Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have Quickbooks Online and need to write a check to refund one of my customers. I would very much like all of the exact steps from beginning to end to on how to record it properly. Do I need to make a refund receipt, Write a check and link the two of those together? If anyone can give me all of the steps I would surely appreciate it.

Hello there, @TammieMB.

I'm here to help you record a customer refund in QuickBooks Online.

If you want to refund for a paid invoice, follow the steps below:

Note: If the customer has overpaid, you do not need the credit memo as you will already have an unapplied credit that acts as your credit memo.

If you want to refund for goods or services for a dissatisfied customer or a customer's overpayment, you can read this article and go to the bottom part for the steps: Record a customer refund in QuickBooks Online.

I'm also adding this article to help you categorize transactions in QuickBooks Online: Categorize online bank transactions in QuickBooks Online.

Don't hesitate to comment below if you need further assistance recording a customer refund in QuickBooks Online. I'm always here to help. Have a great day.

Thank you, but this is not helpful. I’ve already looked this up and it provides too many choices and I’m unsure of the correct one for my situation. 10 months ago a customer paid an invoice with a credit card. I need to refund PART of that invoice and cannot do a partial refund in QBO now at this late date. I need to write a check. Do I need to create a Refund Receipt AND a check? I’ve done that but it doesn’t look right so I may need to delete them. I need specific help for my situation to record this correctly in my books, please and thanks.

Good afternoon, @TammieMB.

I appreciate you coming back and giving some additional information about how you're needing to record a refund to your customer with a check.

With the details you gave, I recommend consulting your accountant to be sure of which route would be best for you.

If you have any other questions after speaking with your accountant, don't hesitate to ask. Have a wonderful day!

I'm curious what you ended up doing and the steps needed to complete it? I'm in a similar situation. Thanks!

What is the reason for the refund? Overpayment? Product return? Other? The reason will dictate the best way to record it.

For simplicity, I think it would be considered "product returned."

Hi, I'm in a similar situation where I need to refund an award to a grantor (aka customer). We received grant monies that we are not going to use. I'm wondering, in what scenarios should I use a "Refund Receipt" instead of a "Credit Memo" (as mentioned in the guidance provided by @Ethel_A)?

Hello there, @MK_APWC.

Let me help you clear things up on how a credit memo and a refund receipt work in QuickBooks Online. A refund receipt is issued when a customer requests an immediate monetary return, whereas a credit memo is provided when a customer prefers to have a credit applied to their account for use in future transactions.

You can follow the steps below to refund your grantor (AKA customer).

For more information, you can refer to the following articles:

Record a customer refund in QuickBooks Online

Create and apply credit memos or delayed credits in QuickBooks Online

I also recommend consulting your accountant for further assistance on accurate recordkeeping. If you don't have one, you can a professional through the QuickBooks ProAdvisor page.

Should you have any questions regarding credit memo, refund receipt, or other QuickBooks-related issues, please leave a reply below. The Community is always available to assist you 24/7.

This did not work. I ended up with two credits to my customer.

Which account am I supposed to select in the drop down for " Deposit To" ???? The instructions didn't say

I appreciate you joining the thread and following the steps provided by my colleague, @ljordal. Allow me to clarify things for you about the refund in QuickBooks Online (QBO).

Firstly, since you ended up creating two credits for your customer, you should void one of them to ensure your financial records are accurate and tidy.

Regarding the Deposit To drop down, you will need to select which account you want the funds to be deposited into. For more detailed information about refunding a customer, check out this article: Record a customer refund in QBO.

I also recommend consulting your accountant for further assistance with maintaining accurate records. If you don't have one, you can find a professional through the QuickBooks ProAdvisor page.

Additionally, you might want to visit the following article to learn how to add specific details to your sales forms: Customize invoices, estimates, and sales receipts in QBO.

If you require further assistance with managing your refund credits or have any other QuickBooks-related concerns, I am here to help. Please do not hesitate to reach out to the Community. Have a good one.

