Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I setup two accounts for Sales Tax, first for retail and other for service. But whenever I create an invoice both for retail and service they used the same Sales Tax Account which is Sales Tax Payable to which is what use for Retail. But I want a different account for services which I created as Service Tax Payable

How can I change the assigned account for Sales Tax?

We are using Enterprise Solutions 19.0

Hello Ramos,

When you create a sales tax item, QuickBooks uses Sales Tax Payable as the default account. Currently we're unable to change it and assign a different account. I'd recommend sending feedback to our Product Development Team. They'll put your idea into consideration for future updates.

I'd also suggest contacting your accountant on how you can move the amounts from the Sales Tax Payable account to the other. They know what's best for you and your books.

I'll be around if you need anything else.

Along with what JamesDuan said

If you have a different sales tax rate for services than for retail, create two sales tax items, one for each.

QB works on names, think of names as sub accounts of the parent account, it you have a sales tax item titled service sales tax and another retail sales tax, when you run sales tax liability reports the two different sales tax rates and the amounts collected will be segregated.

If the sales tax rate is the same, service and retail, then you only need one sales tax item, and you track sales for service and retail with a class. And/or you can use two different income accounts to accumulate sales per type of sale.

Quickbooks cannot change the "default" Sales Tax Payable account while the "Do you charge sales tax?" preference is "Yes." If you want to set up different sales tax payable accounts, go to the Preferences menu, choose Sales Tax and on the Company tab, select "No" for sales tax collection. Set up your Sales Tax Payable accounts as desired, then go back to the Preferences and select "Yes." You should now be able to select to which Sales Tax Payable account(s) you want various items to post.

I was unable to change the sales tax account. We have two separate jurisdictions now and wish to split into TWO liability accounts.

Thanks for coming here with us today, sutley.

While you can setup two different vendors with one liability account, you're unable to split two liability accounts in QuickBooks Desktop.

Since you have two separate jurisdictions, you'll want to set them up as vendors. Here's how:

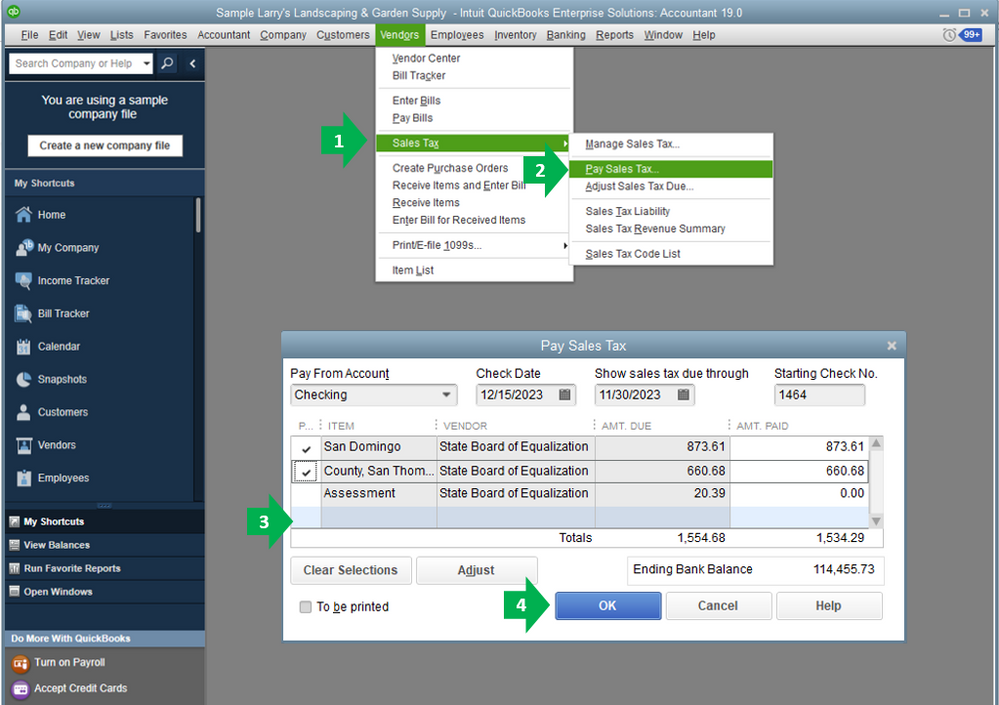

When you pay your sales tax, you can create a payment for each vendor using one liability account. Here's how:

