Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm new to QB and we have a customer that paid twice for a single invoice. We've been waiting to hear from them whether or not they want a credit or a refund. In the meantime, we haven't entered the 2nd payment and now need to. I've read multiple ways to do this and am trying to figure out what's best since we can't link the overpayment to the invoice. Options:

- Issue a credit memo (Q: If I do this, will it automatically count toward receiving payment or do I need to do both in some way?)

- Receive payment, which will generate a credit (Q: Do I also need to create a sales receipt for this as it instructs or do I bypass that?)

Something else? Anything more I need to watch out for?

Any advice is greatly appreciated. Thank you!

Helping you in recording the extra invoice payment in QuickBooks Online (QBO) is my priority, @In Awe. Let me share further details and guide you with the actions you need to take care of this matter.

When a customer (unintentionally) paid more than what they owed, issuing a credit memo is the best option. You can bypass creating a sales receipt (which never happens) since you can use the credit memo to reduce the balance on your customer's next invoice.

If your customer wants a credit, you can create one by following these steps:

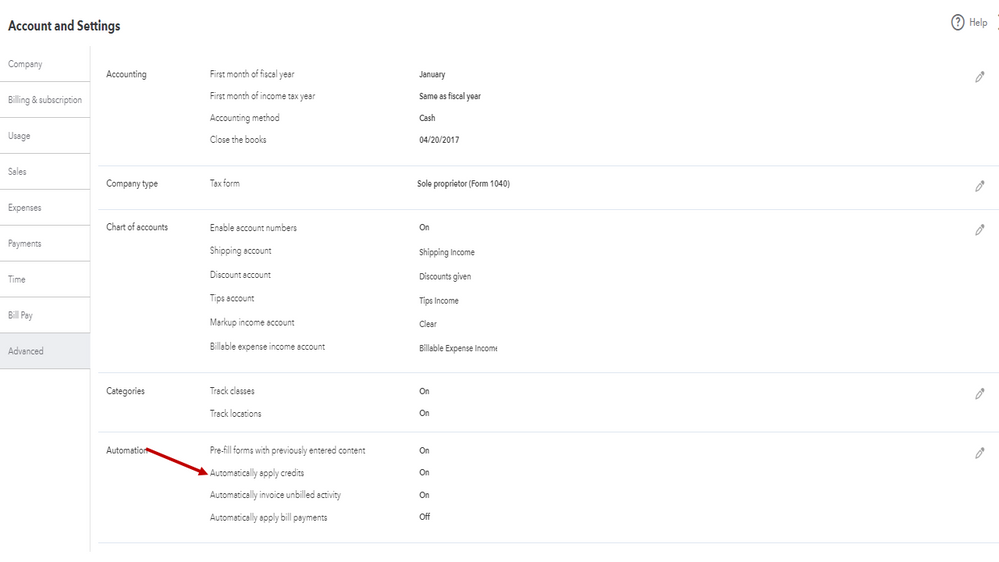

Then, you can also turn on the credit memo auto-apply feature (if you haven't already). This lets QuickBooks automatically apply credit memos to customers' balances or open invoices. You can turn off this feature anytime if you want to decide which open invoices you want to apply credit memos to.

