Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowTo Whom It may concern:

I do about 10 transaction a month for rent purposes. The new 1% (max $10) will end up costing me over $1000 per year. I pay quick books a service fee every month. Why not increase the service fee and keep the ACH transfers to zero? Looking online at the complaints this move is generating, I do not see how the "majority" of the community is asking for this "new" service. I operate a month in advance so waiting 3 to 10 days for a deposit was NOT a hassle for me. I suspect that is the case for the majority of the community.

Looking at the 3rd party apps to continue free ACH transfer appears to be more of a hassle as it requires yet another account with yet another link to my bank, the customer I am sending the invoice to has to sign up, blah, blah, blah.

I request you to please reconsider this decision.

Hello there, rlmcameron. I appreciate you for bringing your concern to the Community forum.

When processing bank transfers with a maximum of $10 per transaction, QuickBooks will charge 1% for every ACH payment process. That's the reason why you're getting charged for that particular rate. Your idea will need to hear by our payments team. With that, I'd recommend getting in touch with them to validate this feedback. I can see how ACH transfer costs you each year.

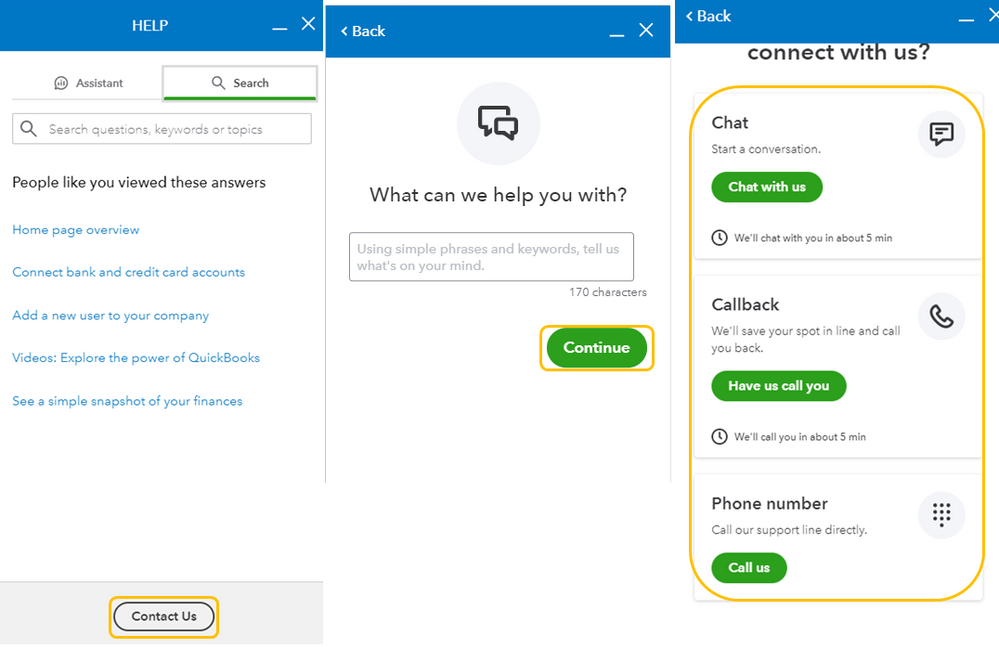

Here's how to contact them:

You may want to check these articles for additional details:

Please visit again if you have other questions about QuickBooks. The Community is always around to help in any way that we can.

That has been done. The information I got from the chat person was that this was "requested" by the community. Since this was a service you could sign up for at any time, I don't see how the majority of the community "requested" this service be mandatory.

That has been done. The response I got from the operator was that this service was "requested" by the community. Since this has always been a service you could sign up for at anytime, I don't believe this was "requested" by the community. I believe it is a way to milk people out of more money.

The party line here is ridiculous. QB has offered next day deposits for some time now, for anyone who wanted or needed to take advantage of that. The capability was there and provided, for a fee. So no, this wasn't done due to complaints about speed. The only difference is now QB is requiring the use of next day deposits, thereby requiring anyone who accepts ACH payments through QB, to pay additional fees! We use ACH payment processing through the software we are already paying for, because it was offered at no cost. Now QuickBooks will just be helping themselves to our funds, while pretending that we asked them to. Clients should be able to opt out of this 'management of our operations'... For us, our new mandatory fee structure begins April 12th. April 11th will be the last day we accept ACH funds paid through QuickBooks.

In a followup, I got an email from qbocaresupport.

<Hi there,

Good day!

We are sending you this follow up email in reference to your interaction with us. We'd like to ask if your inquiry has been fully addressed and resolved to your full satisfaction. If the issue is still unresolve, please feel free to respond to this email so we can send you the step-by-step instructions on how we can get this resolved. You can always reach out to us through the "Help" button on your account. You can choose via phone or chat. We are open from 6AM-6PM Pacific Time (PST), Mondays thru Fridays and 6AM-3PM Pacific Time (PST) on Saturdays.

We are doing our very best in providing our clients with the best customer service by addressing their complaints and concerns to their full satisfaction. Your feedback also really matters to us and is highly appreciated. You may supply your feedback and suggestions to the link that we have provided below about on how we can improve your overall experience using QuickBooks Online.

QuickBooks Online Feedback: http://feedback.qbo.intuit.com/forums/168199-quickbooks-online-feature-requests

Thank you for doing business with us. We're very happy to have you as our customer.

Kind Regards,

QuickBooks Online and Payroll Support Team >

Following the steps to "supply feedback" I get the following <image> That states I don't have access to this forum. Submit through the community. What a crock.

Hey there, @rlmcameron.

Thanks for reaching back out to the Community. I appreciate you coming back and telling us about the steps for supplying feedback to QuickBooks.

