We can record them as bad debt and write them off, Julie

First, let's create a Bad Debts expense account (if not yet created):

- Go to the Gear icon and select Chart of Accounts.

- Click New to create an account.

- Choose Expenses for the Account Type and Bad Debts for the Detail Type.

- Name it "Bad Debts" and click Save and Close.

Then, create a non-inventory item as a placeholder for the bad debt. This isn't a real item; it's just to balance the accounting. Here's how:

- From the Gear icon, select Products and services.

- At the upper right, click New, and then Non-inventory.

- From the Income account dropdown, choose Bad debts.

- Tick the I sell this product/service to my customers checkbox.

- Click Save and close.

Once done, create a credit memo for that customer using the bad debt item:

- Click the +New button and select Credit memo.

- Select the customer and choose the Bad Debts item in the Product/Service section.

- Enter the write-off amount and save your changes.

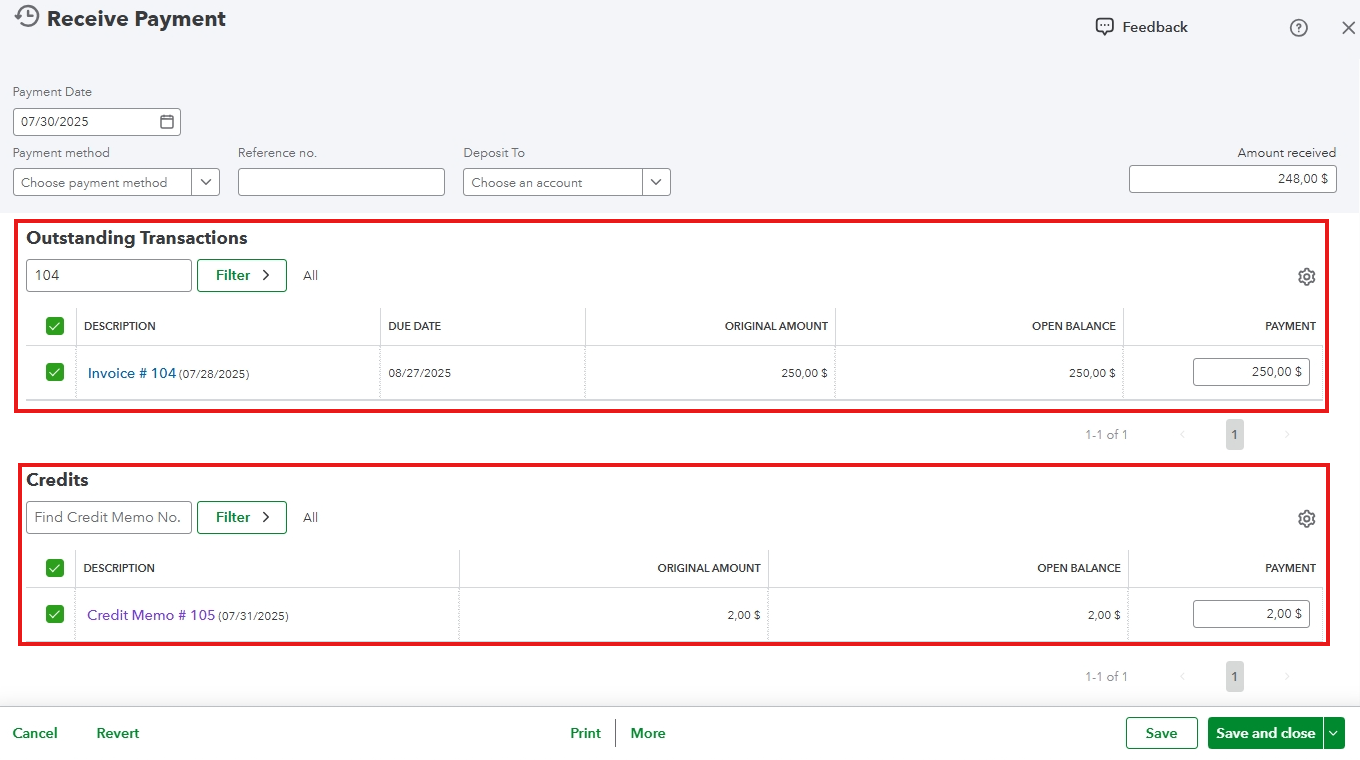

Let's apply it to the invoice by following these steps:

- Click the +New button and choose Receive payment.

- Select the appropriate customer.

- Locate the outstanding invoice and click on it, then apply the credit memo under the Credits section. See the sample image below.

- Select Save and close.

This process helps address minor underpayments quickly and efficiently, and you can maintain strong business relationships while keeping your accounts clean and accurate.

If you have more questions or concerns about QuickBooks, please leave a reply below. We'd be glad to further assist.