Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, @NAYE1. I'm here to provide some information about the Subtotal field on the transactions form in QuickBooks Desktop (QBDT).

To fix this, let's first check if the items you add to the transaction form are taxable. To do so, we need to check its setup. Here's how:

Check to see if the Subtotal field will still include the tax. If yes, we can run the Verify and Rebuild tool to determine any data integrity issues and resolve them instantly. Refer to the steps below:

Verify data

Rebuild data

I've also added this helpful resource that you can access to get more information about managing your products and items in QBDT: Add, edit, and delete items.

I'm always here ready to help if you have any other concerns about managing your sales forms in QBDT. Don't hesitate to get back here in the Community. Have a good one.

What if the Subtotal option is not an item to select in the Footer? How can I add it?

Let's set up the Subtotal option so you can add the item to your transactions, CLN2. I'm here to help ensure the process is a breeze for you.

Here's how:

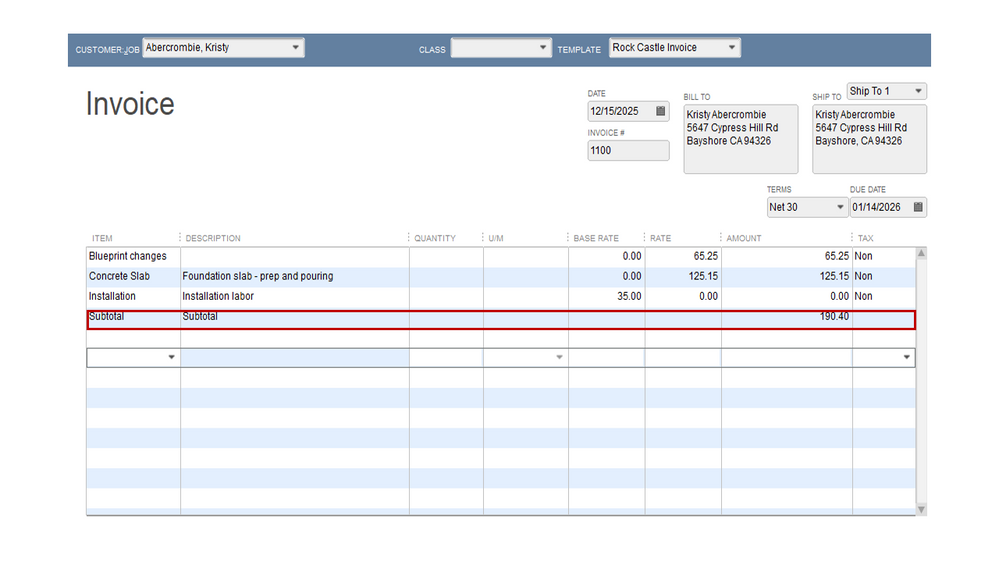

I've attached a screenshot for visual reference:

Next, create the transaction and place the Subtotal as a line item from there.

Furthermore, this reference will show you how to tailor the data, and add or remove information on the header and footer, to name a few: Customize reports in QuickBooks Desktop.

Keep me posted if you have other sales-related concerns or additional questions about refining the look of your sales forms. I'll get back to make sure you're taken care of.

3 Year later... Do you still believe that the Product Developer Team take the time to review every request and try to add them to the next available update? Because my understanding is that they don't care about feedback. If something so simple as to add the subtotal to the screen view takes so much time, i wonder if you really care about the needs of the users.

I have a similar issue and would like to add a parts subtotal on my invoices for items marked taxable.

I would like this subtotal to only add the taxable items prior to the main subtotal on the invoice. any help is appreciated.

Hey there, louie hyd. Let me share some steps on how to add a subtotal for your taxable items in QuickBooks Desktop (QBDT)

When adding a subtotal for your items in the Invoice transaction, ensure that you created a subtotal for your taxable and non-taxable items. Right after, you can add the percentage in the line item, and then next to it is the subtotal.

Here's how:

Step 1: Create a subtotal for your Taxable and Nontaxable item

Step 2: Add the Subtotal and Tax

Furthermore, you can also record an invoice payment when a customer pays you for an open invoice.

If you have further information or concerns, please enter it in the comment section. I'll be happy to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here