Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe had a balance in our AP GBP account from an old transaction from a few years ago. We created the JE in 2021 to remove the balance from the AP GBP account to clear it out, but now its showing in our AP Aging Detail and not our Balance Sheet thus causing a variance between the two reports.

Any help is greatly appreciated.

Thanks for bringing this to my attention, @RCP7.

I'm here to assist you in resolving the issue with the Journal entry appearing on your Accounts Payable Aging Detail report in QuickBooks Online (QBO).

If the journal entry you've created to offset your old transactions isn't linked to any transaction, it'll appear in the AP aging detail report. To clear this in the report, you can connect this entry with an expense transaction. Below are the steps you can take to generate one:

Furthermore, I'll attach these helpful references so you can keep track of your bills and expenses within the program:

You can also generate and customize financial reports in QuickBooks and make them personalized and specific to your needs.

Feel free to tag me or comment back in the comment section if you have further questions about managing reports and expenses or any other QuickBooks-related issues. Our team is available to assist you at any time. Have a great day!

Thank you for the quick reply. I followed those instructions and it removed the entry from the AP Aging and there is no longer a variance between the reports, but now i have the attached issue. That balance moved back into our AP GBP account, which is what we we're trying to clear out initially. Is there a way for us to $0 out that account without taking a $4k expense to offset the amount?

Thanks for getting back to us, @RCP7. I greatly appreciate that you performed the steps recommended by my colleague.

Let me further help you account for the previously created JE and resolve the variance between the Accounts Payable (A/P) Aging Detail and Balance Sheet reports. Just a disclaimer, it would be best to consult your accountant as you go through the steps below to ensure accuracy of your financial records.

Let's start over and deal with this directly. Delete the previous expense transaction my colleague has suggested since the goal is to link the JE with the associated bill transaction (i.e., GBP transaction) to remove them from the A/P Aging Detail report which can't be achieved by creating another expense.

On your first attached screenshot, the JE shows a positive amount of 4057.19 which means this is another amount you'll still have to settle separate from the bill transaction you're supposed to link. If you collaborate with your accountant, they can help review the JE and check if it's associated with the correct accounts since the entry should appear negative to associate it with the transaction. I've attached a screenshot for visual reference.

After you've reviewed the JE, open the Bill Payment window of the paid bill as in the screenshot above and ensure to put a checkmark to the JE to link the two of them. You can use the magnifying glass icon to help in the task of finding the bill payment.

When this is resolved, let me add this article as a guide in managing your bills: Enter and manage bills and bill payments in QuickBooks Online.

Keep us posted if there are other details you'd like to add or if both reports still show variance. We'll do our best to assist. Take care.

Here's how you might be able to remove it from your AP Aging Detail:

Review the Journal Entry: Look back at the JE from 2021 that was supposed to remove the balance from the AP GBP account. Verify if the accounts used were appropriate. Ideally, the JE should have debited an expense account (like Account Payable Write-off) and credited the AP GBP account.

Check for Missing Reversal: It's possible the JE wasn't structured correctly or a subsequent reversal entry was made by mistake. If the JE debited the AP GBP account instead of crediting it, it would cause the balance to reappear in the AP Aging Detail.

Reconcile the AP Account: Reconcile your AP account to ensure its accuracy. This might involve reviewing supplier invoices and statements to verify all transactions are accounted for correctly.

Consult Your Accounting Software: If you're using accounting software, consult its documentation or help section for specific steps to handle old or erroneous transactions in the AP Aging Detail. Some software might allow you to edit or delete the transaction entirely LaSRS Login.

Accounting Professional Help: If the above steps don't resolve the issue, consider seeking help from an accounting professional. They can analyze your situation and recommend the most appropriate course of action to remove the transaction from your AP Aging Detail while maintaining the integrity of your financial records.

The issue with that is that there is no bill for us to apply it to. The JE was created to clear out the account due to a USD/GBP issue. I have attached the GL detail for that AP account from back in 2021. It looks like we have one bill that went in at 10k GBP and the second went in at 14k USD (also 10k GBP). I am not sure why that is the case. If you open both bills in QB it says that they are both the same $14k USD amount, which is why I believe there is the duplicate payment of the same value. When we made payments for both invoices, the "payment" amounts that were applied to those bills were the USD value, causing the variance/debit balance on the account. Is there any way for us to remedy that?

