I do appreciate that you've performed the steps on how to create pledges and the payment, Hcbb-treasurer-g.

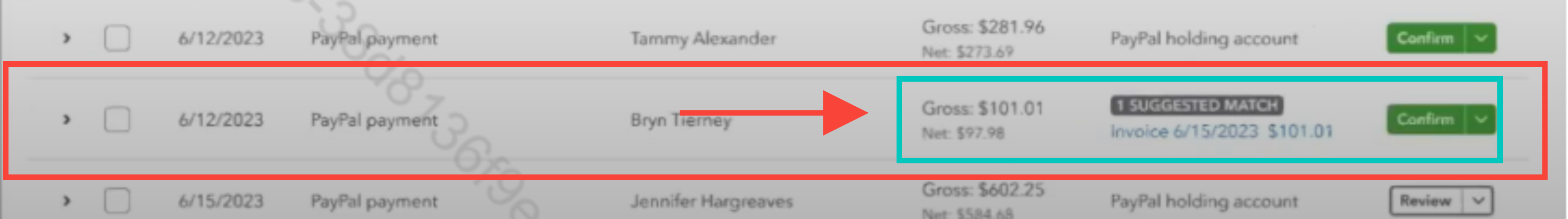

Please note that QuickBooks Online (QBO) can match invoices for up to 90 days from the original invoice date, using details like name, amount, and date for accuracy. This feature enhances flexibility and convenience when managing transactions.

For incoming PayPal transactions, you can match products and services that align between QuickBooks and PayPal to prevent duplicate inventory tracking across both platforms.

If customers or donors make a single PayPal payment for multiple items, open the transaction in QBO and use the Split option to break down the payment into components such as transaction fees, donation/event fees, or other purchases. Be sure to assign each element to the appropriate account or invoice for precise tracking and application.

To learn more about managing PayPal transactions, refer to this resource: Use the PayPal Connector by QuickBooks app.

Also, consider consulting a qualified accountant or using our QuickBooks Live Expert Assisted service. They can review your entries to ensure accurate financial records.

You can always get back to this thread if you have any further questions about managing your PayPal transactions in QuickBooks. The Community is here to help.