Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Our business takes one wee worth of service deposits from our clients before we begin providing services and this deposit stays on file till they don't need us anymore then it goes towards the last invoice, or gets refunded.

I have set up a deferred income account to keep track of this but currently, its hard to know which clients have deposits and how much that deposit is. I am currently putting notes in their client profile but I would love to be able to see this deposit on their account without using a credit memo (it's my understanding that credit memos reduce the AR) Is there a way in qb to keep track of which clients have deposits on file with us?

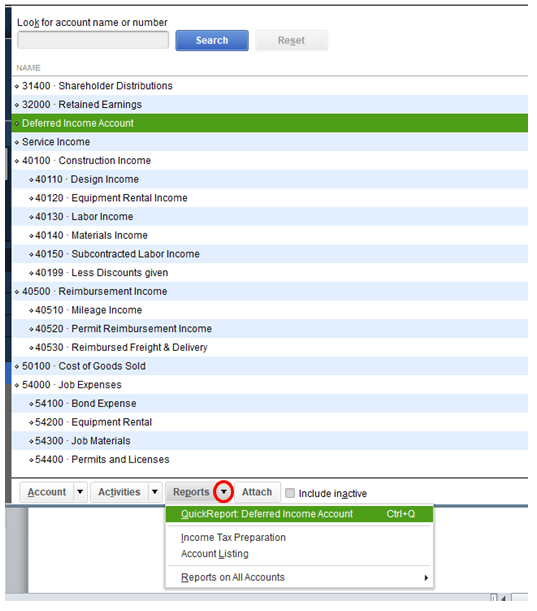

You can run a report for your Deferred Income Account, @Derrick124.

Let me share some information with you so you’ll be able to track which customer has deposits on file and when it was.

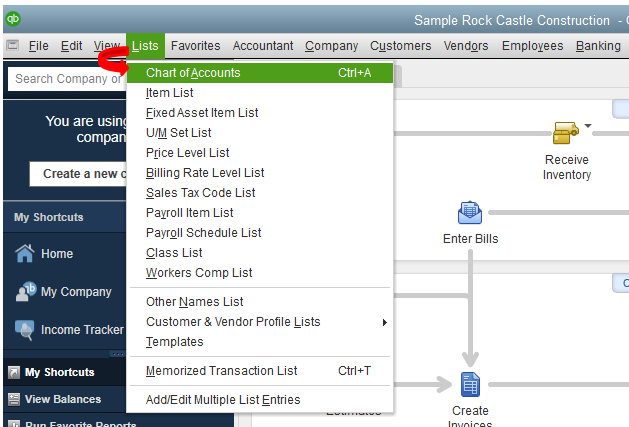

Chart of Accounts has a complete list of your accounts in the program. From there, we can run a QuickReport for the Deferred Income account. Let me show you how:

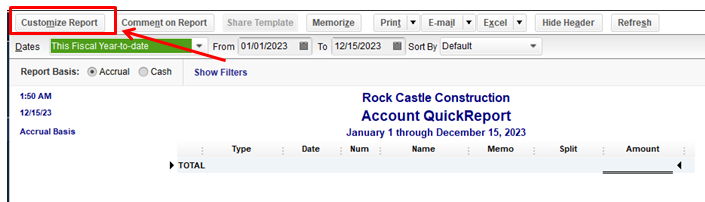

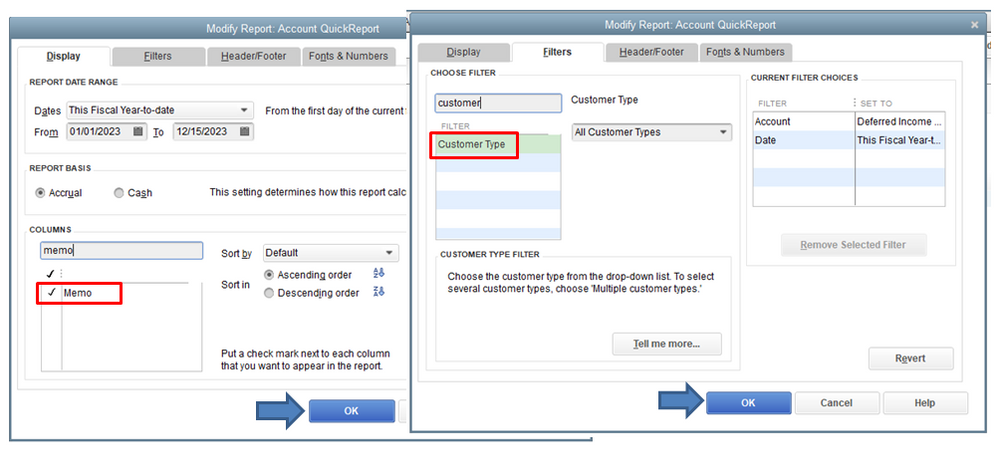

You can also use the Transaction Detail by Account report to track them. Just ensure to use the customize feature to include the information you need the most.

Moving forward, you can record the customer’s prepayment by creating a deposit transaction as the work progresses. This method enters the advanced payments of the customer, so you can easily apply or link it to the invoice. Here’s how:

Let me know if you have other concerns. I’ll be here to help. Have a good one.

Hi Madelyn,

Thank you for responding, pulling the reports does give me all the info on who has a deposit on file but if that number increases drastically, I would still have to do the tedious work of sorting through each name till I find the client I'm looking for.

How do I record prepayment for the client? I think that is the best way to go

I’d be glad to guide you through the steps in recording prepayment to your client, @Derrick124.

