Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I use QBO Plus for a Coffee Roasting Company.

I purchase Un-roasted coffee and then Roast it and package and label and then sell.

How would I use Inventory to keep track of Un-Roasted coffee counts. Then also keep track of Bags and labels as part of the finished product ?

Example. Un-Roasted Coffee COST = $3. Product Bag COST = 50 Cents, Label Cost = 10 cents. Finished COST = $3.60

Would I create Inventory for the Un-Roasted Coffee. Non-Inventory for the bag and label. Then use Bundle to create the Finished Product ?

Solved! Go to Solution.

Hello there, @seion,

You can either sell the item separately or in bundle. The inventory COGS is affected when you sell inventory items on invoices and sales receipts.

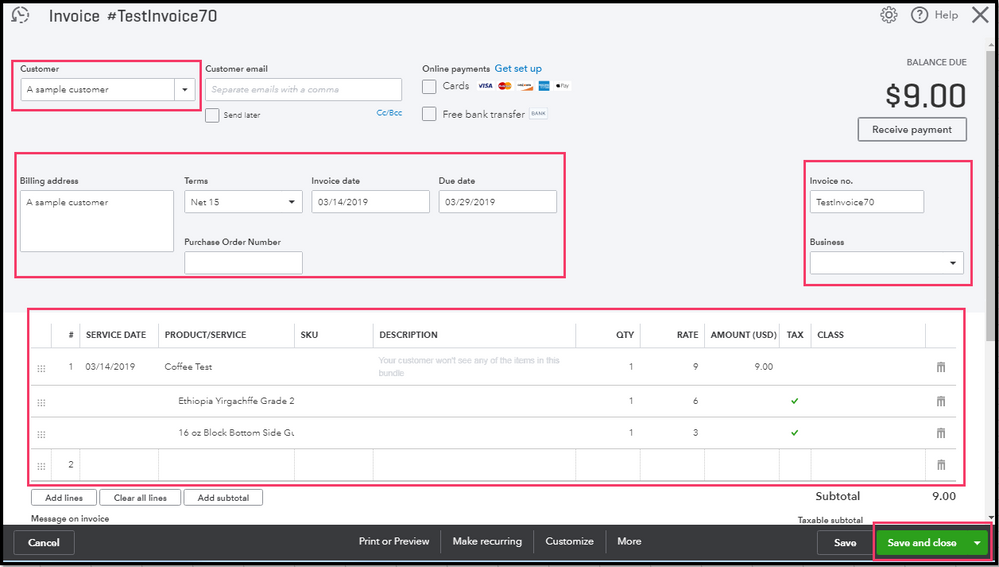

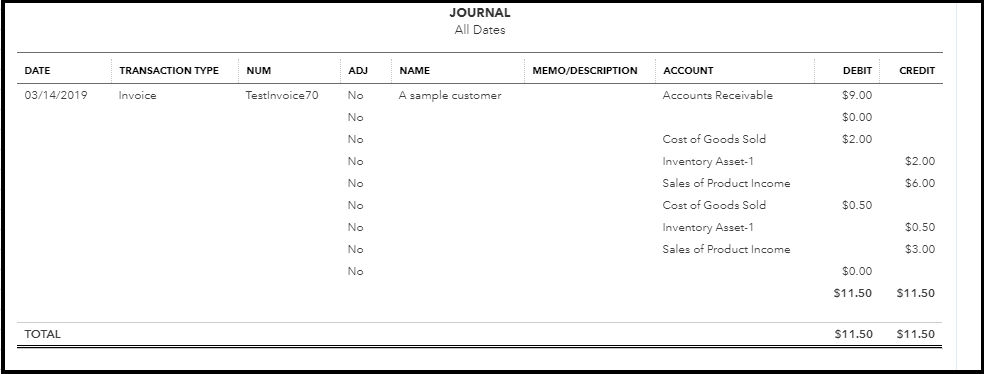

When creating an invoice or sales receipt, run the Transaction Journal Report to see the Sales/Accounts Receivable and Inventory/COGS transactions. This credits the Inventory Asset account and debits the COGS account.

To create an invoice with the bundle item:

For additional information on how QuickBooks handle COGS, please check out this article: Understand Inventory Assets and COGS tracking.

Also, I've added a video tutorial to help you setup an inventory product in QBO.

This will answer your concerns for today.

Feel free to leave a comment if there's anything I can help you with the inventory tracking in QuickBooks. I'd be glad to help.

Yes, you should create a unique inventory item for un-roasted coffee so that you can track this inventory separate from your finished good (roasted coffee). In theory, only the roasted coffee is sold to customers, so it should have it's own unique inventory item setup that is used on your customer invoices. When you purchase un-roasted coffee you should use that item on your vendor bill or expense entry, this will put the quantity into inventory. You will have to do a manual inventory adjustment to move inventory from un-roasted to roasted coffee that is for sale to your customers. The bags and labels can be setup as non-inventory, but they are also COGS (cost of goods sold)

Would the label and the bag and the roasted coffee be bundled and sold or would they be separate and the labels and the bags just hit the COGS account?

Here is what I got so far.

Hello there, @seion,

You can either sell the item separately or in bundle. The inventory COGS is affected when you sell inventory items on invoices and sales receipts.

When creating an invoice or sales receipt, run the Transaction Journal Report to see the Sales/Accounts Receivable and Inventory/COGS transactions. This credits the Inventory Asset account and debits the COGS account.

To create an invoice with the bundle item:

For additional information on how QuickBooks handle COGS, please check out this article: Understand Inventory Assets and COGS tracking.

Also, I've added a video tutorial to help you setup an inventory product in QBO.

This will answer your concerns for today.

Feel free to leave a comment if there's anything I can help you with the inventory tracking in QuickBooks. I'd be glad to help.