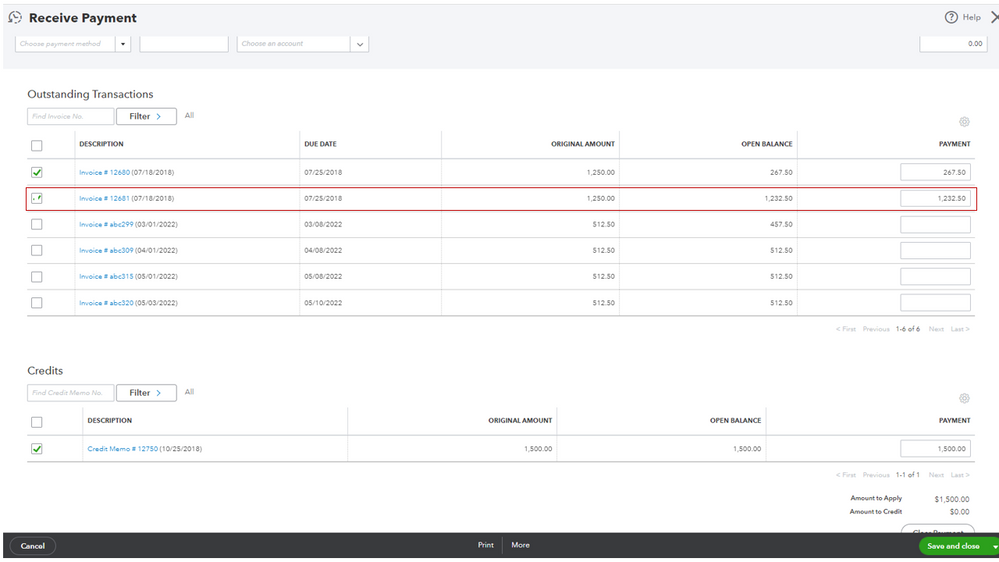

Once you're done, go ahead and apply the credit memo to an invoice (if the credit memo auto-apply feature is turned off). Here's how:

To learn more about how and when to give a credit memo to customers in QBO, you can refer to this article: Create and apply credit memos or delayed credits in QuickBooks Online.

If your customer wants a refund, you can refer to this article for the complete guide: Record a customer refund in QuickBooks Online.

Also, I'd recommend pulling up customers and invoices (i.e., Transaction List by Customer and Invoices and Received Payments) reports. This will help you in monitoring your sales and income transactions. To do this, visit the Who owes you and Sales and customers sections from the Reports menu's Standard tab.

Please keep me posted in the comments if you have other concerns about managing invoices and payment transactions in QBO. I'm always ready to help. Take care, and I wish you continued success, @In Awe.

Thank you. I do have one more question: We provide a service, not an inventoried product. When I create a credit memo, it requires that I add a product. If I choose the service that the customer double-paid on, but they decide to use the credit toward something else, how do I account for that? Just edit the credit memo, or is there another way?

You need to receive the payment first. Use "receive payment" and let QB create a credit. That will sit on the customer account and you can apply it in the future to anything you would like.

You should not use "sales receipt"...you would use that if the customer was paying you for something you actually did and you did not create an invoice for it. That creates revenue. You want this transaction to impact your balance sheet only.

.

Hello,

I'm exactly same situation, I just don't have credit memo line under customers. There is only credit note. How to handle the issue that customer would have credit note, my banking would stay correct and future payment would be recorded correctly?

Thank you

Thank you for following this thread, Dode.

I know having accurate records of all transactions is important for your business. This will keep your bank in balance and ensures future payments are recorded correctly in your company.

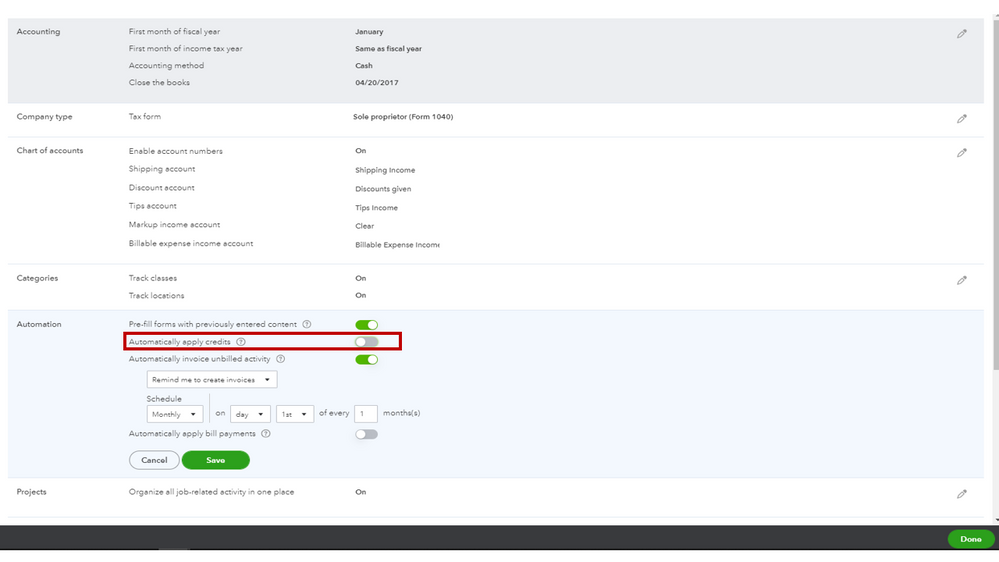

Based on the scenario, you'll have to create a credit note and then apply it to future invoices. Before performing the process, make sure the Automation feature is not turned on. Doing so prevents QuickBooks from automatically applying credits to transactions.

I’ll help make sure you can do this in just a few clicks. Here’s how:

After checking the Automation settings, let's go ahead and enter the credit memo. Follow the steps below to do this one in your company.