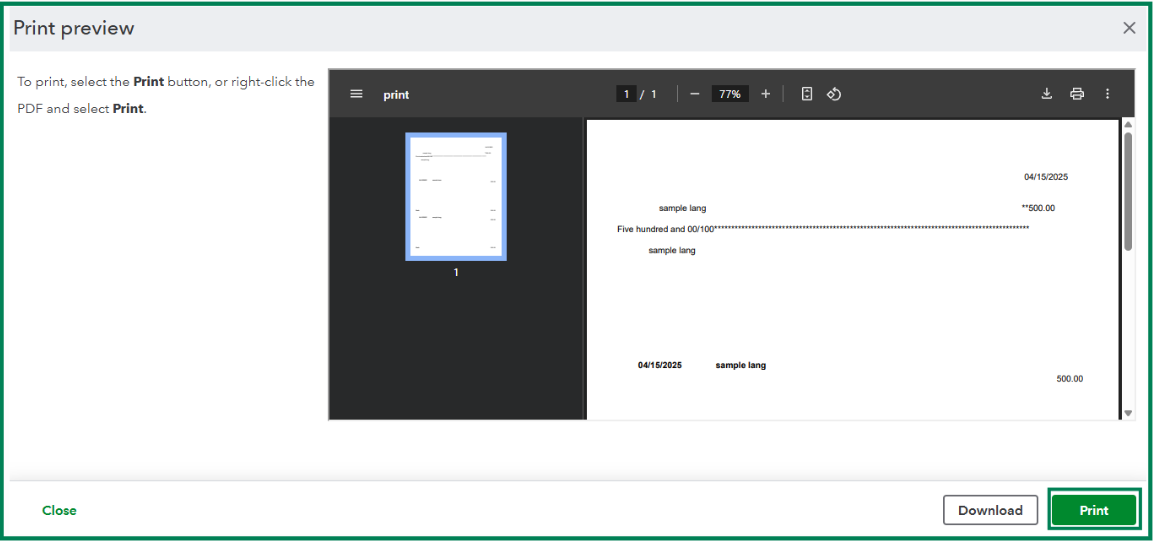

I just had to do this in QuickBooks Online and figured it out. It used to be very, very easy to do in QB Desktop but it's not so obvious anymore and it had the pros stumped. It took me some searching and troubleshooting but I finally got it. Once you get to the create a check step (step #2) you can print the check out physically. Make sure the Customer info is up to date with how you want their name printed on the check. Note that if you already have a Credit in the Customer Account do not make another Credit Memo. Don't forget step 3 or it won't clear out the credit on the back end.

To refund a deposit in QuickBooks Online, create a credit memo, create a check to refund the deposit, and then record the payment.

Once these steps are completed, how do you print the check? The check is not in the print queue.

Let's get this figured out, @naomic8581.