In my opinion, the labels, bags and un-roasted coffee are COGS and not sold to the customer. The product you sell is the roasted coffee, and the un-roasted coffee, bags and labels are the cost of goods sold, or cost of sales for your roasted coffee. It does not make sense to include those COGS items on your customer invoices, either separately, or in a bundle. Less is more when you are presenting your invoices to your customers. You don't want to give an impression to your customer that you are charging them for "everything". It would be better to have a "right-priced" finished good on your customer invoice, meaning that you have included your costs into the price and are making a profit.

There are really 3 options to do it.

Before going into the options, it is important to understand that expenses (i.e. COGS) can only be recognized at the time of sale (when you get the Income). This is called the matching principle in accounting and enforced in (most likely) every accounting standard like GAAP, IFRS.

Simply speaking, this means that "unroasted coffee" is not an expense, but an asset. And once it is roasted, the "unroasted coffee" will be converted to "roasted coffee", from the raw materials to finished goods, which is still an asset, but another item (which could possibly include direct expenses made for roasting, i.e. unroasted coffee becomes more valuable (i.e. manufacturing is adding value to products)). And when roasted coffee is sold, the value from the asset account is debited to the expense (COGS) account.

So, the options:

Option 1. Not tracking inventory (by piece) and using manual journals.

(Or another workaround, which gets the same result, without using manual journals)

Option 2. Using Bundles.

This allows to credit the raw materials (unroasted coffee). But does not allow you to track the value of roasted coffee. I.e. bundles do not understand that you could roast the coffee and sell it at a different time, the functionality presumes that until the instant you sell the roasted coffee, you still possess the unroasted coffee.

Option 3. Choose an inventory or a manufacturing app, that can do it.

In the QuickBooks app store there are inventory apps that support light assembly (simply converting raw materials into finished goods), and several apps for manufacturing (in addition, calendar and capacity scheduling, MRP, shop-floor control, FIFO), like MRPeasy, depending on depth/complexity required. They sync automatically with QBO.

Hi there,

It’s been suggested already, but perhaps the easiest way of doing this could be to list everything as an individual item and bundle them together when selling. Although, this might appear on the customer's receipt too so be warned.

Alternatively, since QuickBooks isn’t the very best for manufacturers looking to track raw inventory and manage production, you could take a gander at the QuickBooks Appstore for a solution?

For example, Katana is an inventory management software that can integrate with your QuickBooks Online account which can bridge the gap when it comes to managing production, scheduling, handling manufacturing orders, converting raw material into finished goods, and calculating manufacturing costs, all automatically.

Hi,

I just came across this feed and I am having the same problem with QB Online.

So to clarify in my own mind: you need one inventory for un-roasted coffee and another inventory for roasted coffee and then each time production is carried out, then you move the un-roasted coffee via a journal entry from un-roasted coffee inventory into the the roasted coffee inventory?

Hi,

I just came across this feed.

Could I keep separate SKU's for un roasted and for roasted coffee?

Hello there, @LUKE26. It's nice to hear from you.

Yes, you can. You'll only need to create a separate item for the unroasted and roasted coffee. This way, you'll be able to keep separate SKU's for the unroasted and roasted coffee.

These steps ensure to help you accomplish the process:

Repeat the steps above for the other item. To display the SKU column when creating a transaction, you'll need to turn on this function first. Here's how:

Also, journal entries won't affect inventory quantities in QuickBooks Online. To move inventory from unroasted to roasted coffee, you can do a manual inventory adjustment. This article will guide you with the complete information and steps on how to do it: Adjust inventory quantity on hand in QuickBooks Online.

You can check out this resource for additional insights: Add everything you buy and sell in your inventory into QuickBooks.

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

Hey Luke! I am having the same issue. Especially because when transferring unroasted coffee to roasted coffee there is approximately a 15% loss of coffee, so the "true cost" of your green coffee is different than the amount paid for the green coffee.

Have you been able to solve this issue?

Yes, you're the first one I see who mentions shrinkage. With some roasters you can loose as much as 25% in weight from green bean to roasted. I also haven't seen anyone address the issue of tracking quantities when you are keeping green beans and roasted coffee separate. You're going to end up with inaccurate quantities for both unroasted and roasted coffee (in fact, roasted coffee will always be negative) unless you set up an assembly.

Almost the same query here about food inventory: We manage multiple villas with only 1 kitchen supplying foods and beverages to these villas.

1. Is there a template that can we use to monitor the ingredients, price, etc. to calculate food costs/marked up? Ordering/provisioning etc.?

2. Can we also monitor/inventory plates, dinner forks, glasses? template?

3. Also, can we manage multiple accounts for :

- Kitchen

- Boutique

- Villas

- Activities/Tours

Dax

White Villa Resort

Consider having a kitchen management app to integrate with QBO.

Hello Dax,

Thank you for joining the thread. I would agree with Fiat Lux – ASIA's suggestion about finding a third-party app to manage your villas' transactions, inventories, and materials.

There are features in QuickBooks called Location and Class tracking. These can be used to track each villa's purchases and sales. Then, you can run reports like the Profit and Loss of each villa or store, or their sales and purchases.

However, the said features are unable to satisfy the other needs of your business, such as monitoring the price, markups, inventories of utensils, tools, materials, etc., as well as the accounts for each business, which you’ve pointed out in #3. This is like having different businesses within a business with their own set of accounts, reports, etc. I say this because I know how our software works and also care for your convenience and experience. That's why I agree with finding an app designed for hotels and resorts with complex tracking, transactions, and processes.

Here's how to find an app:

On the other hand, I'm also encouraging your to submit a suggestion about adding features designed for the nature of business you have.

Please don't hesitate to go back to this thread if you have other questions in mind.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here