Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Our file is pretty much a mess in several aspects, but in my A/R aging reports, it shows several customers who have negative balances. However, when I go to write those off as bad debts, I get a message that there are no open invoices for those particular customers. However when I go to the transaction history for the individual customers, I can find overdue invoices, however the amounts don't match (from overdue invoice to A/R aging report balances). Where are these balances coming from, and how do I get it all cleared up? These are balances from previous years, and there are probably 30 customers with these negative balances.

Negative balances mean the customer has overpaid compared to what you have billed them. In in case it would be unusual to have open invoices. Instead there are likely open/unapplied payments due to the over payment state the customer is in.

If the balance is incorrect, fix it by adding an invoice and then applying the payment to it.

If the balance is correct then there may be nothing to do, or you may want to issue a refund check coded to AR to bring the balance to 0.00.

I am unclear from your post whether you are experiencing negative balances in a/r or overdue invoices. They are two different things and I will try to explain.

Negative customer balances on the aging report actually represent over payments made by customer or credits which are greater than the outstanding invoices. If you want to remove the negative balances you must enter an invoice to offset them. The steps to do that are as follows:

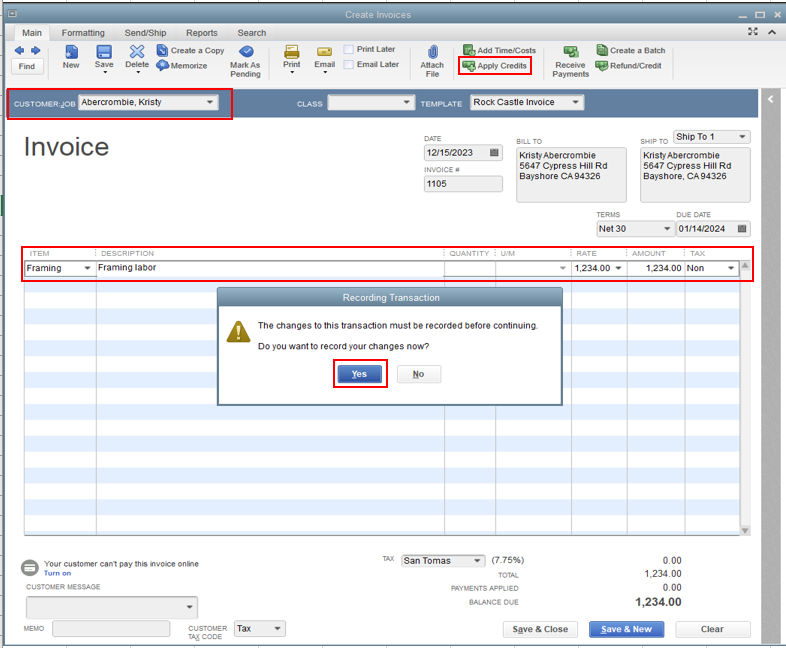

Enter an invoice for the customer and prior to saving & closing the invoice click on the "apply credit" button on the top of the invoice under the "main" heading. The overpayment / credit should appear and you can place a check next to it to apply it to your new invoice.

Outstanding balances for a customer can be removed by going to the customer center, highlighting the customer in question, clicking on the "transaction" tab, changing the "show" section to invoices, changing the filter to open invoices. Then click on the invoice you want to charge off the balance. Under the "main" tab at the top of the invoice choose "refund/credit. This will allow you to enter a credit directly from the outstanding invoice. This credit can be changed to be a partial of the original invoice, it does not have to be the entire invoice or even show exactly the same items. You could for example create an item that is associated with bad debt and use that item on the credit to go against the invoice that is outstanding.

I hope I have answered your concerns, but if not, please feel free to contact me for further details.

Customers with negative balances are monies you owe to them (refunds).

To close these you are not 'writing them off'- its the opposite, you have to create an invoice to them to absorb the credit. Yes this will create income in the current year.

There are no invoices for these balances, only a record of the deposit. The manager at the time did create a new company file due to the old one being corrupt, is it possible that she deposited payments without going back and either creating or recreating invoices for those customers? Could that cause such an issue?

I do understand that they are two different things, I guess I'm just not asking the right questions.

There are negative balances and overdue invoices both in my A/R. When I try to correct a negative balance by creating an invoice to absorb it, I get a message that there are no available credits, and no previously applied credits or refunds to edit.

When I go to the overdue invoices to write them off by creating a credit memo for an item associated with my bad debt account, I get a message that the customer has no open invoices. So somewhere something is off, but I don't know how to pinpoint what is going on, or how to fix it. Does that better explain my situation?

Using Receive Payment without any invoice = Negative AR. People gave you money and you never showed Why.

You are missing Invoices, if AR is negative for a name. Either Refund their money, or show there is a Sale to which it is applied.

Stop making Credit Memos; that is More Negative AR.

If you have Overdue Invoices, that is Positive AR.

Do this: Run the Reports menu > Customers & Receivables, AR Aging Summary. Customize. Filter on Amount <=0. Here are Negative AR customers, which means they sent money and no one processed it using a Sales receipt, and there was no invoice. You are missing Invoices for them.

Hi, i also get the same negative on a/r aging report but mine are all deposits. I dont know how to remove them. If i make an invoice and invoice payment from same amount of deposit that is negative in aging reports, it still sits there. Should i delete it?

Hi there, @Jmp17.

You don't need to delete those deposits but instead, you can apply them to an invoice. This way, all of the negative amounts from your deposits will be removed from the A/R Aging report. Let me guide how.

The reason why the deposits still sit as a negative amount on the report is that you create an invoice then received the payment at the same time. The best way to remove them is to apply the deposits as a credit to an invoice. Here's how:

Once done, you can now review the A/R Aging report to double-check if the deposit with a negative amount already removed.

