Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am having an issue where my sales are not showing on my revenue account. If i pull up my sales report, they are higher than my Revenue account on the P&L.

I pinpointed the issue - some items are posting to the COGS account instead of revenue and I cannot seem to fix it.

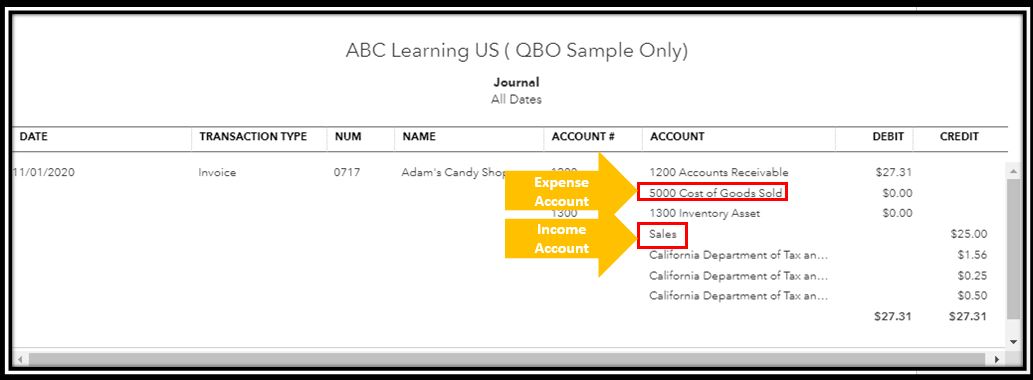

This is the invoice, line item #1 incorrectly posts to COGS while line item #2 correctly posts to Revenue.

This is the transaction journal where you can see how they post.

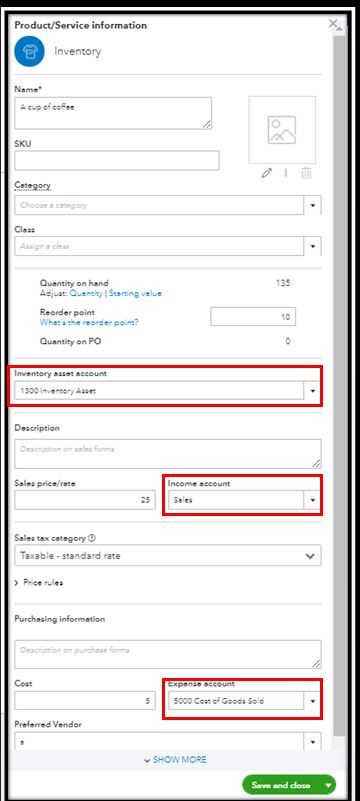

Now, here is the product from #1 and how it is set up correctly in QBO products and services.

I got your back to ensure to post the items on the revenue account so you'll be able to run the correct report data in QuickBooks Online (QBO), krissenior.

The account where your transactions are recorded depends on the accounts assigned to items listed on the invoice. We can open your customer's invoice and review the item details. Let me guide you on how:

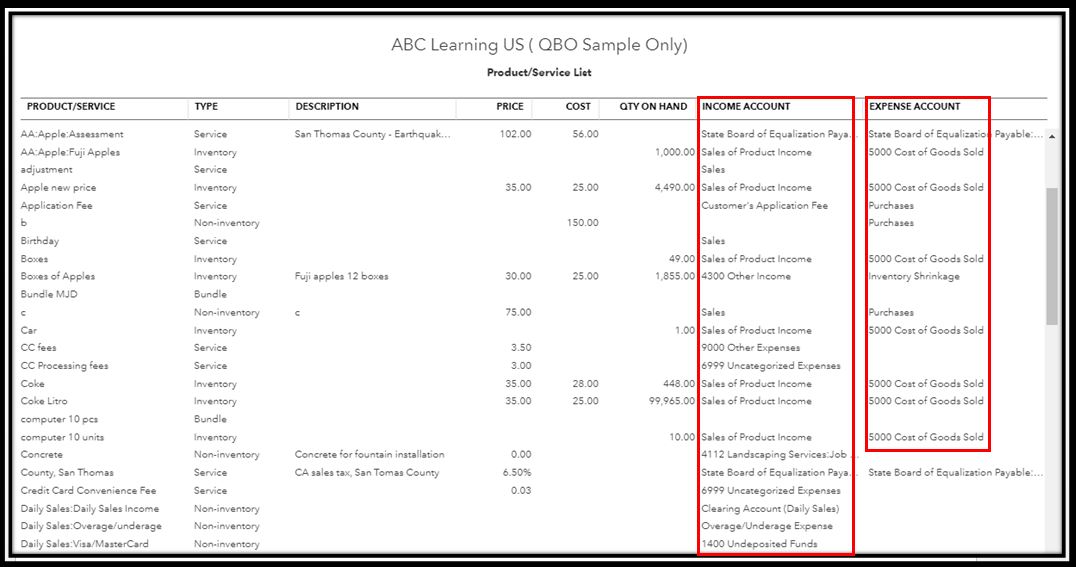

Now, you can run the Product and Service List to have a better view of all the income account and expense account assigned to all of your Product and Service items.