Hi there, RCP7. I know a way to clear out your AP GBP account.

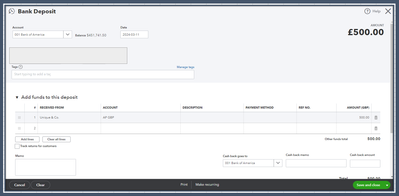

Since the journal entry was created to clear out the account due to the USD/GBP issue, let's enter a bank deposit affecting the AP GBP account to resolve this. Here's how:

After that, link the deposit to the expense transaction you've created on the Pay bills page to clear the amount successfully. I'll show you how:

Be sure to let me know if you have any other questions about managing your books. I got you covered with any QuickBooks concerns. Thanks for coming to the Community, wishing you continued success.

Thank you for the quick reply. Unfortunately, I followed those steps but it still leaves the JE on our AP Aging detail and causing a variance to our BS. I have attached the AP Aging Detail for reference. I tried making a deposit against the AP account and generating an expense against it, but that just leaves a deposit on our AP Aging detail instead. If you have any other solutions, please let me know.

I appreciate you for coming back to the thread, @RCP7. I can assist you with resolving the variance between the Accounts Payable (A/P) Aging Detail and Balance Sheet reports in the previously created JE.

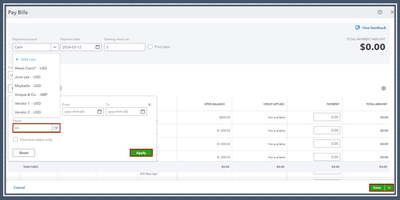

If you have deleted the expense suggested by my colleague, removing the associated bank deposit is recommended to avoid inconsistencies in your records. Creating a new bank deposit after deleting the expense will result in the Journal Entry showing up in the aging report, which may cause confusion and inaccuracies in your records. To fix this, it is not necessary to create any additional transactions. Instead, you can link your Journal Entry to the open balance of your vendor by using the Pay Bills feature.

For additional queries, you may contact our support to help you. They have the necessary expertise and tools that can aid you with fixing the account due to the USD/GBP issue you're facing right now. Here's how to contact them:

On the other hand, you can review this article as your future reference for modifying recorded expense transactions inside QBO: Enter and manage expenses in QuickBooks Online.

Should you need more support in managing reports and expenses or any other QuickBooks-related issues, you can always ask questions by hitting the Reply button or starting a new thread. Have a good one.

Doing that does remove the journal entry from our aging and clear that out, but now that "payment" is showing as an outflow out of our cash account which is causing a variance in cash. Is there another step to reconcile cash or another solution to our issue? I have attached our cash account showing the "payment" causing the variance as well.

Thanks for getting back here in this thread, @RCP7.

It would be best to contact an accountant so they can provide other ways to handle or reconcile the cash account. They can also supply details to help you fix the variance you have in your cash. If you don't have an accountant, we can help you find one by going through this page: Find a QuickBooks ProAdvisor.

Moreover, we have these articles to help you add more details to your reports and learn more about how you can handle journal entries inside QBO:

You can always post here in the Community space or comment below if you have any follow-up questions about this. The Community team will always be around to lend you a helping hand. Stay safe.

With all due respect to QB employees, they don't understand accounting and they're running you in circles. This is an accounting question more than a QB question.

In looking at your screenshot that shows the two bills and two bill payments that caused this A/P discrepancy, the bills posted totaled 24,057.19 and you paid 28,114.38, causing the discrepancy of 4,057.19. That means you overpaid and need to increase your expense if, in fact, those payment amounts are correct. It seems odd that both payments were made for the same exact amount (14,057.19). To clear out the negative (debit) A/P balance, the journal entry posted on 12-31-21 should have been a debit to the appropriate expense account and a credit to A/P - GBP. Was that the entry? Your screenshot doesn't show the offset account. Just so you're aware, the journal entry that was created on 12-31-21 is the same as entering a bill to the appropriate expense category. Then, you just needed to apply the journal entry to the negative A/P balance by going to New > Pay bills and select the "Bill" that was created by the journal entry and apply the credit. When you apply the credit to the journal entry, it won't have any effect on your balance sheet or income statement on accrual basis (it will on cash basis), it will just remove the offsetting A/P entries from your A/P aging report.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here