Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I have 2 STL accounts. One with an asterisk before it and the other one not. Both have same name. My memorized transactions which are invoiced monthly with sales tax post to the one account with the asterisk and the imported transactions post to the other account. My data has been verified.

My imported data identified and apparently created the second Sales tax payable account. I've corrected it in the 3rd party software to import into account with asterisk. How do I blanket change those imported transactions to record to the *Sales tax payable account?

Your answer is most appreciated. -Susan

Hi there, @Susan607.

You can change the Account name of the imported files from your new Sales tax payable account to your old *Sales tax payable account by going to the

register of the newly created account. I'll show you how:

For future reference, you can also check QuickBooks for Mac Manual to help you how to transfer transactions if it has already been reconciled.

Please don't hesitate to comment below if you need anything in regards to QuickBooks. I'll be here to help. Stay safe out there!

Thank you Stephanie. I do know how to change the account names. My difficulty is updating all the reconciled transactions with the old Sales Tax Payable account to the default account *Sales Tax Payable. I've too many transactions imported to the old Sales Tax Payable account to do manually.

I there a way I can update all those transactions to be recorded to the *Sales Tax Payable account. Currently I have these two accounts listed on my balance sheet. Thank you for your help with this. It's greatly appreciated. -Susan

Thanks for your prompt response, @Susan607.

Make sure to edit the transactions, change the Sales Tax code that you use if you wish to allocate it on the correct sales tax account.

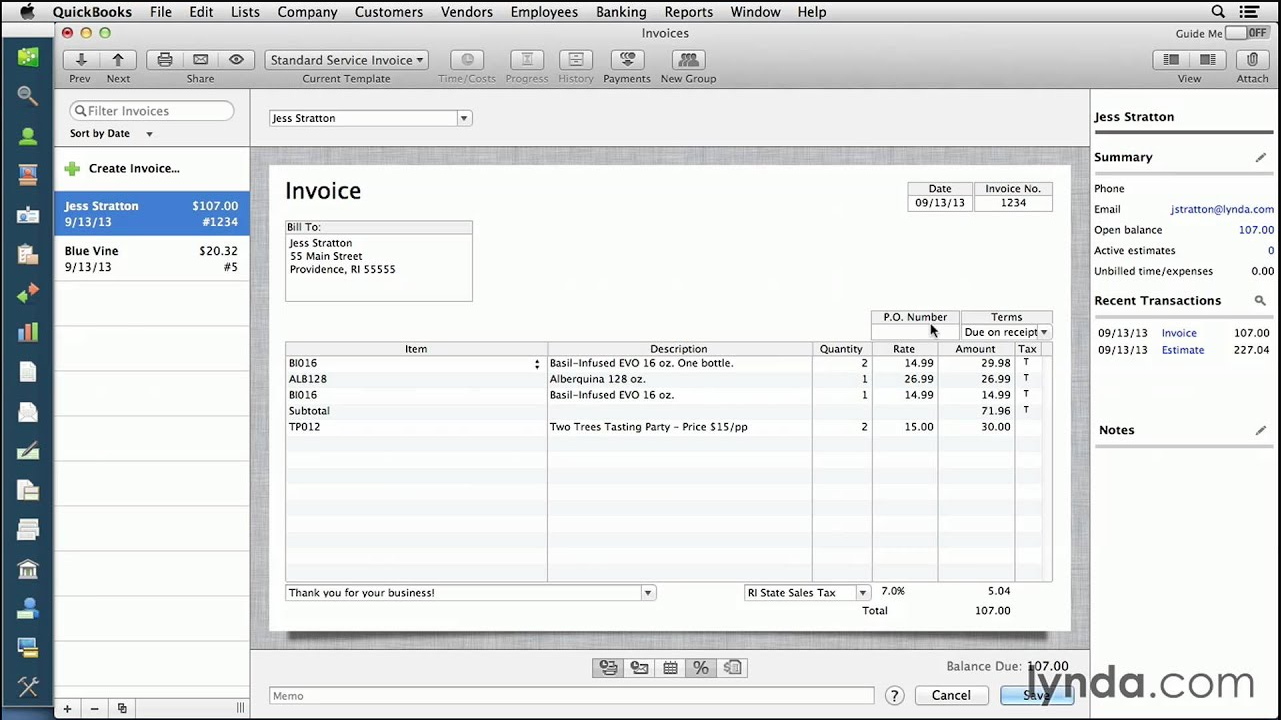

I've added screenshots below to get the transactions and future transactions posted to the right sales tax account.

For additional reference, you can check this article for detailed steps about importing transactions. On your keyboard, press Ctrl + F and search for the Importing items in batches to easily find the topic: https://qblittlesquare.com/wp-content/uploads/2018/09/QuickBooks-for-Mac-2019-1809.pdf. Make sure to allocate each sales taxes when you're done importing the transactions.

To learn more about keyboard shortcuts and what lists and transaction types you can import into QuickBooks, please check these articles for future reference:

Please feel free to place a comment if you have more questions. I'll keep my notifications open. Stay safe and well!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here