Learn more about paying sales tax in QuickBooks Desktop through this article: Pay sales tax.

You can always get back to me if you have other questions and I'll do my best to help you out.

Can you apply different GL accounts to the Sales Tax Items?

Thanks for joining the thread, @dayaccounting1. I'd be glad to provide additional information about sales tax.

Currently, the option to apply different GL accounts to the Sales Tax items is unavailable. When you create a sales tax item, QuickBooks uses Sales Tax Payable as the default account.

Additionally, I'll be adding this to guide you in setting up sales tax in QuickBooks Desktop.

Fill me in if you have anything else in mind. I'll get back to you as soon as I can. Have a pleasant day.

Does Intuit yet support multiple sales tax accounts? I went live with a new company file in April. Without knowing about this issue, I created "Michigan Sales Tax Payable" and "Wisconsin Sales Tax Payable" subaccounts under the default "Sales Tax Payable" account. This is because I owe sales tax to several states (sometimes Iowa, Minnesota, etc.), but most commonly these two, depending on where the customer takes possession of goods. My accountant recently notified me that all sales tax is posting to just one account. Can my accountant journal these payments into the appropriate subaccounts I've made, or can I change something to have the payments post correctly from the beginning? Or do I need to scrap the whole idea of separate accounts and pay my accountant to sort through the mess every year?

I appreciate you providing details of your concern, @Miller55. I'm here to give further information about this.

