Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe are a for-profit company that is receiving donations for a memorial fund that will be used as a scholarship fund for the employees. How do I record the income - receive payment - and tag it as a scholarship. How can I keep a running balance to know how much is still available? Using Quickbooks Desktop. Thank you for any direction provided!

Solved! Go to Solution.

I'll be helping you record this transaction, @LSC2.

You can create the memorial fund as a customer. This will make sure that the money you receive came from the memorial fund. Then create a service or non-inventory item for the Scholarship and account for this as income to post the money from there.

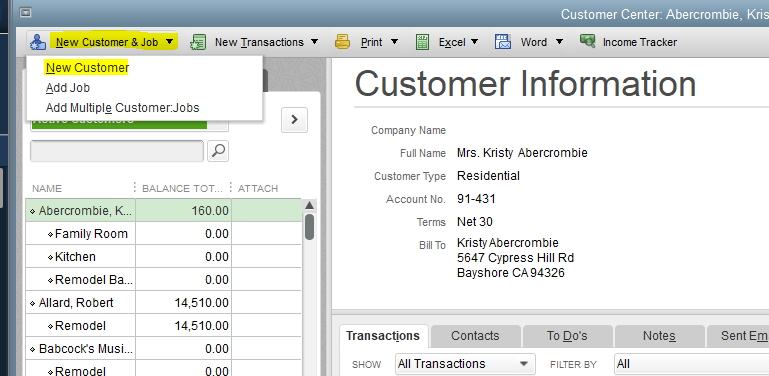

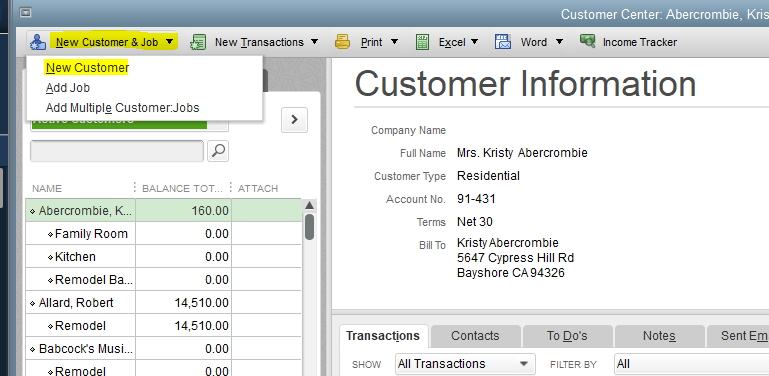

Here's to create a new customer:

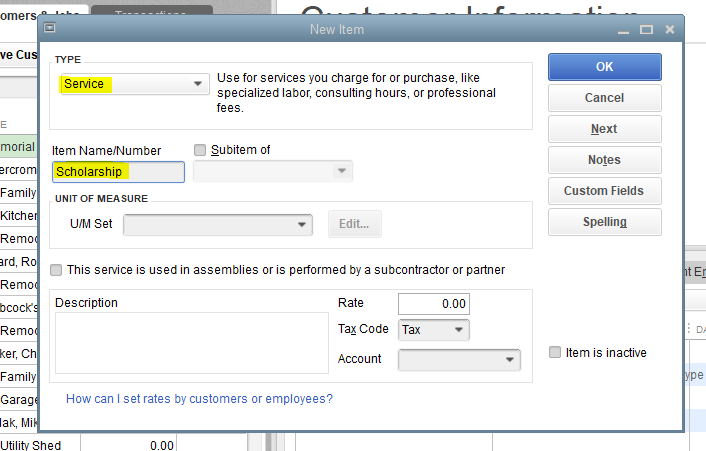

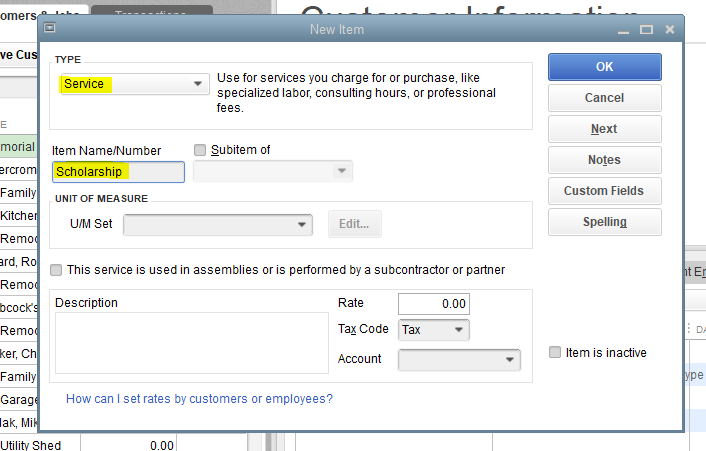

Then follow these steps to create a service or non-inventory item:

Once done, create an invoice and then choose the customer (memorial fund). Then add the service or non-inventory item (Scholarship) and enter the amount.

Lastly, received the payment from the memorial fund.

When you need to use the scholarship fund for employees, simply create the bill/check and use the account Scholarship Fund.

Once done, run the Profit and Loss report to know the running balance of Scholarship Fund.

You'll want to drill down reports and see specific accounts only, you can customize the reports anytime and memorize them so you won't have to customize them again in the future.

I’ll be around if you have other concerns or questions about recording transactions and running balances in QBDT. I’d be more than happy to assist you. Have a great day ahead.

I'll be helping you record this transaction, @LSC2.

You can create the memorial fund as a customer. This will make sure that the money you receive came from the memorial fund. Then create a service or non-inventory item for the Scholarship and account for this as income to post the money from there.

Here's to create a new customer:

Then follow these steps to create a service or non-inventory item:

Once done, create an invoice and then choose the customer (memorial fund). Then add the service or non-inventory item (Scholarship) and enter the amount.

Lastly, received the payment from the memorial fund.

When you need to use the scholarship fund for employees, simply create the bill/check and use the account Scholarship Fund.

Once done, run the Profit and Loss report to know the running balance of Scholarship Fund.

You'll want to drill down reports and see specific accounts only, you can customize the reports anytime and memorize them so you won't have to customize them again in the future.

I’ll be around if you have other concerns or questions about recording transactions and running balances in QBDT. I’d be more than happy to assist you. Have a great day ahead.

This worked great! Thank you so much for your help!

Hi! Can you clarify how to use the scholarship? I’m using QBO and it will be applied to the amount owing on an existing customer invoice. I’ve completed the steps above so I have a service and an income account. I’d like it to show as a negative amount (like a discount) on their invoice. Thank you!

Thank you for sharing the things you've done so far, @ForestPlay.

In QuickBooks, we're unable to enter a negative amount in invoice. What we can do is create a retainer process for your company.

Here's how:

1. Create a liability account.

2. Create a retainer item.

3. Create a trust liability bank account. (Optional)

4. Create Sales Receipt or Invoice for deposits or retainers.

5 Turn retainers into credits on invoices.

In addition, you can create an invoice after setting up the accounts and the retainer item, along with its negative value.

For more information on how to record a retainer, you can use this article for the detailed steps.

Furthermore, I highly recommend consulting your accountant to help and assist further regarding a workaround that includes a journal entry.

If you happen to have any other concern about managing invoice, please don't hesitate to contact us again. It is our pleasure to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.