Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowI do the books for a nonprofit that is just getting started. A donor has offered to pay some start-up bills directly - not items, but things like the rent, the building cleaning services. These are things that the organization will have to pay itself in the future, so I want the vendors and expenditures to show up so that we can easily budget for these expenses in the future. This seems like it should be treated differently than an in-kind service donation (since the donor is not the one cleaning the carpets), or an in-kind item donation (different than I would record it if a donor brings over office supplies). What's the best way to deal with this type of donation?

Solved! Go to Solution.

Thanks for getting back to us and for sharing some clarifications, @molbrez.

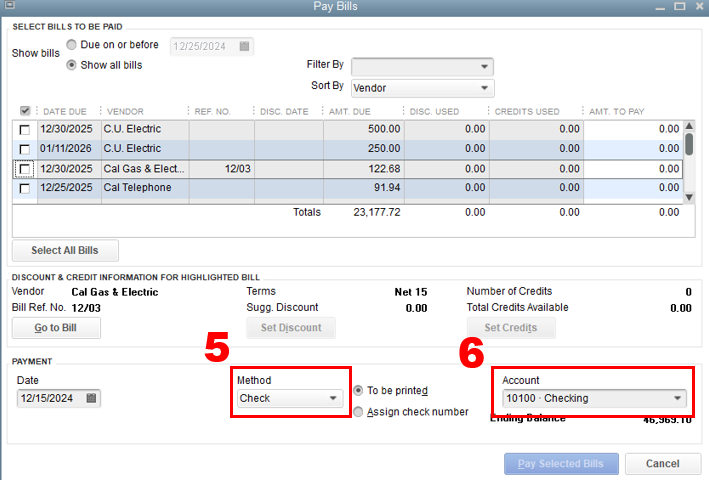

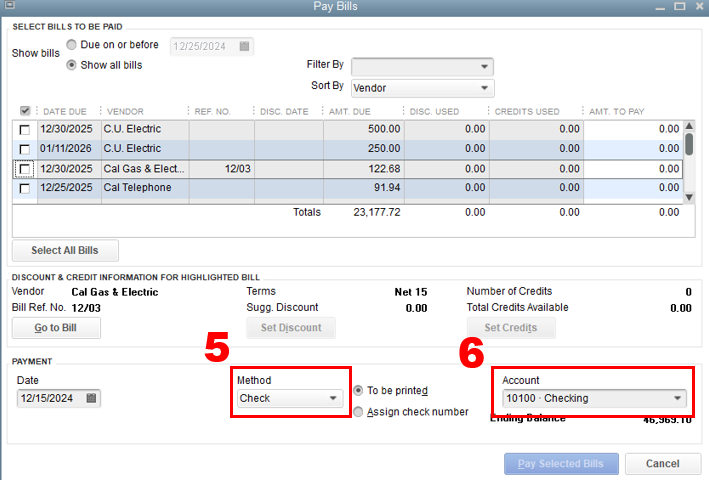

You can record the bill payment using check as the payment method. Then use a clearing account in paying the bills. Let me show you how.

You can also check this article for more details: Pay bills in QuickBooks Desktop.

I’d also recommend working with your accountant for additional guidance and advice. This way, we can ensure your accounts stays accurate after recording this. If you’re not affiliated with one, you can visit our ProAdvisor page and we’ll help you find one from there.

I’ve also added these links that you can read for your future reference in managing your transactions and accounts:

Tag me in your reply if you have other concerns or questions about recording transactions in your software. I’ll be more than happy to work with you again. Keep safe!

Hi there, @molbrez.

Thanks for posting your concerns here in the Community. I'm here to help you record bills paid by a donor for your nonprofit business.

First off, you'll have to set up the donors as customers in the Customer Center to track the fund donations and donated items. Here's how:

To record the donation, you can create a sales receipt. Here's how:

Once done, you can now follow the steps to pay the bills in QuickBooks Desktop.

Lastly, you can consult with your account so you'll be guided accurately in tracking your donations.

For more insights about managing your transactions, you can read through these articles:

Leave a comment below if you have more questions. I', always around to help.

Hi @katherinejoyceO - thanks for your advice. It sounds like you’re advising just entering the funds used to pay the bill as cash donation? And then recording payment of the bill - using what kind of payment method? In this case the donor is actually writing a check directly to the vendor.

Thanks for your direction, @katherinejoyceO . It sounds like you’re advising entering the bill to be paid, recording the amount used to pay the bill as a cash donation, and then entering bill payment - through what method?

To clarify: In this case, the donor is writing their personal checks directly to the vendor, so the dollars are not actually moving through the organization.

Thanks!

Thanks for getting back to us and for sharing some clarifications, @molbrez.

You can record the bill payment using check as the payment method. Then use a clearing account in paying the bills. Let me show you how.

You can also check this article for more details: Pay bills in QuickBooks Desktop.

I’d also recommend working with your accountant for additional guidance and advice. This way, we can ensure your accounts stays accurate after recording this. If you’re not affiliated with one, you can visit our ProAdvisor page and we’ll help you find one from there.

I’ve also added these links that you can read for your future reference in managing your transactions and accounts:

Tag me in your reply if you have other concerns or questions about recording transactions in your software. I’ll be more than happy to work with you again. Keep safe!

