Hi there, Laurel_OR.

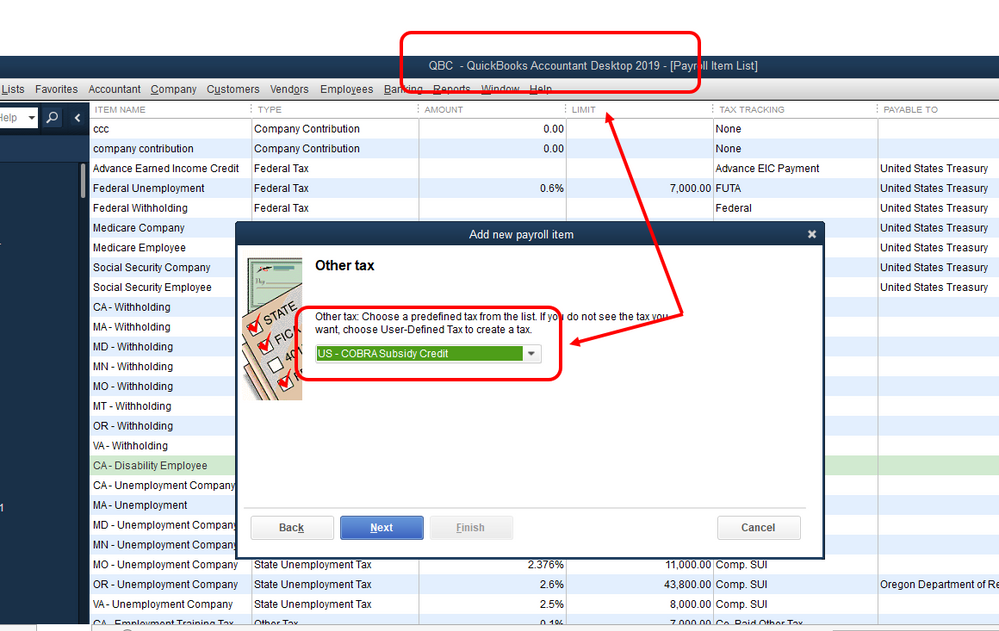

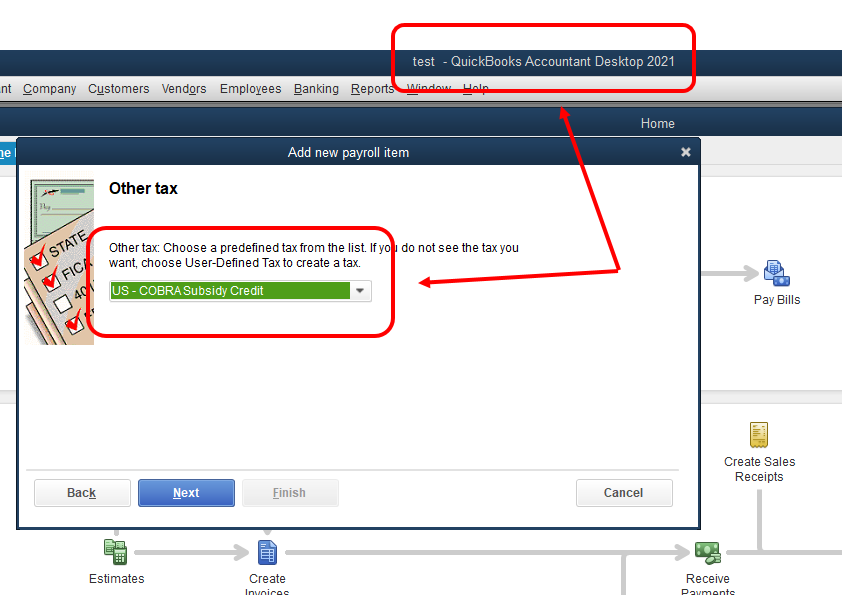

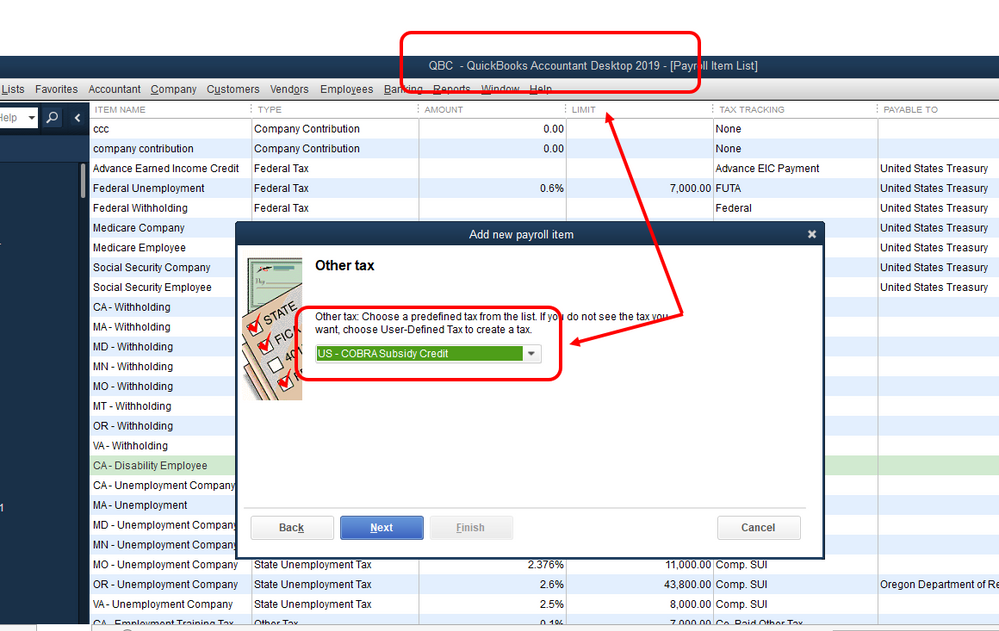

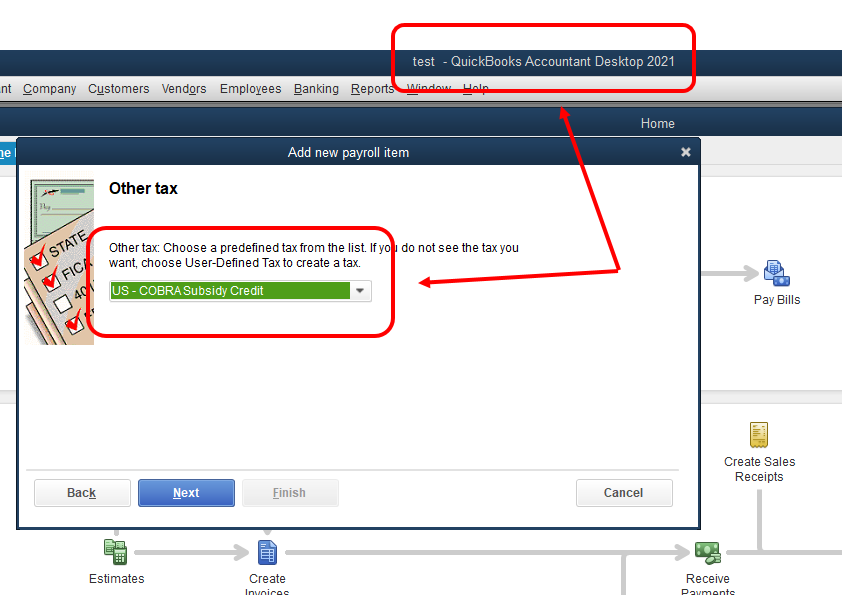

The US-COBRA Subsidy Credit is not only limited to QuickBooks 2021. It is also available in lower versions of QuickBooks Desktop similar to what you have. In fact, I tested it on my QuickBooks 2019 version and I was able to set it up.

I also checked the notes for Payroll Update 22110 and it says "his tax table includes new tax tracking types used to provide employees with paid sick or paid expanded family and medical leave. Due to changes in taxability as defined in the American Rescue plan Act of 2021 (ARPA) these new tax tracking types replace similar tax tracking types used previously as defined in Families First Coronavirus Response Act (FFCRA) of 2020."

Here's a link to it: Payroll Update 22110.

Let's try to reset the maintenance release for your QuickBooks 2019. Here's how:

- Go to the Help menu and select Update QuickBooks Desktop.

- Proceed to the Update Now tab.

- Check the box for Reset Update, then click Get Updates.

Once the update is complete, restart your computer and log back into QuickBooks. Then, download the latest update one more time and check if you can already see US-COBRA Subsidy Credit.

Let me also share these articles for additional guidance and reference:

Don't hesitate to reach out to us again if you need anything else. I'd b happy to get back here and help you again.