In QuickBooks Online, clearly see which projects make money and which ones break the bank. Works best with QuickBooks Payroll and QuickBooks Time.

Keep project costs on track with QuickBooks Online

Available in QuickBooks Online Plus and QuickBooks Online Advanced

Control Costs

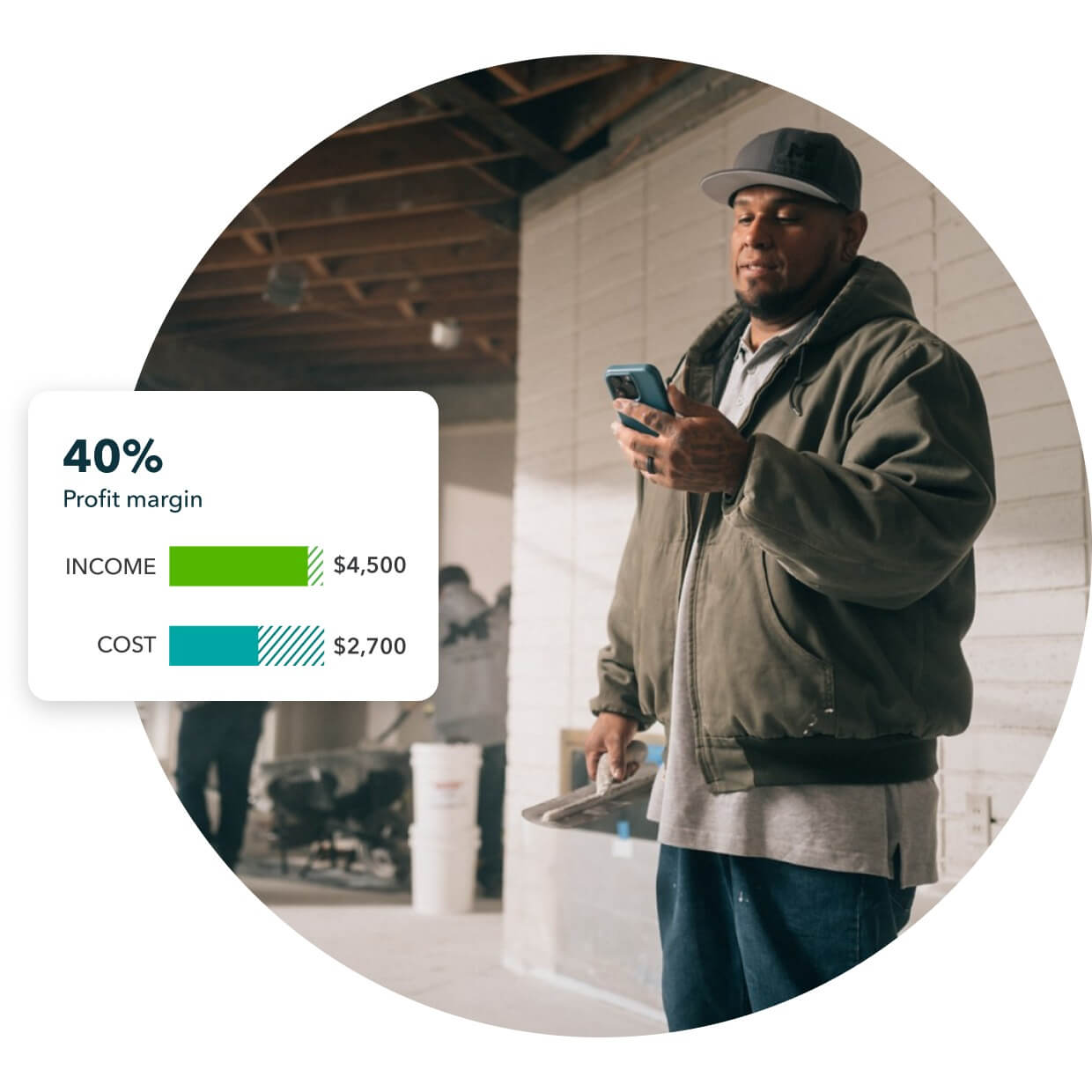

Clear dashboards and reports help you see if your income exceeds your costs.

Instant insights

Profitability insights are one click away with automatic updates when you connect with QuickBooks Payroll and QuickBooks Time.

Maximize profits

See where profit is trending project to project to make smarter business decisions.

Profitability at a glance

Get a bird’s eye view of all your projects, all in one place. Know exactly which projects are profitable and which are costing you money.

Cost tracking calculator

Assess costs on the spot to see if you’re on budget or if you need to adjust. Get profitability insights in real time for each project.

Works with QuickBooks Payroll and QuickBooks Time

Spend less time crunching numbers when you connect QuickBooks Payroll and QuickBooks Time time tracking. With this powerful integration, labor costs and expenses are automatically updated for you.

QuickBooks Time time tracking and Payroll are available to purchase with your QuickBooks Online account.

Flexible QuickBooks Online plans to track job costing and project profitability

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

How to boost your profits with job costing and profitability tracking

By Penny Lane

For project-based businesses, tracking and analyzing the profitability of a job at the project level is critical. If you have a project-based business such as contracting, interior design, architecture, and the like, you know projects can vary widely in scope and complexity. Whether you’re entirely confident or more on the cautious side when engaging with clients on certain types of work and bidding on jobs, variances and unknowns are likely to crop up during projects. Additionally, projecting what it might take in time and costs to complete a job up front can be challenging.

Manage cost overruns

Job costing and profitability tracking can be a powerful tool when it comes to managing things like job cost overruns. And it can help you reflect when it comes to bidding on and accepting future jobs.

