Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI converted my S corp to an LLC (single membership) 12/1/18 (no changes except for name/entity change) and not sure how to handle entries in payroll (I have one employee) and journal entries. Do I just change my name to LLC and start new entries on the day I changed to an LLC? I need help please as I am confusing myself and QBs tollfree number as well. No one seems to understand what I am asking. I do not want to wipe out my YTD info as a C corp in the process. Thank you.

Solved! Go to Solution.

Hi there, @Robin4649.

Thanks for joining us here in the Community. Allow me to provide some information about the transition of your payroll and entries from S Corp to LLC in QuickBooks Desktop.

You'll need to change your company information in your QuickBooks so your tax forms will be updated. Your payroll and other transactions will be recorded as usual.

To change your information:

However, if you wanted to create a new company file for your LLC, you can create a new company file by copying the existing file with the same vendors, customer contact information, chart of accounts and lists. Aside from that, all the lists, transactions, templates, and preferences in the original company file are also carried over. To learn more about this process, please check out to this article: Create new company with lists, templates, preferences, and accounts (empty) from an existing one.

You can also visit this article for more information about changing your business entity in QuickBooks Desktop for your future reference: About changing your business entity.

If you need additional assistance about this matter, feel free to reach out to our Customer Care Team so you'll be guided all throughout the process.

To reach them:

Please keep me posted if you have any other questions, I'm always here to help. Wishing you the best.

Hi there, @Robin4649.

Thanks for joining us here in the Community. Allow me to provide some information about the transition of your payroll and entries from S Corp to LLC in QuickBooks Desktop.

You'll need to change your company information in your QuickBooks so your tax forms will be updated. Your payroll and other transactions will be recorded as usual.

To change your information:

However, if you wanted to create a new company file for your LLC, you can create a new company file by copying the existing file with the same vendors, customer contact information, chart of accounts and lists. Aside from that, all the lists, transactions, templates, and preferences in the original company file are also carried over. To learn more about this process, please check out to this article: Create new company with lists, templates, preferences, and accounts (empty) from an existing one.

You can also visit this article for more information about changing your business entity in QuickBooks Desktop for your future reference: About changing your business entity.

If you need additional assistance about this matter, feel free to reach out to our Customer Care Team so you'll be guided all throughout the process.

To reach them:

Please keep me posted if you have any other questions, I'm always here to help. Wishing you the best.

BettyJaneB, thank you for the information. When I change my info under Information, the Income Tax form used will switch from Form 1120s to form1040. When I select that, a msg pops up saying the tax settings will now be invalid and deleted in all accounts. That worried me and I canceled it because I have not done my W2s and YTD forms for the S corp yet. Will my old information/reports still be there for reference when I had the S corp or do I lose all of that data? Also, do I need to do my YTD reports/W2s for the S corp before changing my info to form 1040 for the LLC status? Thank you (again). Robin

@Robin4649 wrote:I converted my S corp to an LLC (single membership) 12/1/18

I don't think the word converted is right. From a legal point of view the LLC bought the assets of the corp, which ceased to exist. So really you should start a new set of books IMO. From a payroll point of view if control of the entities remains the same, then the rules of succession are used, where the YTD history of each employee carries over, just so as to determine the cap for SS and FUTA, and maybe the state unemployment rate, even with a new FEIN

See attached Intuit form for just such a case. I don't know why the Intuit article says they can't do this. It says "Intuit Online Payroll does not support wage carryover". Maybe the attached is for QBO Payroll, not Intuit Online Payroll.

It would have been easier to make the change on 1/1. Maybe you still can as then the issue of YTD payroll is irrelevant

Thank you so much. This was very helpful!

Thank you so much!

It is not my company. It is a Church and I am secretary. /Where am I clicking on company. I haven't use the QB software yet. We have not been In our church yet. "since the pandemic".

I'm here locate the company settings, ok75.

Before we start, make sure to log into your QuickBooks Online account as the master admin. This role is required to change the company information.