I'm adding this article for your future reference: AR Balance on the Chart of Accounts does not Match AR balance on Reports.

Feel free to visit us again if you have any other questions. The Community team is always here to help.

So this means i have to void the received payments? Would it be a double entry?

Thanks for the follow-up questions, Jmp17.

These negative amounts are usually caused by Credit Memo entries, over payments, or possible duplicate payments.

The steps provided by Mark_R will apply for your future invoices given that the credits are from the customer over payments or credit memos. Therefore, you don't have to void/delete the received payments.

In case the credits are caused by multiple entries, please delete/void the duplicate.

On the other hand, when making deposits, make sure to select the A/R account in the Account column. This way, you'll be able to link it to your invoices.

Keep us posted if you've got more questions. We are here to help.

Thank you for your reply. For some, making an invoice worked. But for some deposits, if i make an invoiice it will only add as overdue. If i make payments from that invoice created it doesnt also help me to move away the deposits under a/r aging reports😢

Let's link the deposits to the invoice, Jmp17.

I'll show how to do it:

I've added screenshot as reference:

Let me know how these steps works. I'll be here if you need more help.

Hi thanks all for the answers. Im actually good for the a/r. Im not working on A/P

this is my first time so yea.

i dont know how to clear A/P aging for vendor credits, expenses, deposit,and to bills

Hey there, @Jmp17,

Allow me to step in and provide another way of clearing your A/P Aging report. Those vendor credits, expenses, deposits, and bills may be the result of an error, overpayment, or underpayment.

You need to write off vendor balances to remove or clear those amounts. Feel free to read through this article for the detailed steps: Write off customer and vendor balances. Go to Accounts Payable, Vendor underpayment, and Vendor overpayment, then follow instructions for your guidance.

Upon sharing this suggestion, I still encourage consulting with your accountant first before making any changes in your account. He/She might have specific instructions about clearing the report and what accounts to debit or credit.

Keep me posted if there's anything else you need and I'll get back to you.

I have a client that has zeroed out deposits on A/R with a Journal Entry. Now the A/R report has several lines of data that zero out but they still show up. What is the best way to clean this up? Most of these entries are from 2017 so I do not want to effect current year income.

Thank you in advance.

Let's make a bank deposit to transfer them to the correct bank account, Kim.

When journal entries were created, the posting account selected must have been an income account. That's the reason why there are still showing up in the A/R report. Let's make a bank deposit to post them to the correct bank account. Here's how:

If you can't find the transactions from the Bank deposit screen, let's undo the journal entries created. Open each journal entry, and delete it. Then, manually receive the payments from these invoices by opening each of them and clicking on the Receive payment link.

Run the A/R report again. Let us know if there's anything else that you need about transferring these zeroed out transactions.

It's most likely from someone receiving payment for the invoice after Quickbooks already received funds, resulting in a negative balance.

I have to clear a negative A/R from the balance sheet but I can't see the above answers will help me. The amount is an amalgamation of entries from years back and is a beginning balance for this year. Is there an entry to make that I can use without entering a customer?

Hi there, Doreen1977.

We're unable to adjust A/R balances without tagging a customer in QuickBooks Online. You can also create a Journal Entry to correct or adjust the balance. Here's how:

However, we recommend reaching out to your accountant prior to creating an adjusting entry since this will affect your financial reports.

You can always add another reply below or post another question if you need anything else.

And what would the journal entry be? I know how to deal with this if I have a customer name or if the issue were this year but as this is an amalgamation of several entries in the past, what is the entry to make so that I don't change the reports in previous years?

I am having a similar problem, but the problem is clearly that there are hundreds of old missing invoices, so as a result there are a bunch of unapplied payments that were previously applied. Is there any way to get them back??

Glad to have you here in the Community, @brookermans.

I'm here to ensure you can apply the unapplied payments to your old invoices.

One of the possible reasons why there are unapplied payments is that the invoices were deleted. Let's run the Audit trail report to verify. Here's how:

If the missing invoices were deleted, you have to recreate them and link the unapplied payments. To link them, you can follow the detailed steps provided by my colleague GlinetteC above.

If the invoices weren't deleted, you want to run the Customers & Receivables report. This way, we can verify if the payments were just unapplied.

Just in case you encounter a difference in the A/R balance in the Chart of Accounts and A/R balance on reports, feel free to check out this article for more details: AR balance on the Chart of Accounts does not match AR balance on reports.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

Thanks for responding. When I do the audit trail, I cannot find Transaction Type.

Regardless, I am 100% sure the invoices are missing. I know how to recreate and apply, but there is a mass amount missing. And WHY are they missing?

Thanks

Thank you for reaching back out to us, brookermans. If you cant find Transaction Type from the Filter tab, use the search engine and type transaction, and it will display Transaction Type. If you notice a mass amount of transactions missing, I recommend running the verify and rebuild tool to see any data issue with your program. Here's how to run the Verify tool:

Depending on the size of your company file, the process may take some time to verify. Once the tool is finished, if you received a message other than "QuickBooks detected no problems with your data," you will need to run the rebuild tool to correct data issues. Here's how:

You will receive a list of information about things that the tool has repaired. Simply run the verify tool again to check for the remaining data damage. Once you receive that message that I mentioned before with the verify tool, go back and see if you can locate those missing transactions. For more information about verifying and rebuilding data in QuickBooks Desktop, I recommend that you review this article to keep up to date.

Please let me know how this goes. I will be looking out for your response. Know that the Community and I will do our best to assist you. Until then, have a lovely afternoon.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here