Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhenever i send out an invoice to someone it will classify it as "Sales".

This is not always correct, sometimes its sales, sometimes i would like it classified as "management income" Other times its not income at all im being reimbursed for a previous expense, i would to classify it under that category.

But its automatically putting any invoice i send out into the Sales category and i dont know how to change it or how to change it after the fact.

Any help would be greatly appreciated.

Solved! Go to Solution.

Greetings, @Baumbach19.

I want to share some details on how you can assigned categories to your transactions in QuickBooks Online.

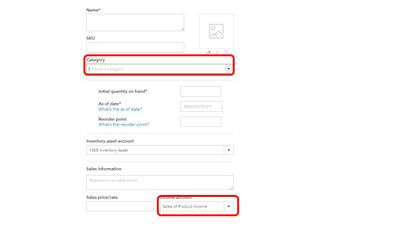

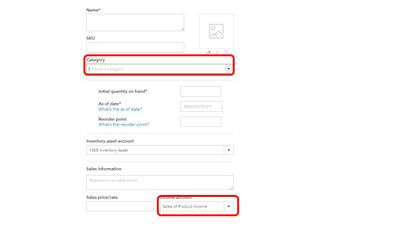

To start with, there are different ways on how you can assigned specific categories to your transactions.

On the other hand, a reimbursed expenses is not an income at all. With QuickBooks Online, you can either make the expense transaction billable and add it to an invoice, or create a journal entry.

If you want to reimburse it through an invoice, here's how to turn on the billable function:

If you want to reimburse the expense transaction through journal entry, you may check out this article for a more detailed instructions: How to Pay for Business Expenses with Personal Funds.

I'd recommend consulting with your account so you'll be guided properly in selecting the proper category for every transaction recorded in the system.

Let us know how it works on your end. I'm always here to help assigned categories to your invoice payments.

Greetings, @Baumbach19.

I want to share some details on how you can assigned categories to your transactions in QuickBooks Online.

To start with, there are different ways on how you can assigned specific categories to your transactions.

On the other hand, a reimbursed expenses is not an income at all. With QuickBooks Online, you can either make the expense transaction billable and add it to an invoice, or create a journal entry.

If you want to reimburse it through an invoice, here's how to turn on the billable function:

If you want to reimburse the expense transaction through journal entry, you may check out this article for a more detailed instructions: How to Pay for Business Expenses with Personal Funds.

I'd recommend consulting with your account so you'll be guided properly in selecting the proper category for every transaction recorded in the system.

Let us know how it works on your end. I'm always here to help assigned categories to your invoice payments.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here