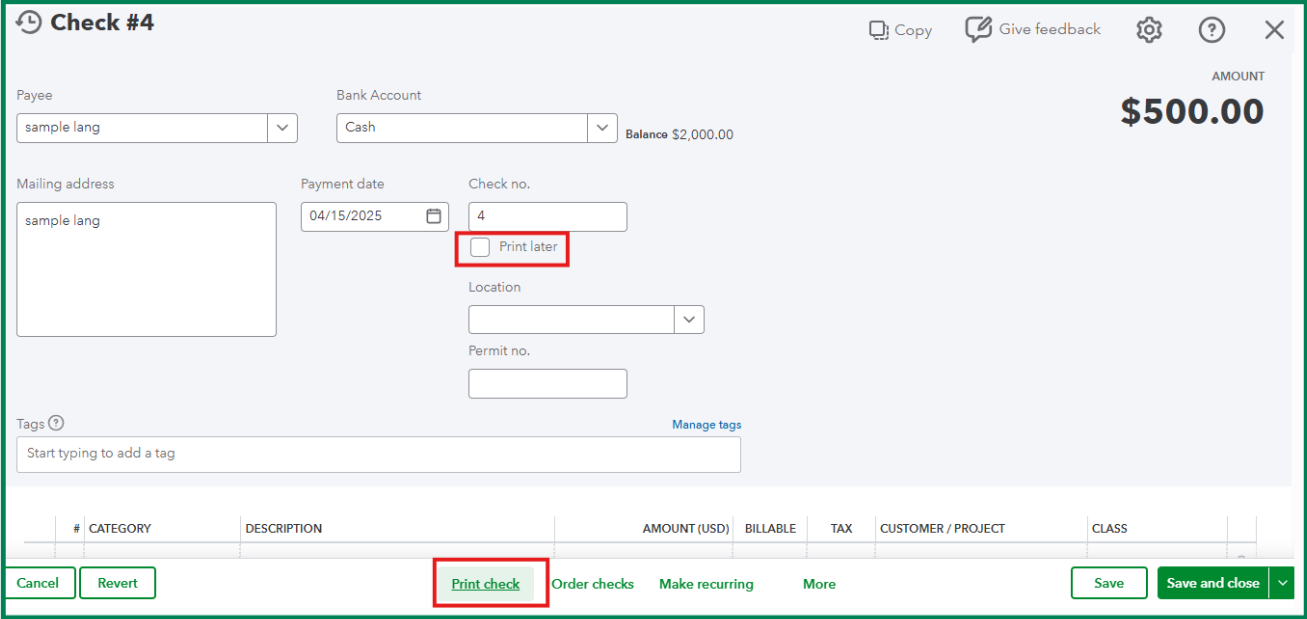

When you record a check in QuickBooks Online (QBO), you must select the Print later checkbox or the Print check option to add it to the print queue.

Since you can't see it in the print queue, you'll have to reopen the check and select those options mentioned.

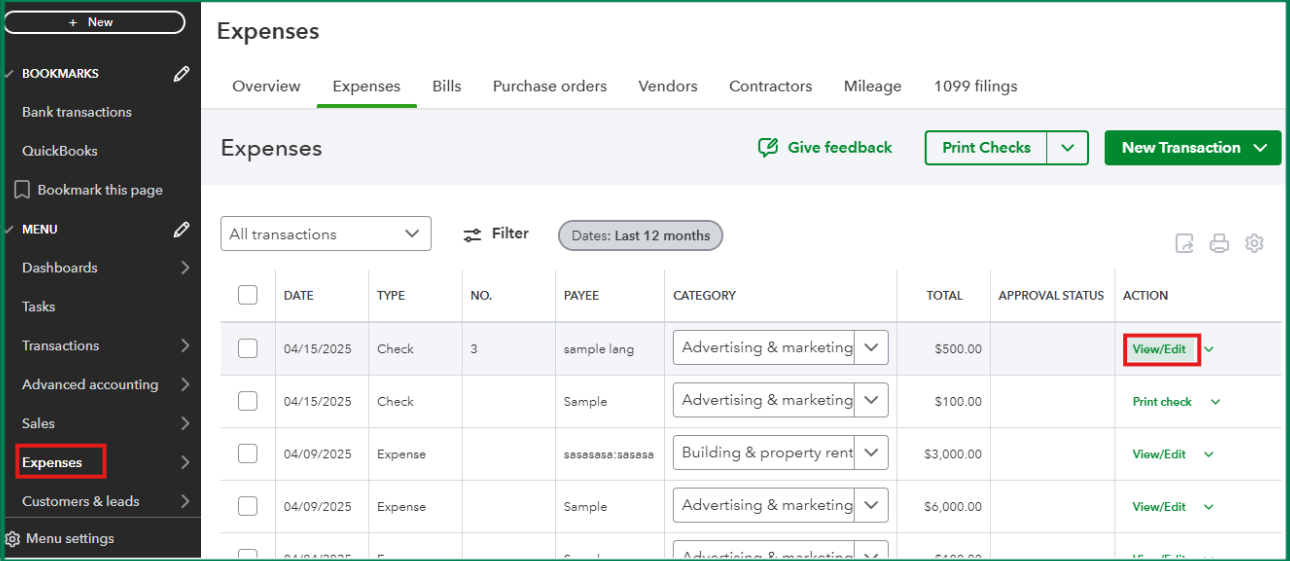

Here's how:

You can read through this article for more details: Print a check in QuickBooks Online.

Additionally, you can refer to this article for future reference about pulling up the Check Detail report or other reports to keep track of your transactions in QuickBooks: Run a report in QuickBooks Online.

If you'd like an extra set of eyes on your checks to ensure you're getting the most out of your program, check out our QuickBooks Live Expert Assisted team. They're available on demand to offer guidance.

Feel free to reply if you need help managing checks and other expense transactions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here