Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi all, we run a small security training and consulting business and we travel to multiple locations to provide training. Our courses range from 5 to 20 private, unrelated clients approximately, who pay us separately for our fees. We recently started using QBO and wanted to know if it is possible to link a project to multiple customers as opposed to only one.

Thanks!

Hi gschon,

The Project feature in QuickBooks Online is intended to only one customer that has multiple services. You'll want to use the class and location tracking feature to monitor the income and expenses, then run reports for different class and locations of your business.

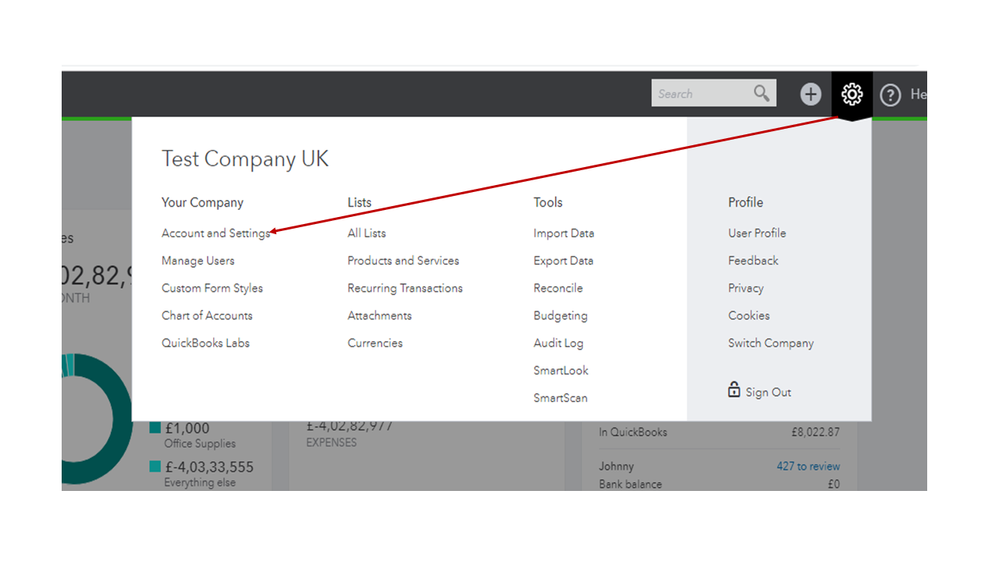

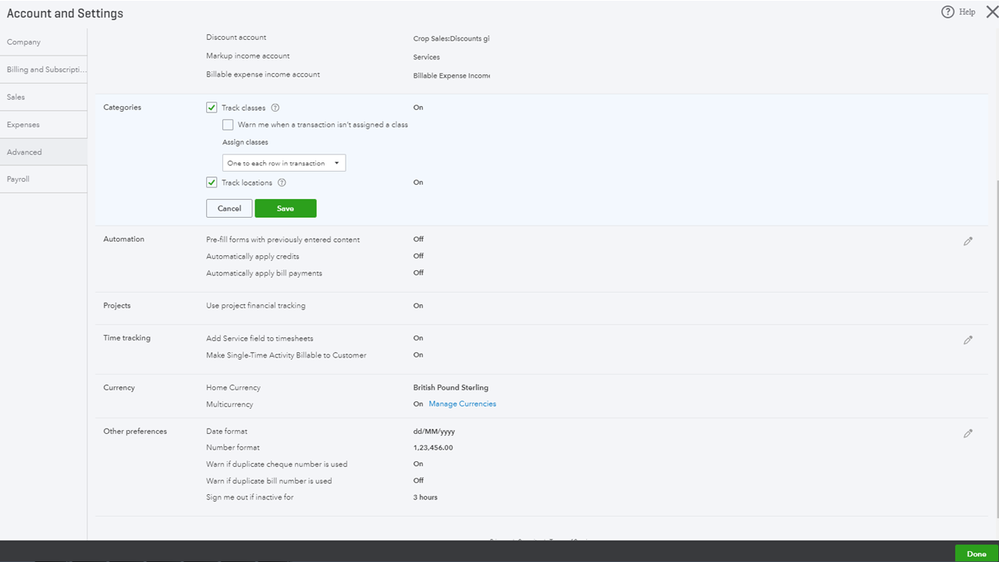

Here's how to turn them on:

