It depends on you how you recorded the deposits, @TNCaterer.

If they're posted to the Accounts Receivable (A/R) account, then you can create a credit memo, write a check and then match it with the deposits.

To create a credit memo, here's how:

- Click + New, and then select Credit Memo under Customers.

- Choose the customer name.

- Enter the total of the invoice, including the deposit in the Amount field.

- Hit Save and close.

Then, you'll need to issue a check to refund the deposit. Below are the steps how:

- Select + New, and then select Check under Vendors.

- Pick the customer in the Payee field.

- Under Category details, choose Accounts Receivable from the Category field drop-down list.

- Enter the amount of the deposit received in the Amount field.

- Hit Save and close.

Once done, you'll need to record the payment made. Here are the steps how:

- Select + New, and then choose Receive Payment under Customers.

- Choose the name of the customer on your invoice.

- The Total Credits should equal the credit memo and invoice listed in the Outstanding Transactions section.

- Pick the checkboxes for the credit memo and invoice in the Outstanding Transactions section.

- Hit Save and Close.

On the other hand, if the deposits were posted to the liability or any other accounts, you can follow the same process above. However, this time, you'll need to use the said account in your check.

For more details about it, please read through this article: How to refund a deposit and close an invoice.

You can void the invoices so they won't overstate your income or follow the bad debt process since you'll be closing your catering company. Below are the articles that can help you achieve this:

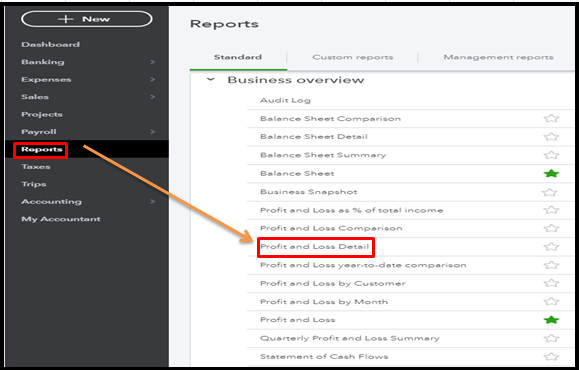

Also, I recommend running the Profit and Loss Detail report to get a detailed view of your income, expenses, and net income (profit or loss). Simply go to the Reports menu, refer to the Business overview section, and then select the said report from there.

I'm always around to help if you have more questions. Have a good one.