Once done, you can apply it to your invoices. I recommend following the instructions shared by @Rea_M above. For more insights into this process, tap here to view the complete details of the article. It provides information on when to create a credit memo or delayed credits.

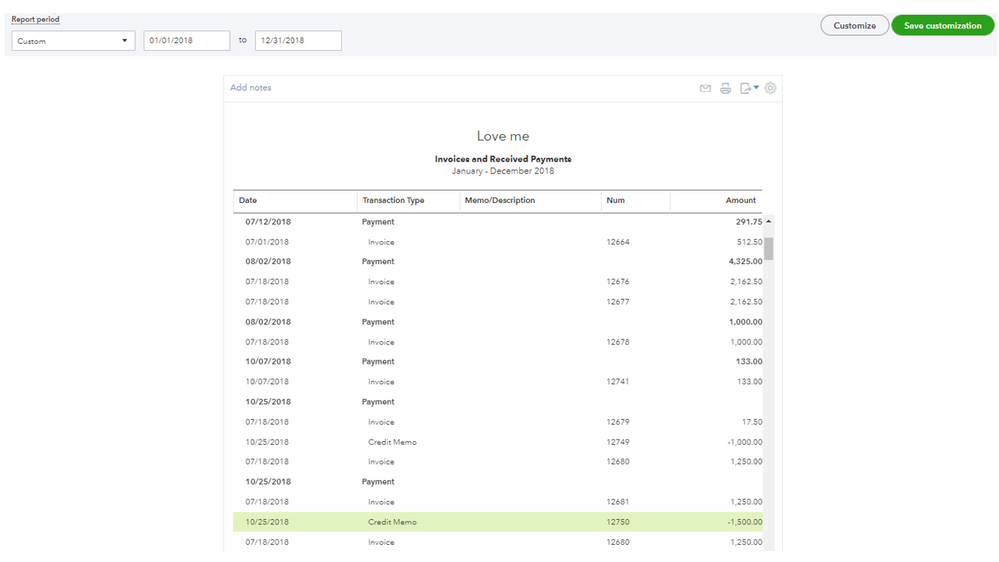

In case you've already recorded one and it didn't show up in the customer's list, run the Invoices and Received Payments report. From there, check which entry it was applied to and unlink the credit note. This way, you can use it for the correct sales transaction.

Here's how:

For future reference, this reference contains a list of topics that tackles sales and customer-related transactions. These resources will guide you on how to handle customer payments, manage your clients' information, create sales entries, and process refunds or credits.

Reach out to me again if you have additional questions about processing a credit note and applying for future payments. I’ll jump right back in to answer them for you. Wishing your business continued success.

The makes sense but how does this clear the banking transaction?

Hi RPress2022,

I'm happy to share how you can record the second payment so it will show up in the bank register. We won't use a credit memo here.

The first payment can be recorded like a normal Receive payment transaction. Then, deposit it into the bank register.

The second payment can be recorded as a deposit in the bank register. Just use the Accounts Receivable account to turn it into customer credits.

If you need to return the funds, just follow the set of steps below.

Step 1: Record the refund for your customer

Step 2: Link the refund to the customer's credit or overpayment. The purpose of this transaction is to close the status of the credits and the check transaction.

You can also check out this article with more refund methods: Record a customer refund in QuickBooks Online.

Let me know if you have any other questions in mind. Take care and happy weekend!

I'm still confused about this. My customer created a second invoice # and paid their created invoice and the real invoice, at the same time. I didn't bill them a second invoice. So if I enter the product as a return, it's going to throw my sales and profit numbers off. I have to enter a product in creating the credit memo and no product was sold a second time. I've already issued them a refund check, but need to reconcile the check in my account.

Don't record it against any sort of sale/invoice/product. Record it as a deposit only straight into your bank account. That will create a credit for the customer. Then you can open the credit and choose to refund it via check.

I might be issuing the refund incorrectly. I went to the customer, clicked on credit memo, entered the appropriate account to refund the money from, check #, etc., but it's still asking for sale/product information.

Before you can issue the refund you need to receive the money.

Then follow the instructions from Intuit:

Note: If the customer has overpaid – you do not need the credit memo as you will already have an unapplied credit that acts as your credit memo.

Thanks, this worked. I had already received the payment so I didn't do that part. It did allow me to reconcile the refund check from my bank account. However, I did have to go to the customer and clear the expense. I ran a report and it all looks right.

Thanks for your help.