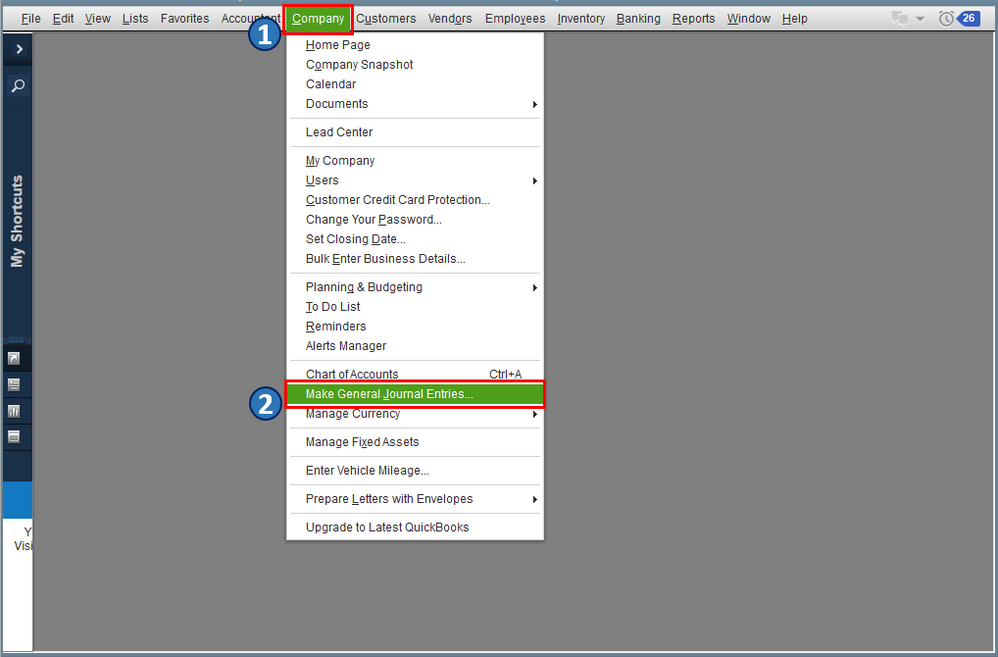

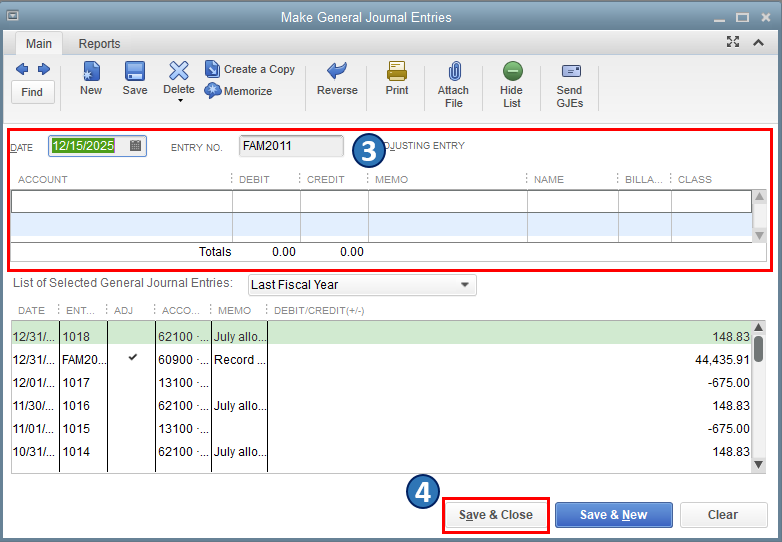

In QuickBooks Desktop (QBDT), the option to use multiple sales tax accounts is unavailable. To help you move the amounts into the appropriate subaccounts, you can use the journal entry feature. Then, to ensure everything will be recorded accurately, I suggest seeking assistance from your accountant.

Before doing any changes to your company file, I recommend creating a backup copy first. This is to ensure that you have the original copy of your file that you can restore in case of data loss or damage.

I've also added this helpful link for your reference in paying sales tax in QBDT: Set up sales tax in QuickBooks Desktop.

Reviewing your sales tax payable in QBDT is also a breeze. To do so, you can run the Sales Tax Liability or Sales Tax Revenue Summary report. With this, you can ensure everything is correct before paying taxes.

Don't hesitate to get back here if there's anything else you need about using multiple sales tax accounts in QBDT. I'd be glad to help you further. Have a good one.

I have a client that somehow created a separate Sales Tax Liability account, when I run the sales tax report for the month it is not picking up amounts as of course the report is mapped to the one they made inactive.

How would I correct this so that the QB payable account is being used instead of the one they set up without having to edit each invoice ?

Keeping your client's sales tax account accurate in QuickBooks Desktop (QBDT) is my priority, @cindy_b.

QuickBooks uses Sales Tax Payable as the default account for your sales tax items. To correct the Sales Tax Liability account used on your client's transactions, you'll have to create a journal entry transaction. This will move the amounts from the separate sales tax liability account to the default one.

Before doing so, please make sure to create a backup copy of your client's accounting data. This is to ensure you can restore a copy of their company file for future use.

Whenever you're ready, here's how:

In case you want to edit, reverse, and delete a journal entry, you can check out this article: Create a journal entry in QuickBooks Desktop.

Once you're done, I'd recommend reviewing your client's payables by running sales tax reports (i.e., Sales Tax Liability and Sales Tax Revenue Summary). This way, you're able to check that their data are accurate before filing their returns.

Also, QBDT helps you keep an accurate record of your sales taxes so you can easily monitor and remit them to the appropriate tax collecting agency. For your guide in paying them, you can refer to this article for the detailed steps: Pay sales tax.

Let me know if you have other reporting and sales tax concerns in QBDT. You can drop a comment below, and I'll gladly help. Take care, and I wish you continued success, @cindy_b.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here