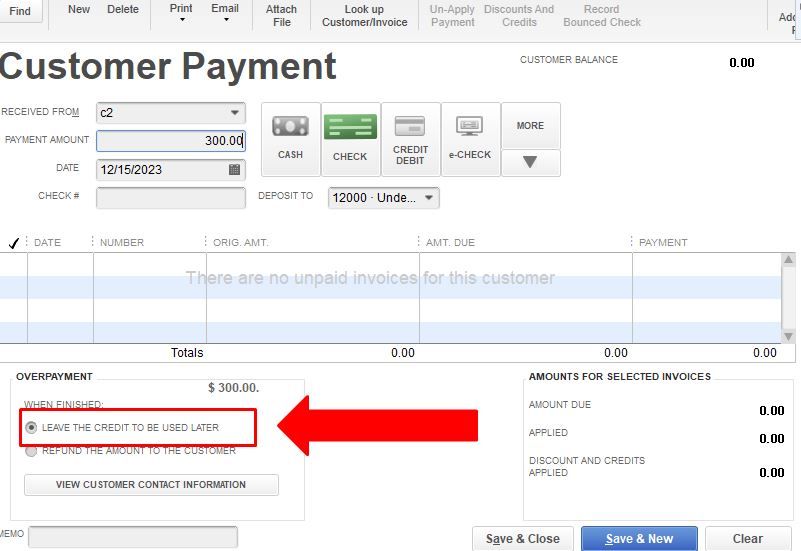

To record a prepayment in your QuickBooks Desktop (QBDT) software, you can start with on receiving your client payment. The payment received will be applied to your client’s future invoice. Let me guide you how.

To track your client prepayment or over-payment, click the Customers menu from your home screen. From the left side, the negative balance means your client has an open balance.

You can also pull up the A/R Aging Summary report and customize it to that specific client. Here's how:

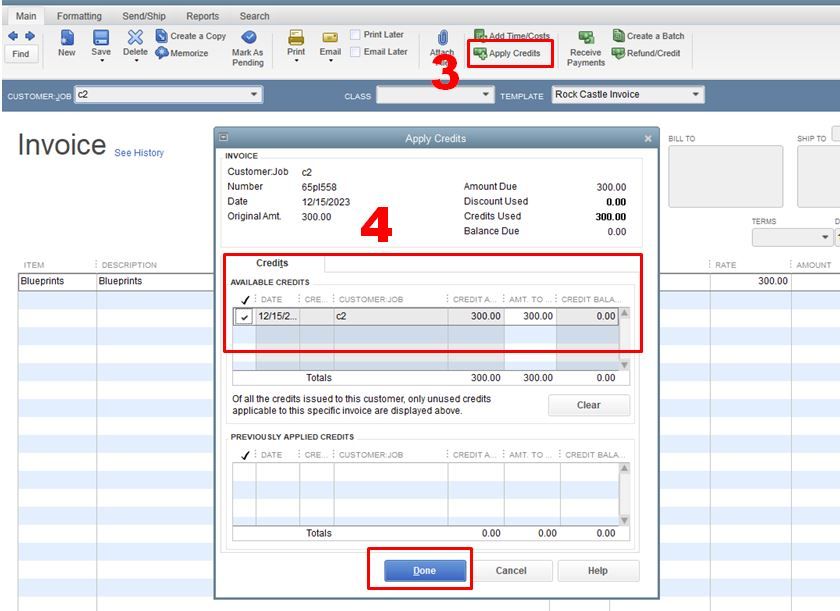

Then, to apply the Prepayment to your client:

In case you need to personalize your invoice and add some information you want your clients to see. You can utilize this article that can guide you through the complete details: Use and customize form templates.

Know that I’m only a few clicks away from you. Whenever you have follow-up questions about recording prepayment in your QBDT software, you can always leave a reply in this thread. Have e great day ahead!

This is helpful. But, what i fyou need to inovice your customer in advance of collecting payment for a prepaid service (an annual subscription)? We created invoices in this case and need to aplly the revenue in the correct period both now and when payment is received. Currently invoices were created in February and are due Feb 15th for an annual service that starts on March 1. What should the QB workflow be? We have the current desktop premier plus edition. Thanks so much!

Hello! We need to crate inovices for clients in advance of collect payment for prepaid annual subscriptions. So, for example, we create invoices 2/1 and email to customer with 2/15 due date for an annual subscripton that starts 3/1. We defer the revenue monthly until the end of the covered subscription year. How would we do this when payment is made prior to 3/1 and when it si mad after 3/1?

Thanks,

I can help you out with this, @JRblt.

You can enter a delayed credit so you can use it in the future once your new subscription year allows.

Here's what you need to do:

.Step 1: Create a delayed credit

This saves the delayed credit. You can choose to apply it to the invoice you sent out on 2/1 fore the upcoming year's subscription.

Step 2: Apply the delayed credit to an invoice

Keep in mind that adding a delayed credit to an invoice from a prior accounting period will affect that period's balances. When you want to apply this payment to your invoice, here's what you'll do:

You can read more about delayed credits by checking out this article: Create and apply credit memos or delayed credits in QuickBooks Online.

if that doesn't work for you, or of you have additional questions just leave a comment below and we can look at other options. Take care!

Hi Madelyn,

I am part of a non-profit organization and we recently received a donation to be used for our general expenses. Our accountant however suggested that we handle it as deferred revenue and spend it in the next 4 years instead of spending it on just the current fiscal year. Let's say the donation is $10000, how do I manage this in Quickbooks desktop so it shows in our balance sheet as $2500 in donation for the next 4 years? Thank you.

Peegee

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here