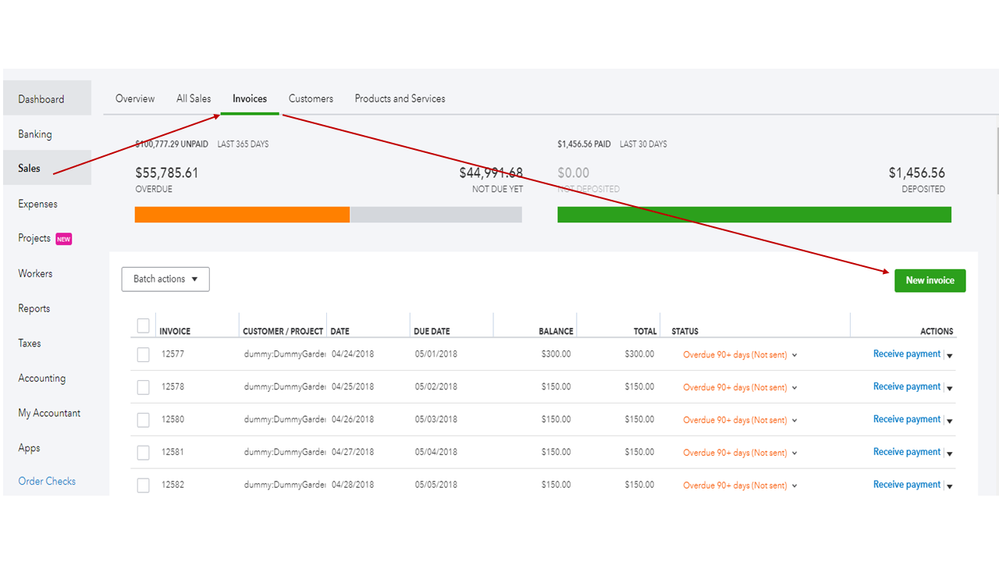

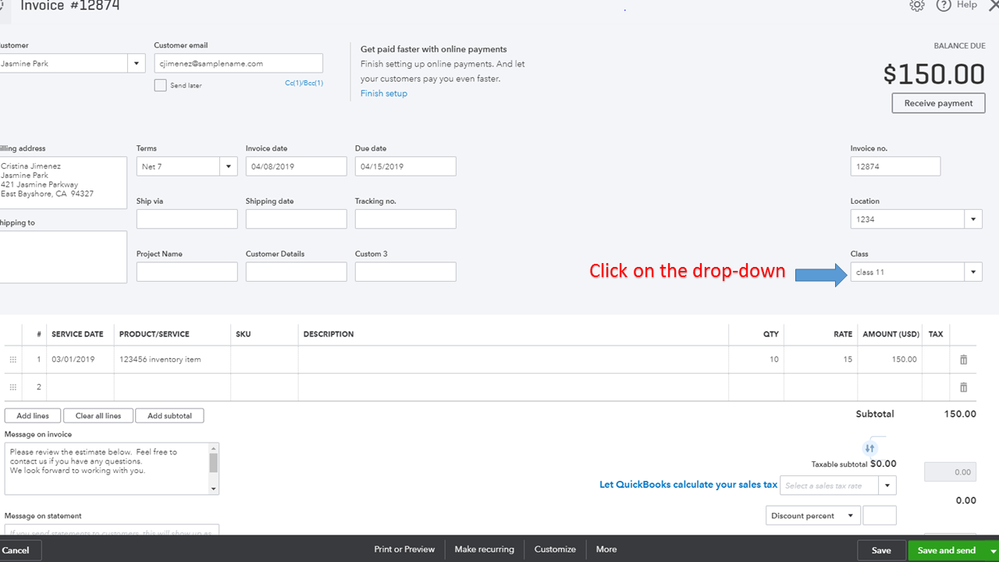

Once done, you can use this feature when creating transactions for your customer.

Also, here's an article that you can read on: how set up and use class and location tracking.

Please let me know if you have additional questions. Have a good one!

Now that Classes + Locations are limited to a total of 40 for QBOPlus users, how can I use QBOPlus to create a separate "project" that can receive donations from multiple donors?

Hello there, @MWT.

Let me share additional information on how you can track donations received from multiple benefactors or donors a specific project.

Yes, one project is good for one customer only. However, you can consider each project you have as a parent-customer. Then, record each donor of the project as a sub-customer.

Here’s how:

The other way to track donations from multiple donors is to create a separate Project per Customer.

Here's how:

For additional insights, you may check out these articles:

Keep us posted here in the Community on how it works on your end. I'm always here to answer your inquiries about using the project feature in QuickBooks Online.

Will this allow reporting that can be used for my Statement of Functional Activities as required by the IRS? If so, would you explain how I get that? The Classes allowed reporting across the entire Chart of Accounts, but Projects & Sub-Customers don't appear as robust, at least not at first glance.

Thanks for getting back to us, @MWT.

I appreciate you running a classes report to reflect your chart of accounts, projects, and sub-customers.

I’m here to help find a report that you can use for Statement of Functional Activities reporting to IRS.

Just to confirm, are you referring to the Statement of Functional Expenses on the Form 990? If so, you can use the Project Profitability report per donor. This report will help you determine if you’re making or losing money on each individual project. Here's how:

After running the report, you'll be able to start tracking the income and expenses for your projects.

To learn more about this feature to help you assist with running your business smoothly, you can check out this helpful article: Track Projects. For more information about the Statement of Functional Expenses, please visit the IRS instructions.

If you have other concerns, don't hesitate to click the Reply button. I'll be more than happy to help. Have a good one.

Hi - Thank you, yes, I am referring to the Statement of Functional Expenses. My goal is to be able to report the Statement according to each "Program" run by the Non-Profit organization, (e.g. , the program of finding "Student Pamphlet Sponsors" takes place at different times across many different schools & events and also receives funds from many different Donors, not just a single Donor.) The organization's accountant has told me to use your "Classes" to do this, but I'm unsure how to handle your new limit of 40 classes. Do you still think the "Project" methodology is the appropriate one to use?

Thanks for the reply, MWT.

Allow me to chime in and provide some additional information on how to track the organization's program and transactions.

Your accountant is correct. The Class feature lets you track account balances by department, business office or location, or each program.

This option is only available if you have the QuickBooks Online Plus version. If you have more than 40 classes, you may want to consider upgrading your current subscription to the QuickBooks Advance version.

This way, you can continue using the Class feature seamlessly. Let me walk you through the process on how to turn this option in your account.

Here's how:

Click on Save and Done.

After completing the process, you can now add this information when creating transactions. I'll show you how:

To get the data you need for your Statement of Functional Activities, you can open any of these reports in QuickBooks. Just go to Reports on the left panel, then enter the name in the search field.

This information should point you in the right direction.

If you have additional questions about QBO, please know I’m just a comment away for help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here