Don't worry. I can go ahead and send in that feedback to our Product Developers for you. They take the time to review every request and try to add them to the next available update.

In addition, you can check out our tutorials page for other details about features that are available in your QuickBooks Online (QBO) account.

Let me know if you have any other questions or concerns. I want to make sure that you're able to get back to running your business. I value you as a customer. I'm only a few clicks away if you need me. Bye for now!

A fee equal to 1% of the invoiced amount up to $10 per invoice may not sound like a lot, but if you're a preschool, for example, with 75+ invoices a month, Intuit just added $7,500 a year to your operating costs just for using their payment by bank feature. Very uncool Intuit and very unfriendly to small business. You should be ashamed of yourself. And those responsible for this decision should be fired. In fact, even your own agents think it was a bad decision.

This feature was announced as a benefit that came with no additional costs. That was a lie. I like what we had before and if I wanted payment faster, I always had the choice to pay 1%. Now we have no choice. Rather we have thousands of dollars of unnecessary fees on top of our monthly or annual subscription fees, which also have increased quite dramatically over the past several years. How is this helpful to small businesses, particularly during a pandemic?

By the way, I spoke with 4 different agents today and not one of them knew how to turn the feature off. This is also a problem for those who can't afford to use the feature any longer.

I was an early adopter of Quickbooks Online and been loyal for 20+ years. But, now I am exploring other options. I hope other subscribers do as well. Then, maybe Wall Street Investors will take note and force Intuit's Board to focus more on serving customers rather than taking 1% of everyone else's money.

@slindner2000 wrote:A fee equal to 1% of the invoiced amount up to $10 per invoice may not sound like a lot, but if you're a preschool, for example, with 75+ invoices a month, Intuit just added $7,500 a year to your operating costs just for using their payment by bank feature. Very uncool Intuit and very unfriendly to small business. You should be ashamed of yourself. And those responsible for this decision should be fired. In fact, even your own agents think it was a bad decision.

You have other options to accept ACH payment for free and integrate with QBO. Otherwise, there are many options in the market including the free one to replace your QBO account. Explore them and contact us in private should you need to purchase a conversion service.

I am out as a QB user. Unless the fee structure reverts, I will be going to another property management solution after this month. I am not going to spend another $1000 a year to get rent. Plenty of free solutions and other solutions that provide expense tracking as well as invoicing. The daycare with the $7500 a year is a better example than mine how ridiculous the fee structure has gotten. That's in addition to yearly subscription fees.

Have you considered these apps to accept ACH payment for free?

https:// melio.grsm.io/quickbooks

https:// veem.grsm.io/veems

Yes. I mentioned that in the original post.

Thank you for the above links.

@Fiat Lux - ASIA wrote:Have you considered these apps to accept ACH payment for free?

https:// melio.grsm.io/quickbooks

https:// veem.grsm.io/veems

Do you know if these payment options work for a U.S. Preschool where monthly tuition payments are coming from parents (not commercial accounts)?

@rlmcameron wrote:I will be going to another property management solution after this month.

Explore this PMS app as one of the options in the market. You may integrate it with QBO later if reqired.

@slindner2000 wrote:Do you know if these payment options work for a U.S. Preschool where monthly tuition payments are coming from parents (not commercial accounts)?

You may create a unique link similar with PayPal.me. The first time they pay with it, they'll have a pop-up that explains how the payment works. Then they can click through and just pay as a guest. To pay as a guest, they can simply enter their email and verify it to choose a payment method and schedule the payment.

I am also outraged. If you find another software to be able to leave QBO, please pass it on! I'm a young new business owner and QBO is all I know how to use, but this is unfair and I don't want to give them one more penny of my hard earned money.

I've already spent HOURS of my precious time trying to see if these two will work. Melio does NOT link to QBO for invoicing customers, only bills that I need to pay. Veem is complicated, I'm on hold with them right now trying to make it work. And now my customers are going to have a new format to pay. That's annoying for everyone. Those are not good options and they WILL take more time, which we all know is money. Tell your corporate A-holes to think about the small businesses not their pocket book. LET US OPT OUT!!!

@Billygoat wrote:If you find another software to be able to leave QBO, please pass it on!

Many options in the market to replace your QBO but we have yet to find any accounting app accepting ACH payment for free.

Same here. Already searched for alternative online billing service and ready to cancel QB. Just in few days they have charged over $30. If this is a community request, they would have made it optional. It is money grab!

For my purposes, I went with Innago (innago.com). They do charge $2 for any ACH transfer but do NOT have any subscription fee. I would have a max of $240 in charges for a year but would still save money considering the $800 price tag for QBO. The accounting is far less than what you get from QBO but for my needs MAY fit the bill. I've turned off accepting ACH through QBO and paused all my recurring transactions. I'll give Innago a shot for a while.

Approver Delete post. Why does it takes so long to review a post?

Hello rlmcameron,

I'd like to verify which post you'd want to delete? Or are you trying to look into the posts and threads you participated in?

Any additional information about your question is much appreciated. Thanks in advance. Take care!

The one that says "approver delete post".

I would like to say something derogatory here but I think I'll just be quiet.

This decision is insane! Our monthly fee went up from 60 to 150 last year. We thought of switching as we have 7 different companies. This insane increase would cost us about $1,000 per month! Since we are in real estate and have no need for immediate availability of funds, quickbooks has lost a loyal fan and customer. Shame on them for trying to spin it ANY OTHER way! Why blame it on customers who need money fast? Why not offer an option in speed AND cost? Shame on you!

I have tried to chat and the chat you are sending us to is UNAVAILABLE. I tried for an entire day using 3 different computers and different browsers. I am sure the FLOOD of shocked customers is causing this.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here