Hello,

I had a customer make a double payment. My question is do I just record the payment as a credit memo. So I am not entering it as a payment at all? Is that correct? Checking for understanding because I know if I record it as a payment a credit memo will be generated that I can not edit and I can not email out directly from Quickbooks.

Thank you for visiting the QuickBooks Community again, LilyLizalde. I'll share details on how credit memo works in QuickBooks Online. Then, I'll ensure you can manage the customer's double payment and apply it to other the entries n QBO.

There are different ways to handle customers' double or overpayment in QuickBooks and tracking this entry depends on how you apply it in the future. You can use this to create a credit memo that immediately reduces a customer's current balance. Please keep in mind that you can always edit and email this transaction directly from QuickBooks.

If you haven't yet created a credit memo in QBO, you can follow the steps below on how to perform the process.

Once done, you can open this article to view details on how to manually apply a credit memo to an invoice: Create and apply credit memos or delayed credits in QuickBooks Online.

Furthermore, you can also enter the overpayment as a tip or refund the customer in QuickBooks.

Lastly, you may refer to this article to see different details on how the Sales page gives you a great at-a-glance view of all the status of your sales transactions like open and paid invoices: View sales transactions.

You can always get back to us if you have any other clarifications or questions about managing overpayment in QBO. I'm always around to help, LilyLizalde. Have a great day!

Customer overpaid invoice so I created a credit memo to record the overpayment and apply to a future invoice. In reconciling the bank account the full amount of the payment is on the bank statement but the QB register only shows the amount of the invoice paid. How am I able to select the credit memo to add to the bank balance as it has been deposited.

Hey there, @melissas-marines.

Thanks for joining in on this thread.

To see what would be the best route on this issue, I recommend consulting with your accountant to be sure. They can review your account and ensure that you have everything properly set up and going to the right accounts.

Keep us updated on how the conversation goes with your accountant. I'm only a post away if you need me again. Have a wonderful day!

It's not an accounting issue it's a QB issue. The overpayment is being recorded as income and I want to recognize the cash coming in and QB won't let me edit the transaction.

Welcome back, Melissa.

I've read your initial post, and I'm here to help you show an overpayment as an income in the bank register so you can get back to working order.

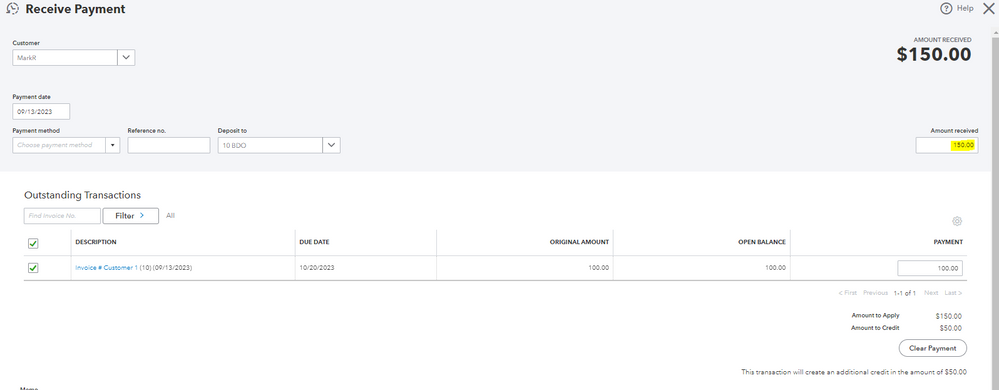

You don't need to create a credit memo to record the overpayment. Instead, you'll need to edit the invoice payment and enter the overpayment amount to recognize it as income. Don't worry, the overpaid amount will still show as a credit and you can use it to apply in the future invoice. This will also match your transactions on your bank statement. Here's how:

If you need more information about reconciling an account, feel free to check out this article: Reconcile an account in QuickBooks Online. This will help ensure your QuickBooks transactions match your bank statement.

Come back to this post if you have other concerns or follow-up questions about this. I'll be around to provide further assistance.

Thank you!!! Exactly what I was looking for...

Thanks for getting back to us, Melissa.

We're glad to hear that the resolution provided by my colleague above was able to resolve your concern about recording customer overpayments in QuickBooks Online (QBO). If you have additional QBO-related issues, please don't hesitate to reach out to us. We'll ensure to respond to your questions right away.

Stay safe and have a wonderful rest of the day!

To record a customer overpayment in QuickBooks, issue a credit memo and receive the overpayment.

To issue a credit memo:

To receive the overpayment:

Note: You do not need to create a sales receipt for the overpayment.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here