From here, you can double-click on each incorrect income account and change it. You can read through this article for more detailed information: Change the account for a product/service item. Once, done try running the Profit and Loss report again.

If the same thing happens, let's perform some browser troubleshooting steps to resolve this issue. To start, let's open QBO using an incognito browser. Private browser prevents saving cache and cookies that sometimes cause errors when running frequently visited websites. Here are the shortcut keys:

If it works, return to your default browser and clear the cache. Every so often the cache becomes overwhelmed with older data which can potentially cause viewing and performance issues. Clearing it will refresh the system, and you'll be able to work with a clean slate. Switching to other supported web browsers can also help rectify the issue.

Also, you'd want to check this article for reference in case you want to change your product and service item types. This will guide you through the step-by-step process: Change product and service item types in QuickBooks Online.

Please fill me in if there's anything else I can do to help you run your financial reports. You can click the reply button below to add your response.

Something's off obviously. QBO is posting a reduction in COGS for that item instead of posting it to revenue. I suspect that somewhere along the way, this item was not received properly or an adjustment was made. Can you run an Inventory Valuation Detail Report and post a screenshot just for that item? It would be great if you could post the report all the way back to the beginning of when you started receiving that item in stock.

Unfortunately, this is not working.

Unfortunately, this did not help the issue.

Thanks for getting back to this thread, @krissenior. It's my goal to ensure you'll get the assistance you need so the items in invoices will appropriately post in the income account in QuickBooks Online (QBO).

When you create an invoice for a product, the income generated from that sale is recorded as revenue or income.

Since the issue persists after performing the troubleshooting provided above, I recommend getting in touch with our customer support team. They are equipped with a screen-sharing tool to thoroughly investigate the item setup and determine the cause of the problem.

Here's how:

Furthermore, you can utilize reports in QBO to view your sales and inventory status.

Please don't hesitate to reach out to us whenever you need further help with sales. The Community is here to assist anytime. Take care.

OK, so what I think is happening is that QB is posting that invoice as a reduction in COGS because you are letting inventory go negative. You should never let your inventory go negative. In your report (which I understand is subsequent to the invoice in your original post), you were oversold by 13 units on 6-22-23 and again oversold by 6 units on 7-6-23. I would guess you were negative on that item previous to this as well. When you sell a product that you do not have in inventory, QB still reduces your inventory and increases your COGS by the cost of the items sold. However, that's an issue because you are expensing the cost of the item sold as of the invoice date but, since you never bought and paid for that item, you should not be recording the expense. So, QB will make adjustments to reduce your COGS by the amount overstated as a result of overselling the items. If @BigRedConsulting is lurking on this thread, she/he understands the adjustments that QB makes much better than me.

The only way to prevent this is to make sure you're not letting your inventory go negative. If you Google 'negative inventory in quickbooks online', you will find all kinds of results talking about why you don't want to let inventory go negative. If you take pre-orders, you can convert a PO to a bill or, even better, record the customer payment as a credit to be applied to the invoice when you receive the product in stock. Hope this helps.

This is an incredible help.

i do not actually think we will be using the inventory module here, it isnt complex enough for our needs. So I am trying to figure out how to undo this madness so that the P&L is accurate.

do you have any ideas?

i was going to deactivate all inventory items. Make adjusting journals to ensure the right amounts are in cogs/revenue accounts and just upload all items as non inventory, since we are looking into an outside inventory management software.

Would moving the quantities to positives undo these COGS decreases? Or is the method I am thinking the only feasible one?

This is an incredible help.

i do not actually think we will be using the inventory module here, it isnt complex enough for our needs. So I am trying to figure out how to undo this madness so that the P&L is accurate.

do you have any ideas?

i was going to deactivate all inventory items. Make adjusting journals to ensure the right amounts are in cogs/revenue accounts and just upload all items as non inventory, since we are looking into an outside inventory management software.

Would moving the quantities to positives undo these COGS decreases? Or is the method I am thinking the only feasible one?

If you're in the process of just "considering" an alternative inventory app, I would strongly suggest taking a physical inventory count of the items of concern and updating them in QBO using COGS as the adjustment account (New > Inventory qty adjustment) so you're in control of the adjustments. If it's not too time/cost-prohibitive, taking a full physical inventory is obviously the best. IMO, the adjustments that QB is making is correcting your P&L so you may not be in as big a mess as you think. Until you have decided on what inventory app to use, you will want to keep QBO inventory active and accurate so that you can transfer your inventory from QBO to the inventory management app and keep accurate inventory/COGS data until the switchover. Just my $.02.

My client was having the same issue, but they do not use Inventory. All Products/Services are Non-Inventory item types. The items are mapped to the correct income account (and do not have an expense account mapped for the purchase of these items). Yet, still, the invoice amounts are showing up in COGS.

I finally figured out that this was caused by their having “Track quantity and price/rate” turned ON in their Account Settings for Products and Services. Turning that feature off solved the issue.

Just wanted to add this in case others are in the same situation. Happy number-crunching!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here