Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhat determines the "default" chart of accounts (COA). Tax Form or Industry?

Is there something to select that will not automatically include Inventory, Cost of Goods Sold and Sales of "Product" Income? Because apparently those accounts in the COA can never be deactivated.

Accounts that can’t be deactivated

The following default accounts are created when you set up QuickBooks, or when an event triggers them, like turning on the sales tax setting. You can’t make these accounts inactive or use them for any other purpose.

We have clients that perform services only and will never have a need for inventory accounting. Having Inventory type accounts in the COA will only cause problems for accountants to fix later.

When establishing your QuickBooks Online, the company type describes the nature and structure of your industry. It helps QuickBooks create a default chart of accounts that applies to your business, CPA.

QuickBooks Online Plus and Advanced versions automatically include inventory accounts in the Chart of Accounts due to the inventory tracking feature available.

However, you can use the QuickBooks Online Simple Start or Essentials instead since these plans will not track inventory.

I understand that you are providing services only for your business. However, there isn't an option to exclude this automatically since this is working as designed within the system. I suggest modifying them instead.

Here's how:

1. In the Chart of Accounts, choose the Inventory or Cost of goods sold account.

2. Press on the Dropdown arrow. Click the Edit.

3. Modify the Account name, Account Type, and Detail Type.

4. Lastly, press the Save button.

Consequently, the Inventory, Cost of Goods Sold, and Sales of Product Income accounts cannot be deactivated in QuickBooks because they are essential for tracking inventory and sales related to inventory items.

For more details, refer to this page on how to manages your default and special accounts in QBO: Manage default and special accounts in your QuickBooks Online chart of accounts.

Moreover, assigning a number list of accounts you use can help you stay organized and locate them. See this page on how to activate this feature: Use account numbers in your chart of accounts in QuickBooks Online.

If you need to clarify things regarding your chart of accounts, I am still available to help you. Just write your comment below, and I'll be there.

So 2 more questions based on your reply.

Will the Inventory (Asset), Cost of Goods Sold, and Sales of Product Income accounts appear in "ALL" chart of accounts regardless of what you input for the "Company Type"?

Can the Inventory, Cost Of Goods Sold and Sales of Product Income accounts be "EDITED" to change the "DETAIL TYPE" so there are no accounts in the chart of accounts with an Inventory, Cost of Goods Sold or Sales of Product "detail type"? Or will QuickBooks just create another chart of account for those "Detail Types" if nothing in the chart of accounts has those detail types?

Regardless of the company you set up, the Inventory Asset, Cost of Goods Sold, and Sales of Product Income accounts will appear in your Chart of Accounts. To help you navigate these accounts efficiently, I'd like to share some guidance and insights that clarify their purpose and usage. Let me help you with this and elaborate this for you further, CPA.

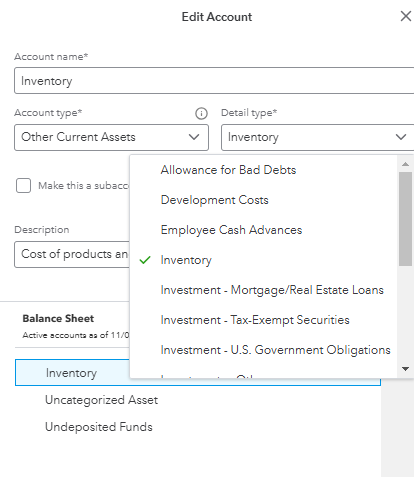

While you can modify the Detail Type field for these accounts, QuickBooks offers a limited selection of options to maintain consistency and accuracy in your records. To assist you further, I've included a screenshot for easy reference and visualization:

Also, when setting up a company in QuickBooks Online (QBO), QuickBooks automatically creates certain default accounts in your chart of accounts based on the business entity you select. To better understand which accounts are generated by QuickBooks, I recommend reviewing this informative article: Manage Default and Special Accounts in QuickBooks Online Chart of Accounts.

Additionally, after you're able to organize your Chart of Accounts, consider connecting your bank accounts to QBO. This setup allows for automatic transaction imports, giving you real-time access to your financial data. It also simplifies the reconciliation process by making it easy to match bank statements with your recorded transactions. For a step-by-step guide, check out this resource: Connect Bank and Credit Card Accounts to QuickBooks Online.

Let us know if you have further questions or need further assistance about your Chart of Accounts. We're here to make sure everything is covered. Have a nice day!

MarieSoledadG,

Thank you for your reply and clarifying no matter what is selected in Company Type during setup. These accounts will be created. Even if you select a Service for the "Industry" field.

For the " Tax form" field in "Company type" Not sure/Other/None was selected. The default chart of accounts (COA) QuickBooks Online setup for that was 4 yes 4! "Sales of Product" "Detail Types". And according to your link if that account is... deleted or renamed, QuickBooks Online will create a new account to take its place.

So we are considering purging the data for the client and starting over since nothing has been input for customers, sales or any other transactions. Should we use the link below and select the option on the bottom of the page that says "If your books are less than 60 days old" and also select Create an empty chart of accounts?

The client has used QuickBooks Desktop for more than 60 days. But they just last week signed up for QuickBooks Online and don not want to import anything from QuickBooks Desktop. The instructions in the link say If your "BOOKS are less than 60 days old." But is also says whether you've been using "QuickBooks" for longer than 60 days. Not QuickBooks Online. Which is it?

Purging your account will depend on how old your QuickBooks Online (QBO) is, CPA_. Let me share additional information regarding this.

Choosing or creating an account in your Chart of Accounts during a purge helps allocate balances from deleted transactions, maintain accurate financial records, and facilitate auditing and record-keeping.

If you wish to purge your account, you can use the link you provided, as it includes detailed steps. Please note that the process may vary depending on how long your QBO company file has been active.

If your QBO data file was created less than 60 days old, you can remove the data by following these steps:

Here's a screenshot for more information regarding the steps above:

On the other hand, you'll receive a prompt if your account has been active for more than 60 days. With this, you need to cancel your QBO company file. Afterward, start a new one using your user ID and password.

You can also view this screenshot to see how the prompt shows on your end in case your company file is more than 60 days old:

You can also use this article to help you set up your account since it contains a series of videos that help you set up your account: Get started with QuickBooks Tutorials.

Please let me know if you have further concerns or information regarding purging, CPA_. I'll be glad to help you further.

IrizA,

Thank you for the clarification about what the 60 day limit means in order to purge the QuickBooks Online data.

So even though the client has a QuickBooks Desktop account. The "60 day limit" to purge a QuickBooks Online Plus account is based on the date the "QuickBooks Online file" was created. Correct?

Because this is a copy of the instructions on that page.

Your next steps depend on your subscription level, and whether you've been using QuickBooks for longer than 60 days.

That could mean people who also have been using "QuickBooks Desktop" longer than 60 days.

You should clarify those instructions to say:

If your "QuickBooks Online data file" was "created" less than 60 days ago.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here