Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I want to help you download your 1099s, Chris.

When you receive an email from QuickBooks that your 1099 is ready to download, you will need to create an account with us. Click the link provided on the email to create a QuickBooks Self-Employed (QBSE) trial account, this way, you don't have to pay for the subscription fees.

When creating an account for the 30 day trial, make sure you are using the credentials you entered when fill out the W-9 Form. Here's more information on how to fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed.

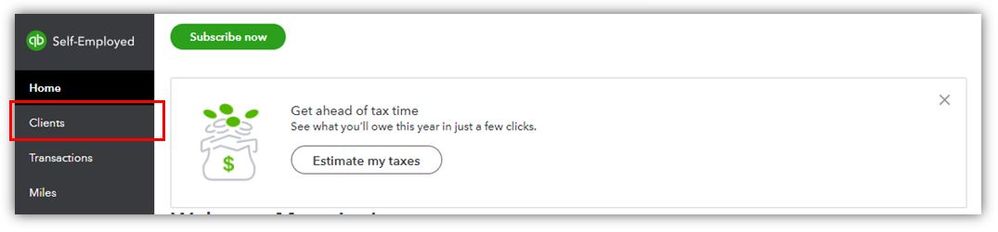

If you already created the account, simply go to the Clients menu. You will only get this tab if the client sent you an invitation to fill-out your W-9s. See this:

If you need further assistance with creating a trial account and accessing the 1099 form, please contact our Self-Employed Support. Use this trial link if you don't have a QBSE account yet.

Visit us again if you have other questions about accessing your 1099s. I'm always here to assist you any time. Take care.

Hi Jennifer,

I spent an unreasonable amount of time with one of your co-workers through chat trying to resolve this problem (Intuit is holding my 1099 hostage for a subscription fee).

Tried your fix and it does not work.

Got a 1099 through QB last year and did the "30 day free trial" at that time.

This year when I log in to get the 1099, it's not "free."

Didn't know you could do that with a 1099 (make people pay for it).

Sure would be nice to have the 1099.

Should I give the IRS your e-mail to explain why I don't have it?

Would really like an easy solution to this problem (ie- just give me the 1099).

Waiting for your response.

Hi Jen_D,

Thanks for responding to my question.

Yesterday I spent an unreasonable amount of time with one of your co-workers through an on-line chat trying to resolve this issue.

The conversation ended with the answer, "no, you can't access the 1099 without purchasing a subscription."

Tried your solution, it did not work.

Got a 1099 from the same contractor last year; completed the demo/free account; got the 1099.

This year the contractor sent the QB/Intuit notice to download the 1099.

Clicked the link and "presto" land on the subscription page with no options other than get out your credit card.

Thank you,

Chris_needmy1099

Original question remains, "Is this legal?"

I just want my 1099 (without paying for it).

A quick response would be nice, tax day is a few days away!

Hello @chrisgreenedc-ma,

Let me help share how you can obtain and view your 1099 tax information in QuickBooks Self-Employed (QBSE).

In QuickBooks Self-Employed, you can easily access your 1099 forms, free, anytime as long as you have accepted the invitation link sent via email. This account won't ask for a subscription since it'll only provide limited features such as filling out your W9 information and viewing your 1099 tax profile.

You can read this article to learn more about your access to the account: Fill out a W-9 and view your 1099-MISC in QuickBooks Self-Employed.

But if the email notification doesn't give you the form you need, I recommend contacting the company whom you've worked with as their contractor. They can send you a new invitation to view your form or receive a manual copy of your 1099 tax information.

Additionally, I've also included this reference with a compilation of articles to learn the basics of QBSE while working with us: QuickBooks Self-Employed Overview.

If there's anything else that I can help you with aside from this one, please let me know using the Reply option below. I'll be here to lend a hand. Take care always!

Hello JonpriL,

Walked through all the steps you outlined.

Clicked on the link from the e-mail sent to me by the contractor to access the 1099 which is hosted on your website.

Same result as the many other times I have followed the instructions given by you and your co-workers.

It is clear the problem is on your side of this issue.

I am using the same e-mail address as last year and your system is forcing a subscription before releasing the 1099. Again this does not seem legal.

The solution offered by you and QuickBooks is contact the contractor. That's the next step. Kinda makes your product useless if it can't generate a 1099 on demand.

This has been a very disappointing experience with your support team as it has been a lot of run-around offering solutions that are a waste of precious time.

Incredible to think the ultimate solution is go back to the contractor and ask them for a hard-copy of the 1099.

What a waste of time!

This is absolutely trash. There is no way for the person to do it in the 2nd tax year. Intuit won't get away with it, eventually this will lead to a class action lawsuit and then it will have to pay this money back. Until then, all of us must put up with this extortion.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here