Hello, Barbara. When sales tax fails to calculate, it often stems from a configuration in the sales tax item settings. Reviewing and confirming these settings is the best way to identify and resolve the issue.

Before proceeding, please ensure that your QuickBooks Desktop is updated for optimal performance and that the Sales Tax feature is enabled.

Here are detailed steps for reviewing the Sales Tax Item:

- Go to Lists on the top menu, then select Item List.

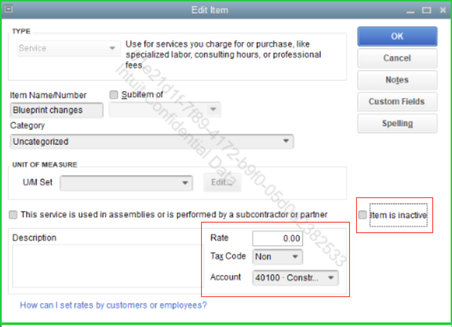

- Look for the sales tax item and double-click it to open the Edit Item window.

- Review or confirm the following details:

- Type: The item type should be set to Sales Tax Item.

- Tax Rate: Verify that the sales tax rate matches what you intend to use (e.g., 10%).

- Double-check that the item is not set to Inactive, as this can prevent the sales tax from appearing on your transactions.

After that, please verify the Tax Code in the Sales Tax Code List to ensure it's correctly assigned to the sales tax item, as this determines whether the customer and related transactions are taxable or non-taxable.

I’ll keep this conversation available for any follow-up updates or questions.