Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

Switching from Quickbooks for Mac to Quickbooks Online has really steep learning curve for me as a new home builder so I need you help on how to enter the following transactions at Quickbooks Online.

Example:

1) I order $1000 plumbing items on Build.com for a specific project (work in progress items). It has an order ID.

2) Build.com charged $1000 to my credit card.

3) I canceled the order due to the delivery time not meeting the project needs.

4) Build.com refunded $1000 to my credit card.

When I migrated the company account from Quickbooks for Mac to Quickbooks Online, this transaction went into Unapplied Cash Bill Payment Expense as -$1,000 Credit Card Credit and $1,000 Vendor Credit. I wonder if I have to delate that entry and manually recreate the same entry in Quickbooks Online in order for this transaction to not show in the Unapplied Cash Bill Payment Expense section.

Thank you,

Nick

I appreciate the details you've shared to record the bill payment and credit card credit in QuickBooks Online (QBO), @dukexm.

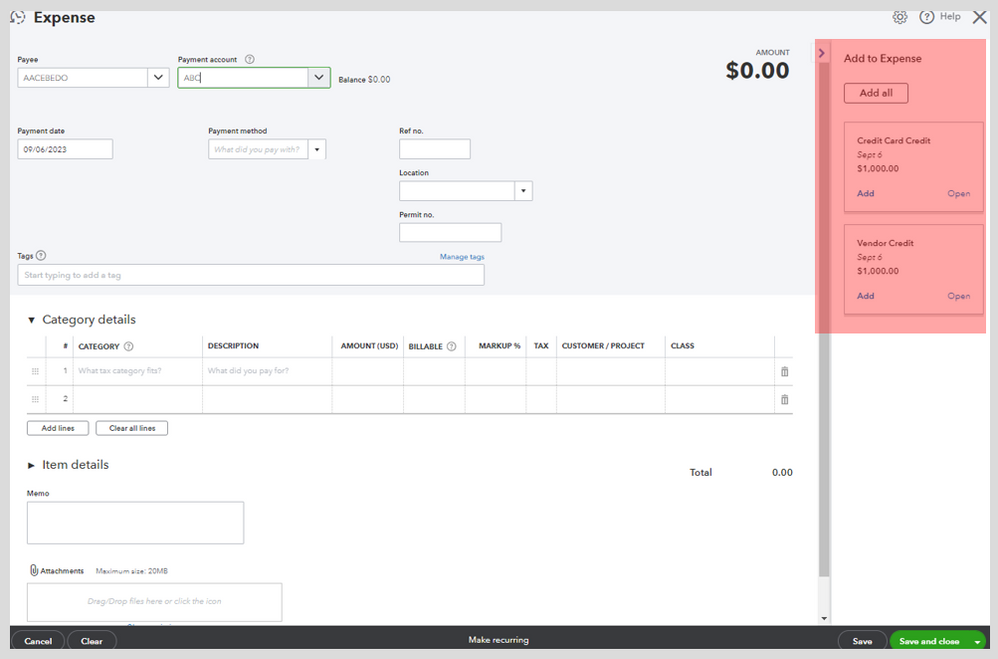

You can create an expense to link the Unapplied Cash Bill Payment Expense and Vendor Credit. But you'll need to use the Accounts Payable account in the Category details section of the Credit Card Credit transaction to link it to the Vendor Credit instead of using an item or other accounts. Doing this can help you zero out the vendor balance.

Also, ensure picking the credit card account in the Payment Account field when you link the Credit Card Credit and Vendor Credit transactions.

Here's how to record an expense and link the transactions:

For more details about entering a vendor credit card refund and other refund scenarios, see this article: Enter vendor credits and refunds in QuickBooks Online.

You've mentioned that you purchased plumbing items for a specific project. You may use the Projects feature and create a bill to mark the expense as billable to the project. I'm adding this article to learn more about how your QuickBooks Desktop for Mac data converts in QuickBooks Online: Learn how features and data move from QuickBooks Desktop to QuickBooks Online.

Please don't hesitate to comment here if you need more assistance handling vendor and customer refund transactions. I'm willing to help you out more. Stay safe and well.

Thank you for your help and I will try your method. If this transaction showed up in the Unapplied Cash Bill Payment las shown below after the migration Mac to Online, how can you fix it and the the 2 entries disappear from the Unapplied Cash Bill Payment? This is my big frustration about QuickBooks Online.

| Account name | Date | Transaction type | Name | Account name | Amount line | Balance |

| Unapplied Cash Bill Payment Expense | 03/10/2023 | Credit Card Credit | Ferguson | CapitalOneCreditCard | -$ 46.21 | -$ 46.21 |

| Unapplied Cash Bill Payment Expense | 03/10/2023 | Vendor Credit | Ferguson | -- | $ 46.21 | $ 0.00 |

| $ 0.00 |

It's our duty to provide you with the right details so we can provide you with appropriate information and resolution. May we know the report you pulled up? It would also be helpful if you could provide us with the posting accounts affected by your Credit Card Credit and Vendor Credit transactions. This will help us determine the root cause of the problem and guide us in giving accurate solutions.

We're looking forward to your response. Keep safe!

It is pulled from the Unapplied Cash Bill Payment Expense under the Profit & Loss report.

Please note that when I entered those transactions on Quickbooks for Mac there was no Unapplied Cash Bill Payment Expense and the credit card transactions and billing entries are just fine.

Thanks,

Nick

I appreciate the additional details you've shared, @dukexm.

I've updated my answer to this in my first reply. You'll have to create an expense transaction to link both Credit Card Credit and Vendor Credit transactions to remove the Unapplied Cash Bill Payment Expense account under your Profit and loss report.

But before that, you'll need to update your Credit Card Credit transaction by following the steps below:

Then, you can follow my first reply to link the Credit Card Credit and Vendor Credit transactions. After that, rerun the Profit and Loss report to see if it removed the Unapplied Cash Bill Payment Expense account.

I've included some links that can help you later enter bills and expenses and how to match them with your banking transactions in case you connected your online banking in QBO:

Please let me know if you need more assistance aligning migrated transactions or other concerns with QBO. I'm still here to help, as always. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here