In addition to identifying and mitigating very specific profit leaks and providing solid information for future jobs, project-level job costing and profitability tracking is the proof or reference you need to understand whether the markup you're charging or profit you're making on jobs is being realized overall and is ENOUGH to support your business.

When it comes to job costing and profitability tracking, the amount of detail you choose to track is up to you and may be unique to your industry or business. When I work with clients to set up their job costing system, we usually start with their detailed take-off estimate. Then we consider what estimated-cost-versus-actual-cost detail will be the most valuable for managing the job in progress and analyzing the accuracy of their estimated costs after the fact.

Examples of profit leaks:

A building contractor who notices framing labor costs are already at 50% of the budget, but the framing labor is only 30% complete. Now is the time to step in and attempt to mitigate this overage.

An interior designer who notices the cost of the drapes are much higher than anticipated and realizes a customer wasn't charged for the upgrade.

An architect working with a new client that adds last minute changes to the layout. The architect spends time on the iterations and notices that the updates will create additional costs and require more of his time.

Discover tools to streamline day-to-day cost tracking

Consider the practicality of tracking costs to the desired detail level as they come in. For some businesses, cost tracking is as simple as labor and materials. For others, it may be important to track to the individual parts. Some businesses even have a mix of projects and tracking levels depending upon the size of the job.

If you feel overwhelmed by the concept of implementing a job costing and profitability tracking system in your business, there are many tools available to help you streamline day-to-day cost tracking. There are also many professionals available to help get your systems and workflows in place. I have helped hundreds of businesses set up their job costing systems. It’s always less painful than expected, and clients are ALWAYS amazed and empowered by the insights provided by their job costing reports.

How to cost your jobs appropriately

By Megan Sullivan

The overall success of your business is directly tied to profit and loss. This relates not only to securing enough business to pay your bills and expenses but also has to do with pricing and costing your jobs appropriately.

Job Costing is a process that takes into account the three main elements of a job: labor, material, and overhead. Let’s examine the different aspects of job costing, why it’s important and how doing it correctly can prevent you and your business from losing money.

What is Job Costing?

Job costing is the act of figuring all the different costs associated with a job or project to

determine its profitability. The most common costs to be calculated are:

Labor: This relates to the costs associated with the employee(s) who will be directly working on this specific job. Calculate their hourly rate and multiply that by the estimated hours for the job to be complete.

Materials: Every job will require a commitment of physical materials (we’ll discuss job costing in other industries in later articles). These materials come with a non-negotiable cost that will be spent per project.

Overhead: Overhead refers to all of the general “doing business costs” that you associate with running your business on a daily basis. These could include rent, business insurance, accounting, billing, and office equipment.

Five tips so you don’t lose money

Let’s examine the different aspects of job costing, why it’s important and how doing it correctly can prevent you and your business from losing money.

1. Include any incidental charges when calculating labor costs

Let’s assume you pay one of your contractors $75/hour. If you estimate that a particular job will take six hours, the labor cost would be $300, right? Not necessarily.

Consider any of the other costs for which you reimburse that employee. Do they receive a mileage reimbursement? What about a per diem or a spending account for incidental project needs? These costs can quickly add up and add a few hundred or thousands of dollars to your project.

2. Overestimate within reason

Have you heard the old adage “under promise and over deliver”? In simple terms, it means telling your client you’re going to do only the work you’ve promised, and then exceed those expectations. If you’ve estimated that a job will take 10 hours and it only takes 8, that’s a positive over delivery and cost savings. Plus you get the added bonus of your client thinking you are a miracle worker.

Overestimating also enables you to account for slight setbacks within a project, that you may not anticipate. Having a cushion built into your job costing estimate means you can absorb these hiccups without having to re-approach the client to ask for more money.

3. Make a careful accounting of your overhead costs

It’s easy to overlook overhead costs. They are typically such an integral part of your business that you just ignore them. When costing out a job, it’s better to take a more accurate accounting of these costs. As mentioned above, overhead costs cover a wide range of areas that you probably don’t think about on a daily basis.

Make sure to consider the following when calculating overhead costs:

- Rent

- Administrative Assistants

- Office Utilities

- Insurance

4. Compare like jobs to one another

A good way to know that you’re charging the appropriate amount for your work is to compare like jobs to one another. Let’s say you have two kitchen renovations that you do within a year. When getting ready to cost out the second project, take a look at the first.

Compare your initial estimate for the first job to the actual costs. How close were you? What were the hidden costs you didn’t anticipate on the first go around? Take all of these costs into account when calculating the estimate for your second job.

One caveat: this assumes that the two renovations projects are similar in size and scope. If one project is markedly different than the other than a straight a comparison may not be as helpful. However, you could still use the final costs from one project to extrapolate data for the second.

For example, if your first renovation project was a for a kitchen measuring 1,000 square feet, but the second project is for a kitchen that measures 2,000 square feet, a good way to start your estimate might be to double the costs from the first project. Fine-tuning may be needed, but this is an initial place to start.

5. Pay attention to job timelines and deadlines

Job costing can enable you to keep your jobs on track from both a timing and pricing perspective. By having a good account of how much a job and the materials will cost before it begins, you’ll be able to track these costs as the job progresses.

This process can also enable you to bill throughout the project, allowing you to maintain a steady cash flow while the project is in progress, as opposed to waiting to bill until the entire project is complete.

Keeping track of these job costs and timing will require some minor monitoring of the project as it goes along. But that’s why you figured in those overhead costs; so you can ask your accounting department to keep track throughout.

For different industries, job costing requires different considerations. Job costing a construction project includes different variables from costing a web design job. QuickBooks will explore the nuances associated with these different industries in the coming months to provide you with more in-depth insight into this process.