@molbrez Hi there! I have a similar situation and I was wondering if the solutions offered worked out for you. You marked the question as "solved" but I'm not sure I fully understand the solution(s) offered and was hoping you could add some insight.

Here are the details: we were granted $3,000 to cover heating costs. Rather than send us a $3,000 check, the donor sends the check directly to our gas utility company and the utility company credits our account for the full amount of the grant. Until the credit is fully spent our gas bill reflects $0.00 "owed" each month. To keep it simple lets say our heating costs are $1,000/ mo, for three months we would receive an invoice with a $0 due from the utility, the grant credit balance on account with the utility company would decrease by $1,000 each month, and the credit would be fully applied after 3 months.

I need to report on how much it actually costs to heat the building on a monthly basis. In the past, we would record an "in-kind" journal entry for the full amount of the "donation" (debit in-kind utility expense $3,000, credit to in-kind contributions $3,000) and simply file away the $0.00 gas invoices without recording them in QB. The two in-kind accounts (in-kind revenue and in-kind utility expense, reflected in the "other" section at the bottom of the P&L) zero each other out, so without actually recording the gas expense incurred, our P&L won't reflect the true cost of heating the building.

What transaction(s) must we record so the actual heating costs incurred with the gas company are reflected as an expense on the P&L without creating an AP due to the gas company? And then how do we correctly record the in-kind donation received?

If I follow the instructions offered by @katherinejoyceO (set up the donor as a customer, then enter the donation as a "sales receipt") I would need to select an account for the "deposit to" dropdown on the sales receipt (my choices are existing Cash, AR, and Other Current Asset accounts). Since the check was sent directly to the utility company, it doesn't make sense for me to choose any of these accounts. @JasroV suggested using a Clearing Account (bank) when recording the bill payment (which I would have to create since we don't currently use one); would I select the Clearing Account when creating the sales receipt?

I'm still lost as to the next steps. I assume I would enter the utility bills for the full amount (lets say there are 3 x $1,000 bills) as I normally enter all bills, and then use the "pay bills" function and select the clearing account. But, where does the customer (donor) "sales receipt" come into play? I somehow would need to apply the payment made by the donor as a credit against the bill and I'm not sure these steps would accomplish this. Any further assistance would be greatly appreciated!

Thanks for joining the thread, Jeremiah.

I'll provide a different method for recording the full amount of donations sent by your donors.

You can create a bank deposit to record the full amount of the grant. This way, the amount will reflect in your in-kind revenue account without affecting the Accounts Receivable (AR). I'll show you how.

Then, generate a monthly bill and use the expenses tab to record the transaction to the in-kind expense account.

Here's how:

After that, you can follow the steps provided by my colleague JasroV to pay the bill using the clearing account.

I recommend getting in touch with your accountant for your other option to record the transaction. This ensures your books stay accurate.

You may also visit our website for more suggestions and other resources to help you manage your books: QuickBooks Help Articles page.

You're welcome to post again if you have further questions or concerns. We're always available to help you.

So I have a similar question. I have a donor who has offered to write a check to cover the cost of some printing. I want to be sure he credits credit for his donation while at the same time recording the printing expense so I will know how much the program cost at the end of the year. How is it best to record this situation?

Thanks for any guidnace.

Hi bhamilton,

It's good to know that your donor has offered to pay some printing costs for your business. I will guide you through recording their donation, and at the same time, reflecting the expenses in your books.

QuickBooks Desktop has a feature called billable expenses charge, which allows you to mark the printing costs transaction as billable to your donor. The that billable expense reflects in the customer's profile and can be turned into an invoice. You just need to mark that invoice as paid, which represents the donor's donation.

To record the printing cost, you can write a check to the vendor (printing shop) and make the item billable to the donor. This process will post the expenses to your books.

The billable charge can be added to the donor's invoice, and the invoice can be marked as paid. The payment represents their donation to to your business.

You can also check some customer/donor-related reports after recording your transactions. Here's an article for your reference: Customize customer, job, and sales reports in QuickBooks Desktop.

Let me know how I help you record the printing expenses paid by a nation. Take care if you have more questions.

Does the donor's payment of the invoice only "count" for IRS gift reporting when the invoice is sent to the donor? If the funds don't pass through the charity isn't this treated as a gift in kind and the donor only gets "soft credit" on the charitable giving books?

Hi there, Jared. Let me shed some light regarding recording a donor payment of the invoices for the IRS.

When a donor pays an invoice they have received, this is deemed a donation or gift. The gift tax is imposed on transferring property from one person to another, where the recipient doesn't receive anything in return.

Moreover, please know that there are following things that the IRS doesn't consider as gifts. Here are the following:

Additionally, please know that for these payments to be subjected to reporting, they must exceed the $18,000 threshold.

For more information, you can check this article: Frequently asked questions on gift taxes.

Importantly, please know that it's best to coordinate with your account regarding the funds that don't pass through the charity. They have the specialized knowledge to manage these situations effectively and can provide accurate recommendations.

Furthermore, I have included these articles that will assist you in gaining a deeper understanding of reports and how to personalize them effectively.

You can always get back to this forum if you have other concerns regarding reporting a donor's payment to the IRS. I'll make sure to help you out anytime.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here