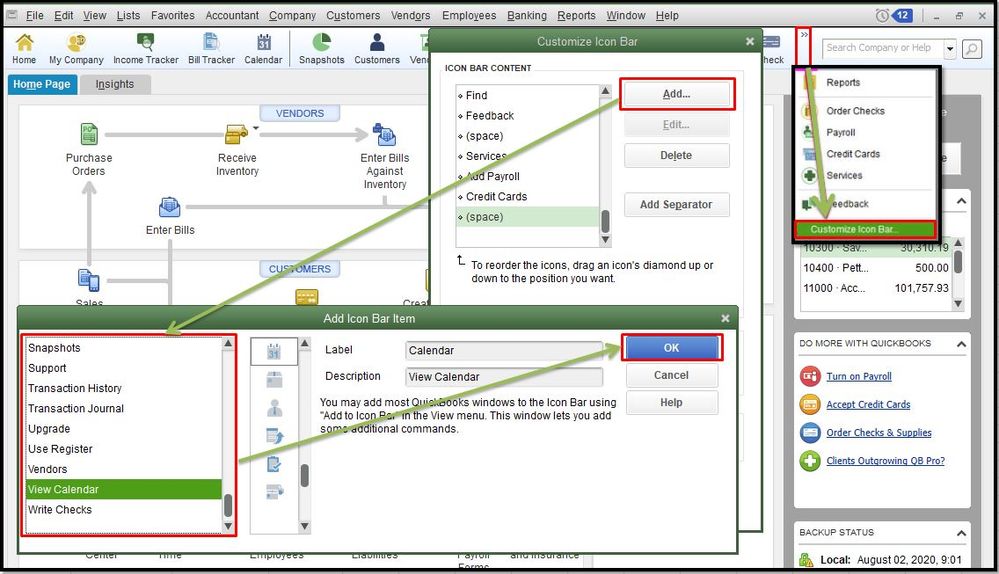

If you also want to add a new icon bar item, you can follow these steps:

If there's anything else you need help with, please, don't hesitate to post here anytime. Thanks for dropping by and have a nice afternoon.

Thank you! I checked the file and all is good, credit card charges are being sent correctly and all other hardware is great!! Those are some good tips to customize since it can be confusing when you upgrade or get a repaired file back to know what is the working file and what is not.

Thanks for keeping us updated, budgeco.

It's great to hear that your file is working seamlessly. As always, if you have any other concerns or QuickBooks-related questions, please don't hesitate to visit us again.

The Community Team always has your back. We're also looking forward to helping you out in the future.

how does this impact the taxes and making fake invoices? We were reading if you create a test company, that it is still reported as "income" etc?

I'll share some information when creating a test drive in QuickBooks, Beckey.

QuickBooks provides user who wants to dive deeper into the features using a test drive or company. This is a good way to learn and experiment with the different features that you can try.

For security, we don't allow bank connections in sample companies. Therefore, this security protection doesn't affect regular accounts. However, even if it is a test company, invoices will still be reported as income.

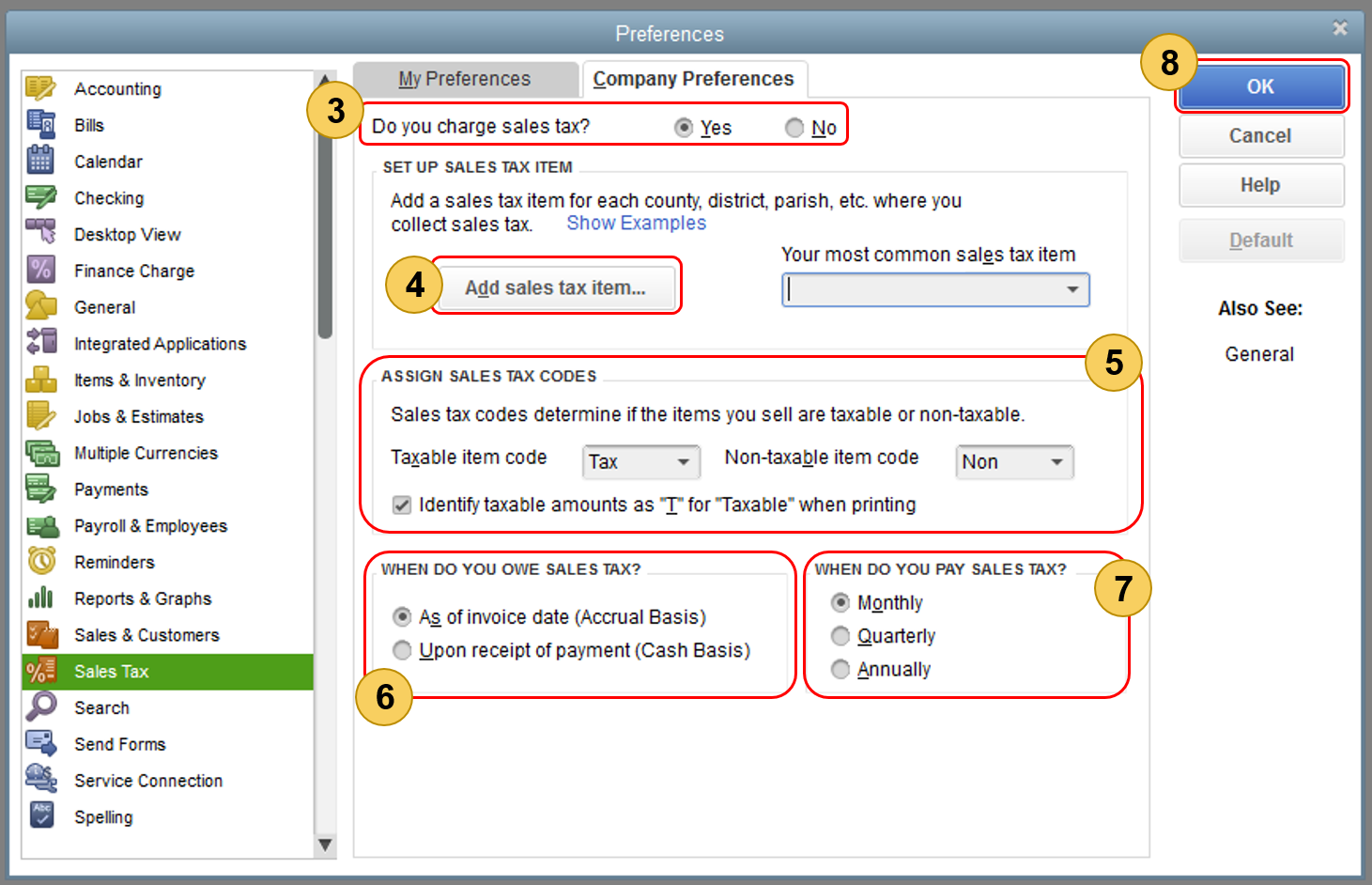

When it comes to taxes, the impact relies on how you've set them up. You can check your preferences to see how everything is being set up. To do so, follow the steps below:

Additionally, you may also be required to collect taxes for your goods and services. To give more details on the complete process, consider reading this article for more information: Set Up Sales Tax In QuickBooks Desktop.

You can always keep in touch if you need further assistance when creating test companies, invoices, or even taxes. The Community is always here to help you anytime. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here