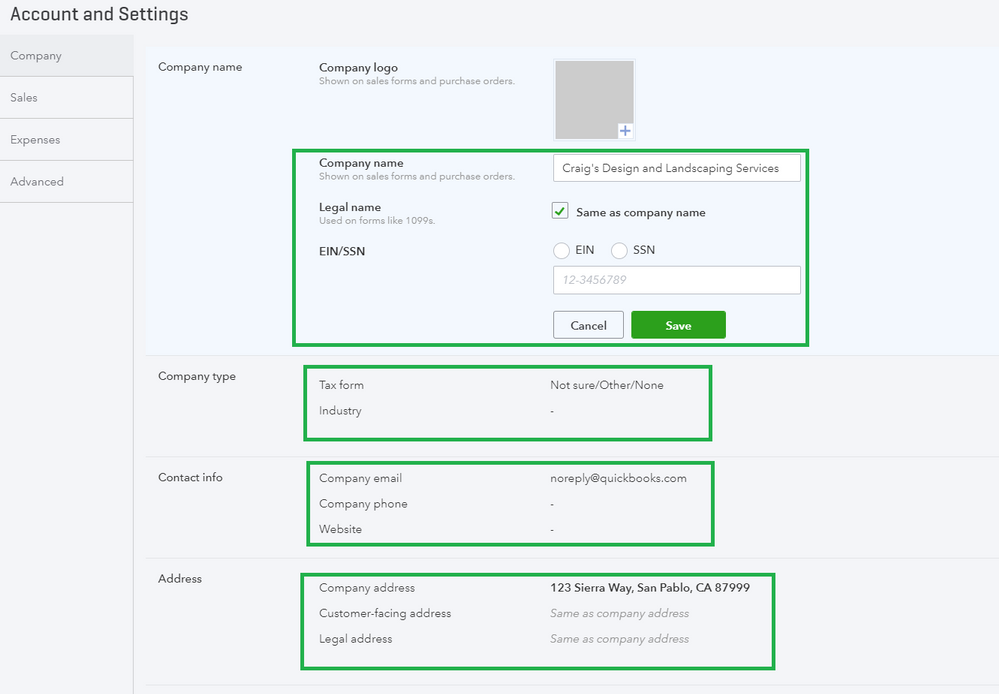

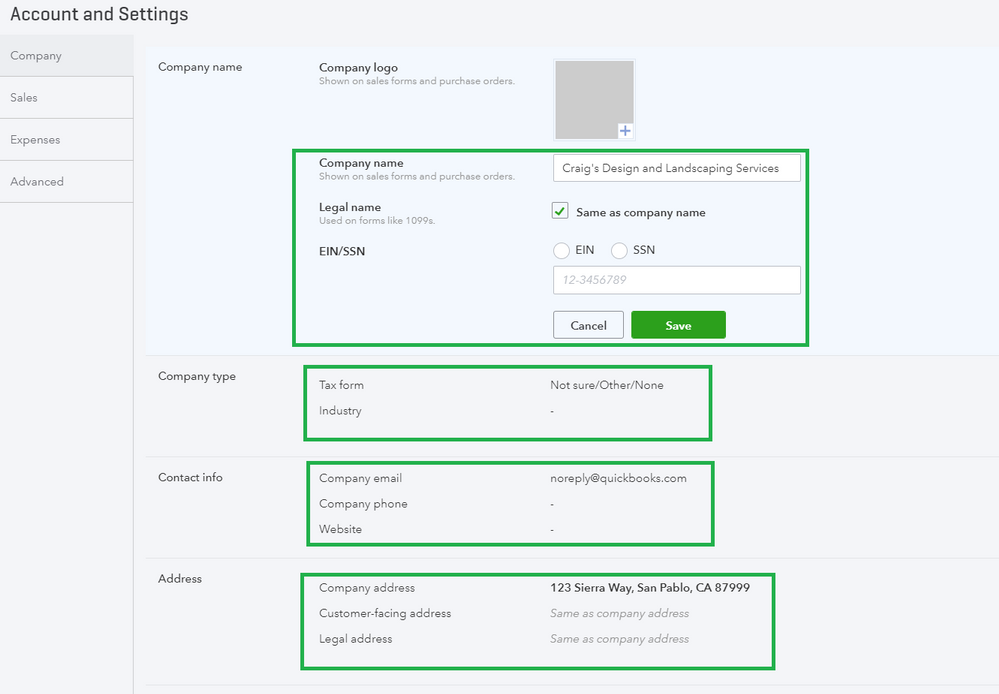

Once you're inside QuickBooks, here are the steps you can follow:

You can also visit this link for additional information: Change your business name, contact info, or EIN in QuickBooks Online.

Also, these articles cover all of the setup and accounting workflows you need to know, guiding you from the initial sign up through the next financial quarter and beyond:

Stay in touch with me if there's anything else I can help you with QuickBooks. I'll be right here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here