Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow to record a purchase of a computer and a trailer that was purchased for the business from personal checking and credit card account? This was purchased for the business before we had a business account. I know I will set up an asset account for each, but I'm confused as how to record for the personal checking and credit card that was used.

Thank you!

For a company taxed as a sole proprietor (schedule C) or partnership (form 1065), I recommend you have the following for owner/partner equity accounts (one set for each partner if a partnership)

[name] Equity (do not post to this account it is a summing account)

>> Equity

>> Equity Drawing - you record value you take from the business here

>> Equity Investment - record value you put into the business here

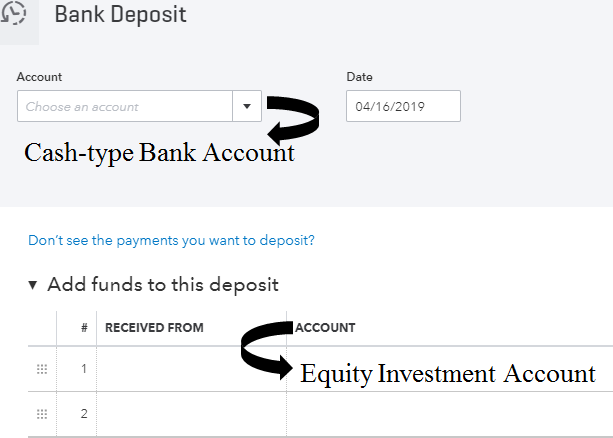

make a deposit in the cash type bank account = to the total paid, use the equity investment account as the source account for the deposit

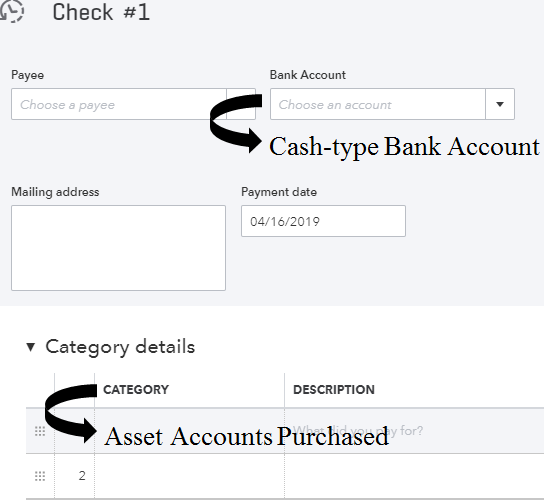

Pay for the two assets from the cash type bank account

Sorry, I'm still learning Quickbooks and not following what you mean by:

make a deposit in the cash type bank account = to the total paid, use the equity investment account as the source account for the deposit

Pay for the two assets from the cash type bank account

Any clarification would be appreciated.

It's nice to see you again, @r_max!

You can deposit the funds to your cash type bank account. Allow me to join into this conversation so you can record the assets you purchased.

In addition to @Rustler's solution, here's how you can make a deposit:

Once completed, you can pay your purchased asset by writing a check. Here's how:

This way, you can record all transactions of your purchased assets.

In addition, here's a couple of articles you can read to learn more about creating a deposit and writing a check:

It'll be always my pleasure to help if you have any other questions.

@r_max wrote:

How to record a purchase of a computer and a trailer that was purchased for the business from personal checking and credit card account? This was purchased for the business before we had a business account. I know I will set up an asset account for each, but I'm confused as how to record for the personal checking and credit card that was used.

Thank you!

I would create a Journal Entry:

Debit Fixed Assets, if you want to classify the purchases as fixed assets, or expense type accounts if not,

Credit Owners Contributions - equity type account, if this is a sole propietorship or partnership, Shareholder Loan Account if a corporation

How does one record a similar transaction if it is incorporated (Canadian business here - the canadian forums are really quiet, sorry) with multiple partners?

I already have partner's equity accounts set up for expenses, but am looking to record multiple asset purchases (furniture, computers, headphones, microhphones, podcasting gear etc.) through this method.

I'm not sure I follow what steps I need to take, since no money actually entered and exited the bank accounts here, but the assets need to not only be recorded, but also reimbursed to partners.

You need to set up an ACCOUNT usually called/named "Furniture & Fixtures" which needs to be an FIXED ASSET type of account so you can post/allocate - Here in NC anything under $2500.00 now goes into EXPENSE type of account so it's a right off not an asset that gets depreciated.. you need to know the limit in Canada...

For example I bought 2 items; Computer paid $2600.00 and Office Chair $1000.00 (here's how to post them)

(account) General Bank (type of account is BANK). CREDIT $2600.00

(account) Furniture & Fixtures (type of account FIXED ASSETS) DEBIT $2600.00

Always have to balance out... now here's the next posting;

(account) General Bank (type of account is BANK). CREDIT $1000.00

(account) Office Supplies (type of account EXPENSE) DEBIT $1000.00

Can you tell me what a "Summoning Account" is? Thank you for your time.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here